As experts in investing, we provide an essential step-by-step guide on how to buy US ETFs in Europe. Using a licensed brokerage platform, Europeans can gain exposure to various popular indices and leading US enterprises.

Summary:

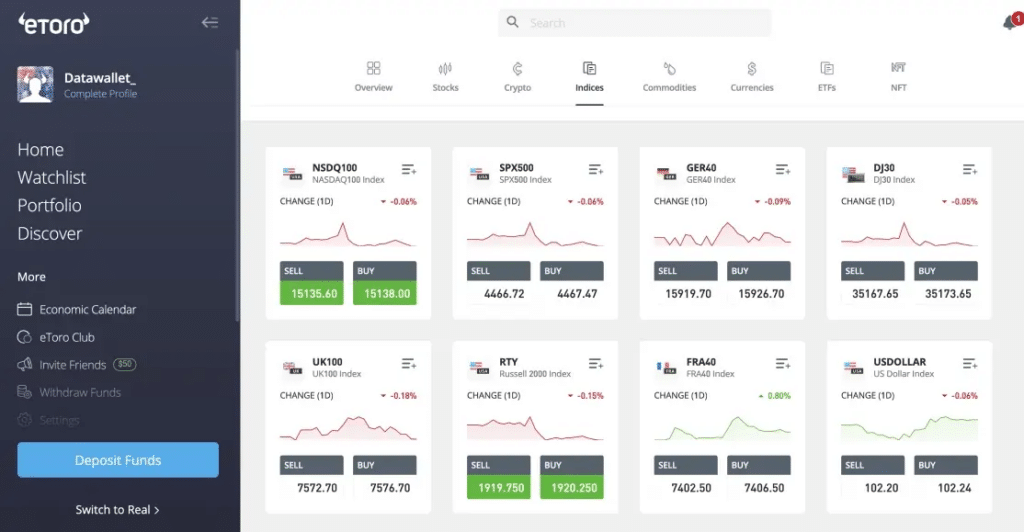

Based on extensive research into licensed brokerages in Europe, we highly recommend using eToro as the ideal platform for buying US ETFs. eToro allows instant Euro deposits through multiple payment methods and offers very competitive fees starting at just 0.05% to invest in a vast range of popular US indices ETFs. With robust security protocols and strict regulatory compliance, eToro is the premier gateway for European investors to gain exposure in the US markets.

What are US ETFs

US ETFs or Exchange Traded Funds are financial instruments that provide investors an avenue to invest in various market indices, bonds, assets, or basket of securities through purchasing shares in the ETFs. They function similarly to stocks, with their shares trading throughout market hours. Popular US ETFs track prominent indices like the S&P 500, NASDAQ-100, and Russell 200 to give exposure to broad enterprise groupings.

What are Popular US ETFs to Invest In?

Here are some of the most widely traded and recognized US ETFs that European investors can purchase:

SPDR S&P 500 ETF (Ticker: SPY)

- Tracks the renowned S&P 500 index comprising 500 leading US public companies.

- Provides broad exposure to top US enterprises across diverse sectors.

- One of the oldest, highly liquid, and trusted ETFs in the world.

Invesco QQQ ETF (Ticker: QQQ)

- Mirrors the NASDAQ-100 index focused on the largest non-financial firms.

- Heavily weighted towards technology and internet giants listed on the NASDAQ exchange.

- Top holdings include Apple, Microsoft, Amazon, Alphabet Inc., etc.

iShares Russell 2000 ETF (Ticker: IWM)

- Follows the Russell 2000 index covering 2000 small-cap US enterprises.

- Provides an avenue to invest in high-growth potential small and mid-sized publicly traded US companies.

- Allows tapping into a broader set of businesses beyond mega-cap titans.

If you are specifically interested in Vanguard ETFs, you can check our detailed guide on How to Buy Vanguard ETFs in the UK. For using UK-based Starling Bank to invest in stocks and ETFs, read our article on How to Buy Stocks with Starling Bank. And if your focus is purchasing the S&P 500 ETFs as a UK investor, head over to our walkthrough on How to Buy S&P 500 in the UK.

Step-by-Step Guide on How to Buy US ETFs in Europe

Follow this comprehensive walkthrough to invest in US ETFs as a European investor:

Step 1: Research US ETF Options

Conduct due diligence on popular US ETFs tracking indices like S&P 500, NASDAQ-100 etc. Assess historical performance, key sectors, major holdings etc. to inform your decision.

Step 2: Open an eToro Account

We recommend using eToro that allows easy Euro deposits from European bank accounts to trade US ETFs. Complete eToro’s account opening process.

Step 3: Verify Your eToro Account

Verify your eToro account by submitting the required KYC identity documents to comply with regulations.

Step 4: Deposit Euros

Transfer your desired investment capital in Euro currency from your European bank account into your verified eToro account.

Step 5: Determine Number of ETF Units

Decide the number of units of your target US ETF that you wish to purchase based on your strategy.

Step 6: Execute US ETF Buy Order

Use eToro’s order execution interface to place a buy order for your chosen US ETF. Input details like number of units and order type.

Step 7: Confirm Transaction

Carefully review all purchase details before confirming and completing the US ETF order execution.

Step 8: Monitor Investment

Continuously track the performance of your purchased US ETF and stay updated on key financial news.

Fees for Buying US ETFs

The fees for purchasing US ETFs on eToro predominantly include the spread between 0.05% to 0.15%. There are no commission charges, account management fees or currency conversion fees, allowing cost-efficient investing.

Taxes on US ETF Investments

US ETFs are subject to different tax regulations based on the country of residence. For example, in the UK, capital gains tax applies on profits exceeding the tax-free allowance from selling US ETF units. We recommend consulting a tax advisor to grasp the precise implications based on your jurisdiction.

Conclusion

In conclusion, purchasing US ETFs as a European investor first involves selecting a suitable licensed brokerage like eToro that facilitates secure Euro transactions. After funding your account, you can search for and invest in your preferred US indices ETF as per your financial goals. Tracking the performance and staying updated on driving factors allows efficient management. With appropriate due diligence, US ETFs offer European investors meaningful market exposure.

FAQs

Which European countries allow buying US ETFs?

Most European countries like Germany, France, Netherlands, Italy, and Spain allow investing in overseas assets like US ETFs through regulated brokers.

What are the risks of investing in US ETFs?

While US ETFs carry lower risk than individual stocks, they still carry market risk based on external factors impacting their underlying securities or indices. Appropriate due diligence is vital before investing.

How much money do I need to invest in US ETFs?

A: The minimum investment varies across platforms. However, certain US ETFs have a high nominal share price. For instance, the SPDR S&P 500 ETF (SPY) trades around $400 per share, requiring ~$400 for one share purchase.