A detailed review outlining what the five best crypto exchanges in USA are. Learn about the top platforms and compare their fees, features, security, customer support options, and more.

Cryptocurrency trading has grown exponentially in popularity over the past few years in the USA. With increasing adoption, it’s important for novices to utilize trustworthy exchanges regulated by American authorities for purchasing and trading Bitcoin and other cryptocurrencies legally and securely.

Summary

In the USA, experts advise opting for exchanges regulated by the Financial Crimes Enforcement Network (FinCEN) for purchasing and trading Bitcoin and other cryptocurrencies. By utilizing bank transfers, credit cards, or digital payment platforms like PayPal to deposit US dollars, individuals can legally buy, stake, and trade digital assets.

For novices embarking on their crypto ventures in the USA, we’ve assessed the top 5 trading platforms prevalent in the region:

- Kraken – Best Overall Crypto Exchange in USA – https://www.kraken.com

- Coinbase – Best for Security Measures – https://www.coinbase.com

- Gemini – Ideal for Newbies (Easiest to Use) – https://www.gemini.com

- Crypto.com – Top Choice for Institutional Investors – https://crypto.com

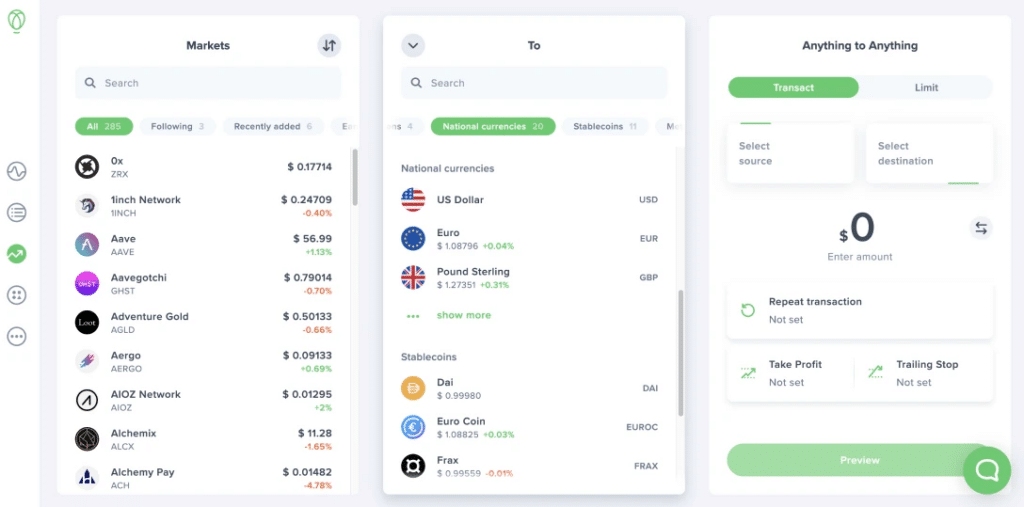

- Uphold – The Cheapest Exchange – https://uphold.co

Kraken

Rated as the premier crypto exchange in the USA, Kraken is known for its substantial trading volume of over $1 billion daily and deep liquidity. It offers over 250 cryptocurrencies to trade, with some offering up to 25% APY through proof-of-stake and lending.

- Trading Fees: Kraken charges between 0.05-0.26% maker/taker fees depending on 30-day trading volume. Lowest fees in the USA.

- Supported Assets: Over 250 cryptocurrencies including BTC, ETH, XRP, LINK, and more.

- Regulation: Regulated by FinCEN in the USA with licenses in multiple states.

- Deposit Methods: Wire transfer, bank transfer, debit/credit cards.

Key Metrics:

- Kraken is the #66 website in Finance > Finance – Other category in the US

- It ranks #4,785 in the US and #6,277 globally

- Kraken’s website traffic grew 28% month-over-month

- The site averages 7.4 million visits per month

- Kraken’s bounce rate is 34%, better than industry benchmarks

Why we like it: Kraken’s competitive trading fees, a vast selection of tradable cryptocurrencies, and top-notch security features make it the top choice for active traders.

Coinbase

Emerging as the security-focused crypto trading platform, Coinbase is laso ideal for beginners due to its simple user interface and educational resources.

- Fees: Standard trading fee of 1.49%. Highest in the USA but adds convenience for beginners.

- Supported Assets: Over 100 cryptocurrencies including popular coins.

- Regulation: Regulated and licensed by the FinCEN.

- Deposit Methods: Bank transfer and debit/credit cards.

Key Metrics:

- Coinbase has 56 million verified users.

- 6.1 million Coinbase users make at least one transaction per month.

- Coinbase generated $1.28 billion in revenue in 2020. And has already made $1.8 billion in the first 3 months of 2021 alone.

- Trading volume on Coinbase in Q1 2021 was $335 billion.

- 11.3% of the entire crypto market capitalization is held on the Coinbase platform.

Why we like it: Due to Coinbase’s industry-leading security practices like insured hot and cold wallet storage, it’s the best platform in the USA for protecting cryptocurrency investments.

Gemini

Gemini is ideal for newbies due to its beginner-friendly mobile interface and extensive educational materials. It’s amongst the top ten crypto exchanges globally.

- Fees: Trading fees range from 0.25%-1% depending on 30-day volume. Lower than Coinbase. No charges for USD deposits & withdrawals.

- Supported Assets: Over 100 cryptocurrencies and NFTs.

- Regulation: Regulated in New York and approved for 49/50 US states.

- Deposit Methods: Wire transfer and debit/credit cards.

Key Metrics:

- Global rank decreased from 41,763 to 19,095 over the last 3 months

- Received 3.5 million total visits in the last 3 months

- 150.4% increase in traffic compared to previous month

- Bounce rate is 54.54%

- Pages per visit is 3.17

- Average visit duration is 2 minutes 12 seconds

- 39.04% of traffic comes from the United States

- Audience is 65.91% male, 34.09% female

- Largest age demographic is 25-34 years old (37.37% of visitors)

- Top referral traffic source is Organic Search, driving 67.32% of visits

Why we like it: Gemini’s easy account setup, extensive learning resources, and regulated status in the USA make it a top choice for amateur crypto investors.

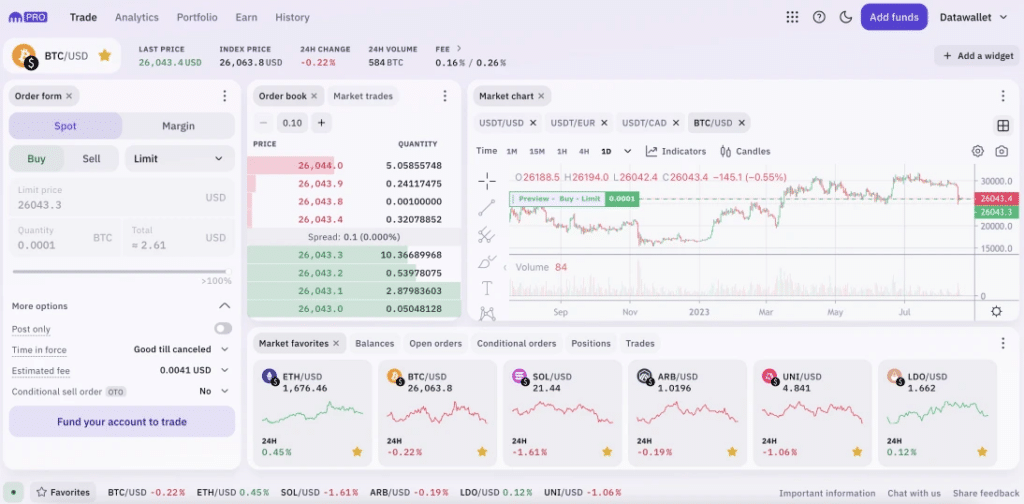

Crypto.com

Crypto.com is the top choice for institutional investors due to its comprehensive platform for quantitative traders. it has one of the highest trading volumes globally.

- Fees: Zero maker fees and taker fees range from 0.4%-0.8% based on 30-day volume. Competitive fees.

- Supported Assets: Over 200 cryptocurrencies including DeFi tokens.

- Regulation: In accordance with NYSDFS regulations and holding ISO/IEC 27001:2013 certification.

- Deposit Methods: Wire transfer and debit/credit cards.

Key Metrics

- Global rank of 13,965 with over 4.6 million total visits.

- Ranked #133 in Finance category in the US.

- 20% of traffic from US, 7% from UK, 6% from Singapore.

- Bounce rate of 51% indicates engaged visitors.

- Processed over $14.5 billion transactions in Q4 2021.

- Venture funding from renowned investors like Sequoia Capital.

- Over 10 million users worldwide.

Why we like it: Crypto.com’s deep liquidity, tight spreads, and institutional-grade trading tools empower professional traders in the USA.

Uphold

Uphold emerges as the cheapest crypto exchange due largely to its zero trading fees and low 1.5% spreads on average across all orders. It has lower barriers to entry.

- Fees: Zero transaction fees and competitive 1.5% average spreads. No fees.

- Supported Assets: Over 250 cryptocurrencies and stablecoins.

- Regulation: Registered with FinCEN as a Money Services Business.

- Deposit Methods: Wire Transfer, Credit/Debit Card, ACH, Google Pay & Apple Pay.

Key Metrics:

- Global rank: #1,403

- 35.6 million total visits per month

- 52.29% bounce rate

- 5.02 pages per visit

- $500 million to $1 billion annual revenue

- 92 supported cryptocurrencies

- 0.75% minimum crypto trading fee

- Licensed and regulated in EU

- 68.36% male visitors

- 25-34 most common age group

Why we like it: Uphold’s ability to buy crypto with zero commissions coupled with extensive payment options makes it ideal for cost-conscious crypto investors.

How to Purchase Cryptocurrencies in the USA

For beginners aiming to safely invest in digital currencies within the USA, here are the basic steps:

- Select a Reliable Exchange: Refer to our analysis and choose a platform regulated under FinCEN like Coinbase, Kraken etc.

- Complete Registration: Sign up using email, establish strong passwords and complete KYC checks.

- Deposit Funds: Fund your account through ACH transfers, debit/credit cards or wire transfers in USD.

- Locate your Preferred Coin: Search and select the coin you want to purchase like Bitcoin, Ethereum etc.

- Buy Cryptocurrency: Input the amount and purchase your selected coin with USD funds.

- Secure your Assets: Withdraw coins onto your personal hardware or paper wallets for optimum safety.

Adhering to the proper procedures outlined above from credible exchanges is key for a secure crypto journey within the legal framework of the US.

Legality and Regulation of Crypto in USA

Cryptocurrency investing is legal in the USA and regulated at the federal level by FinCEN. However, each US state also has its own statutes:

Is Cryptocurrency Legal in the USA?

Yes, cryptocurrency investing is legal in America. However, certain activities like securities issuance or money transmission require additional licenses. In summary:

- The US treats cryptocurrency as an asset class rather than currency regulated by FinCEN, IRS, and CFTC.

- Holding and transacting crypto as an investment or payment method is permitted across most states.

- ICOs are regulated as security offerings requiring SEC registration in some cases.

- Crypto must be reported for taxes similarly to capital assets like stocks.

So in general, possessing or trading crypto is allowed in the USA when done legally through compliant exchanges and with relevant tax compliance. Only specific activities involving security/payment aspects face additional regulation.

How are Cryptocurrency Transactions Taxed?

For US federal taxes, the IRS treats crypto as property instead of currency. This means:

- Capital gains taxes apply on profits from trades or sales held over one year (15-20%).

- Short-term capital gains for assets held under one year face income tax rates (10-37%).

- Payments or tips with crypto tokens also face income tax.

- Mining rewards and airdrops are taxed as ordinary income similar to salaries.

- Crypto to fiat transactions or use of crypto to buy goods produces a taxable event.

- Record keeping of transaction histories and valuations is necessary for reporting crypto taxes.

Recent Developments

In 2023, the crypto market has continued to evolve, bringing new regulations, opportunities, and challenges for US-based traders. Here are some of the key recent developments:

State Regulation

While crypto is federally regulated by FinCEN in the US, individual states have also started implementing their own rules. In 2023, Texas issued one of the country’s first comprehensive state crypto laws focusing on custody, taxation, and disclosure requirements. Such state-level regulations add an extra layer of oversight.

Expanding Options

The number of available crypto assets and trading avenues keeps rising for US traders. In 2023, PayPal added the option to transfer cryptocurrencies to external wallets. Venmo also enabled crypto trading. So the interfaces to access crypto investments are increasing.

Ongoing Volatility

2023 began with immense volatility as crypto valuations declined due to macroeconomic factors. Bitcoin dropped below $17,000 in January 2023 amid broad risk-asset sell-offs. So crypto remains a highly volatile asset class requiring robust risk management.

Increased Adoption

Despite price swings, 2023 may see record crypto adoption as US institutions like banks, pension funds, universities, and more keep entering the space with investments, tokens, lending products, and blockchain integrations.

Conclusion

In summary, by choosing exchanges regulated by FinCEN and following best practices, crypto traders in the USA can partake in this burgeoning asset class responsibly. Platforms like Kraken, Coinbase, Gemini, Crypto.com, and Uphold provide secure, legitimate gateways to the cryptocurrency world. With increasing regulatory clarity as well, investing in digital currencies from within the USA is a viable option. Always select trustworthy exchanges to ensure your crypto assets are well-secured.