Our Coincipher experts recommend a step-by-step process for seamlessly funding a regulated crypto exchange account and executing compliant trades using CIMB Bank’s convenient online banking platform. By outlining the precise pathways to buy crypto with CIMB Clicks, we empower its clients to integrate cryptocurrencies into their portfolios while upholding Bank Negara Malaysia’s regulatory standards.

Summary

Directly purchasing cryptocurrencies through traditional banking systems is still an evolving capability. At Coincipher, our extensive experience analyzing Malaysian digital asset investing informs us that seasoned crypto traders rely on specialized platforms to access coins and tokens, unlike traditional banks.

Our experts have focused extensively on integrating Bybit’s robust array of tradable cryptocurrencies alongside CIMB’s online MYR funding channels. By clearly outlining the pathway for funding, transacting and safely custodying digital assets, we empower CIMB clients to unlock the tremendous potential of crypto investing within Bank Negara Malaysia’s regulatory framework.

Cryptocurrency Adoption in Malaysia

The cryptocurrency market has experienced monumental growth in Malaysia in recent years. As of January 2024, Bank Negara Malaysia estimates over 5 million Malaysians now own cryptocurrencies, seeking exposure to digital assets and decentralized finance amid rising inflation concerns. This enthusiasm has prompted forward-thinking financial institutions like CIMB Bank to support regulated avenues for crypto investing for their customers.

Why Choose Bybit

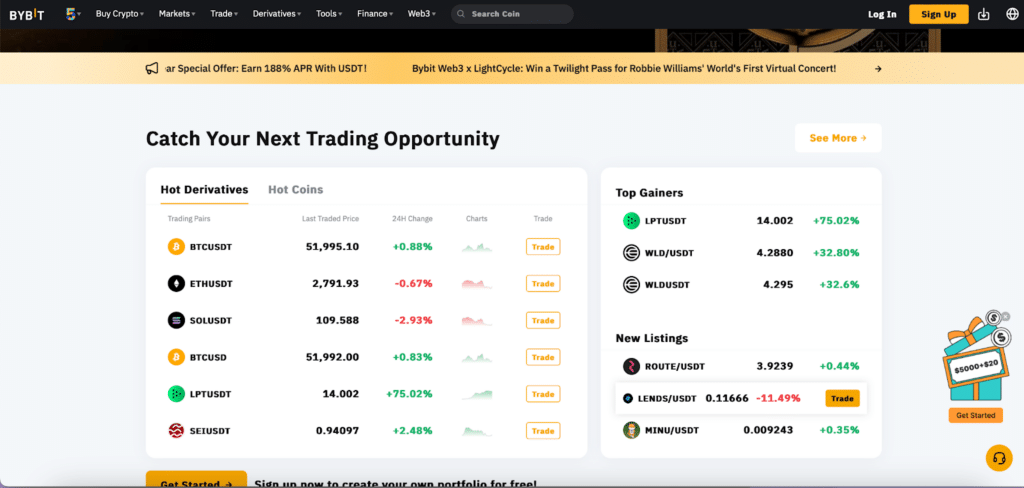

Bybit stands out as the best-integrated platform for CIMB Clicks users looking to trade cryptocurrency for several key reasons:

- Extensive variety – Access over 930 cryptocurrencies and trading pairs

- Security – Bybit stores 98% of funds in cold wallets and leverages SSL encryption

- Smooth deposits & withdrawals – Supports CIMB Clicks online banking transfers and debit card payments

- Low fees – Competitive 0.075% taker and -0.025% maker fee structure

- Compliance – Approved to operate in Malaysia by Bank Negara Malaysia (BNM)

Key Metrics:

- Global rank: #2,333

- 19.8 million total visits per month

- 36.77% bounce rate

- 8.3 pages per visit

- $25 million to $50 million annual revenue

- 400+ cryptocurrencies

- 0.075% taker fee

- Unregulated globally

- 70.53% male visitors

- 25-34 most common age group

Bybit’s combination of asset selection, security, convenient banking tools, discounted trading fees and regulatory approval makes it the top choice for CIMB Clicks clients.

Step-by-Step Guide: How to Buy Crypto with CIMB Clicks

Follow this straightforward process to securely buy and sell cryptocurrency using your CIMB Clicks account and the regulated Bybit exchange:

Step 1) Open a Bybit Account

Navigate to Bybit.com to setup a new user account with an email and password. Complete identity verification to activate your account.

Step 2) Deposit MYR Funds

Once logged into your account, select “Assets” followed by “Deposit” to reveal MYR payment options. We recommend direct bank transfers from CIMB Clicks for lower fees.

Step 3) Browse Cryptocurrencies

Utilize Bybit’s search bar to explore available crypto assets and trading pairs. Compare prices, market capitalizations, trading volumes and recent performance.

Step 4) Execute Your Order

Enter investment amounts in MYR, select your chosen cryptocurrency, set order specifications, and finalize your purchase.

Bybit’s intuitive trading interfaces allow seamlessly funding accounts via CIMB Clicks internet banking and executing compliant cryptocurrency transactions.

For those with accounts at other major banks interested in crypto investing, see our guides on buying crypto with Truist Bank, GO2Bank, and Virgin Money.

For those with Truist Bank accounts seeking to invest in cryptocurrencies securely, our guide on buying crypto with Truist Bank will walk through recommendations on the best regulated exchanges to use for funding and compliant token trades.

Additionally, if you bank with GO2Bank and want exposure to digital assets, our article on how to buy crypto with GO2Bank details steps for linking bank accounts, depositing, and purchasing tokens based on deep expertise in your region’s market landscape and regulations.

Moreover, Virgin Money account holders interested in adding crypto to investment portfolios can discover our specialists’ tailored advice on how to buy crypto with Virgin Money accounts in your area.

About CIMB Clicks

CIMB Clicks is the online and mobile banking platform managed by CIMB Bank, the 2nd largest banking group in Malaysia. CIMB Clicks offers customers robust digital banking capabilities including:

- Online account dashboard

- Mobile banking app

- Transfer funds domestically or internationally

- Pay bills with ease

- Deposit checks instantly

- Foreign currency exchange

While CIMB Clicks does not directly offer cryptocurrency services, it enables users to securely transfer Malaysian Ringgit to regulated crypto exchanges like Bybit that are approved by Bank Negara Malaysia, the country’s central bank and financial regulator. This makes CIMB Clicks a convenient banking tool for funding cryptocurrency accounts.

Understanding Fees

When conducting crypto transactions through CIMB Clicks and regulated Malaysian exchanges like Bybit, investors should be aware of trading, deposit and withdrawal fees, which can erode portfolio gains. Thankfully, Bybit is renowned for its competitive 0.075% taker and -0.025% maker fees compared to rivals. Bybit accepts CIMB Clicks debit card and bank transfer deposits for minimal fees, making it a cost-effective on-ramp for crypto investing.

CIMB Clicks Supports Regulated Cryptocurrency Investing

While CIMB Clicks does not directly offer cryptocurrency purchase or custody services, it enables customers to transfer MYR funds to regulated Malaysian crypto exchanges endorsed by Bank Negara Malaysia (BNM), the nation’s central bank.

This forward-thinking policy gives CIMB Clicks customers secure access to cryptocurrency markets, while ensuring transactions adhere to Know-Your-Customer (KYC) regulations through BNM-approved platforms. Critics who claim cryptocurrency investing cannot integrate with traditional finance should examine CIMB Click’s pragmatic approach.

Conclusion

By leveraging CIMB Click’s online banking tools and Bybit’s extensive yet regulated exchange, cryptocurrencies can be readily incorporated into investment portfolios. We encourage interested CIMB customers to thoroughly research digital asset investing risks and educational resources to make informed decisions for their financial futures.

FAQs

Does CIMB Clicks allow cryptocurrency purchases directly?

No, CIMB Clicks does not directly facilitate customers buying or selling cryptocurrency. However, it does permit MYR transfers to regulated Malaysian crypto exchanges.

What Malaysian exchanges support CIMB Clicks transactions?

Bybit stands out for security, variety of cryptocurrencies, and MYR payment integration. Other options include Tokenize Xchange and Luno which are regulated entities approved by Bank Negara Malaysia (BNM).