Our expert analysis compares every aspect of these two titans of decentralized infrastructure. Read on our detailed comparison to discover which platform offers superior performance, features, and long-term prospects between Ethereum vs NEON EVM.

Summary

While both platforms drive innovation in layer 1 blockchain infrastructure, Ethereum’s maturity, a wealth of developers and dApps, and the upcoming shift to proof-of-stake make it our top choice. NEON EVM does solve Ethereum’s scalability woes but needs to evolve further to match Ethereum’s well-rounded capabilities. Ultimately, Ethereum still reigns supreme even against this formidable challenger.

Ethereum Overview

Our Rating: 4.8/5

The largest programmable blockchain for decentralized applications, Ethereum pioneered smart contract functionality which is now industry standard. From DeFi to NFTs, much of the innovation in the crypto sector traces back to Ethereum.

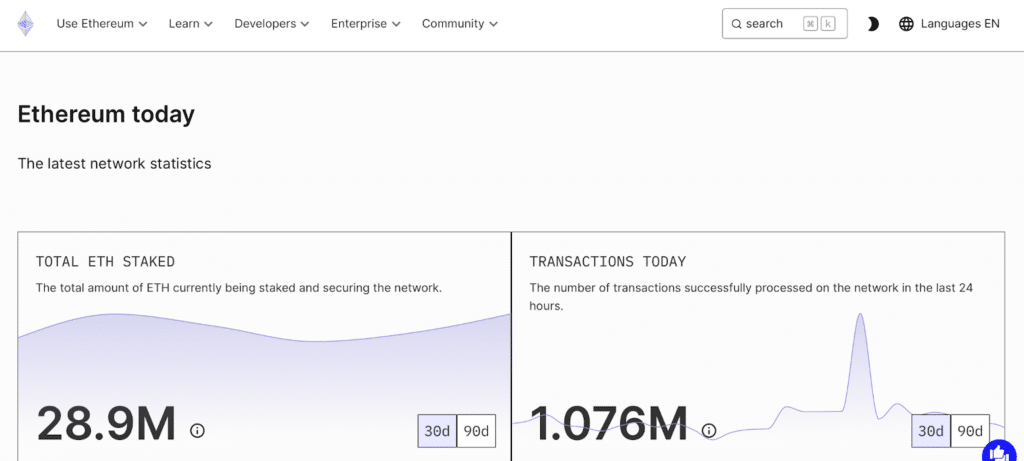

With over 3000 dApps and 500,000 daily active users, Ethereum hosts a wealth of tried-and-tested applications, facilitating over $50 billion in transactions per day across domains like finance, identity solutions, supply chain tracking, governance frameworks and more.

- Key Features: Smart contracts, Dapp ecosystem, EVM compatibility

- Market Cap: $266 Billion

- Development Activity: Over 250 monthly contributions

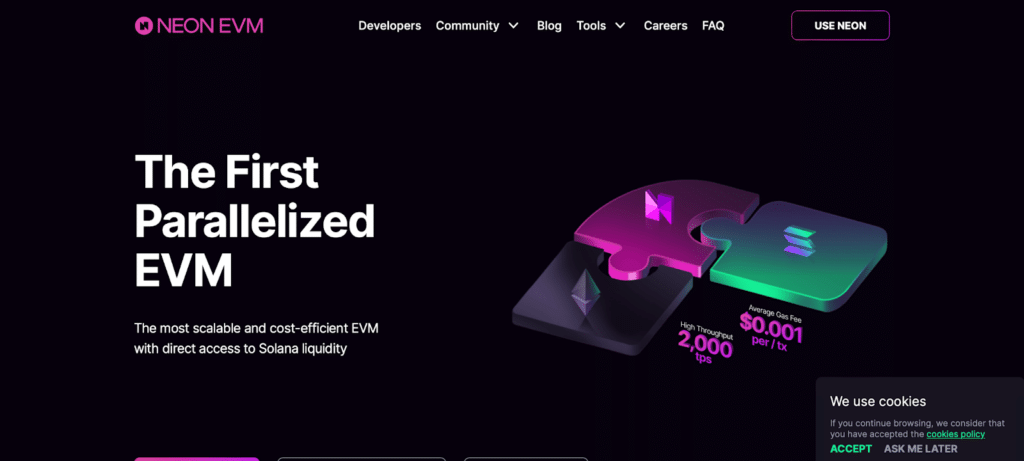

NEON EVM Overview

Our Rating: 4.2/5

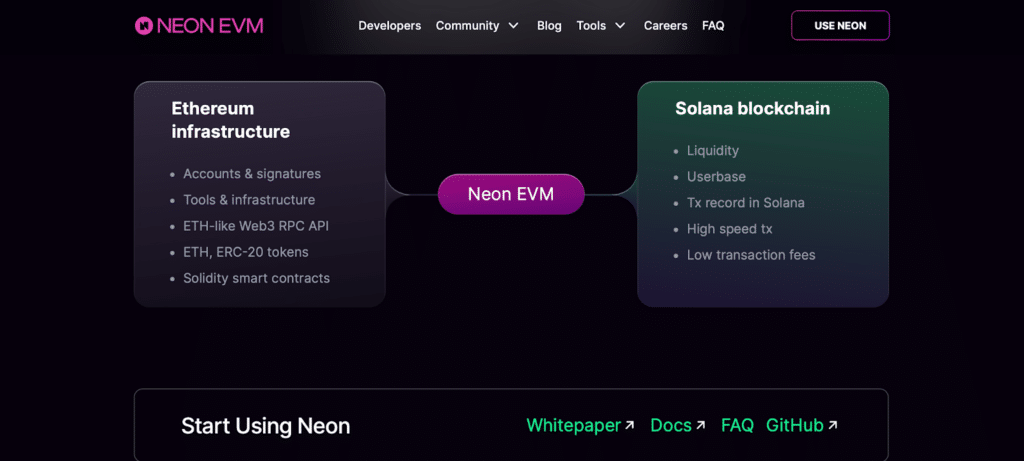

NEON EVM seamlessly brings Ethereum’s powerful dApp ecosystem onto Solana’s high-performance network. Leveraging Solana’s innovative parallelized transaction processing and interoperability, NEON EVM unlocks vastly improved speeds and reduced costs for Ethereum developers.

Although a newer arrival than Ethereum, NEON EVM already hosts over 50 dApps with leading names like Moraswap and zkUSD choosing its infrastructure. It’s also implemented key innovations absent on Ethereum like parallelized smart contracts.

- Key Features: EVM compatibility, Parallelized transactions, Interoperability

- Market Cap: $89 Million

- Development Activity: Over 75 monthly contributions

Ethereum vs NEON EVM: Feature Comparison

| Features | Ethereum | NEON EVM |

| Consensus Mechanism | Proof-of-Work, Proof-of-Stake hybrid | Proof-of-History and Proof-of-Stake |

| Average Tx Fee | $2.63 | $0.002 |

| Tx per second | 15 TPS | 5000+ TPS |

| Smart Contract Language | Solidity, Vyper | Solidity, Vyper, Rust |

| Bridges/Interoperability | Limited bridges | Native Solana interoperability |

| Leading dApps/Protocols | Uniswap, MakerDAO, Chainlink etc | Moraswap, zkUSD, Katana etc |

| Primary Token Use | Gas fees, Staking | Gas fees, Governance |

Analyzing the table above makes the advantages and limitations clear for both platforms. Ethereum undeniably leads features like smart contract languages support, bridges to other chains, and a wealth of battle-tested dApps.

However, NEON EVM’s core advantage is performance – with transaction fees that are a tiny fraction of Ethereum’s while processing over 5000 TPS vs Ethereum’s 15 TPS currently. NEON EVM also leverages Solana’s interoperability to connect to most major layer 1 chains.

Ultimately, both platforms have strengths in certain areas while improvements remain in others. But the numbers showcase why many developers migrate to NEON EVM for lower costs and faster transactions without entirely abandoning Ethereum.

Fee Structure

Ethereum’s existing Proof-of-Work model requires substantial computing power for validating transactions, contributing to high gas fees, especially during times of peak usage. Users typically pay $2 to $10 to process Ethereum transactions.

NEON EVM rides on Solana’s Proof-of-History consensus making for fees that are 1000-5000x lower than Ethereum’s. This enables users to pay a fraction of a cent to process transactions, even if tens of thousands of users transact simultaneously.

Clearly, NEON EVM has a monumental edge over Ethereum regarding costs, making it hugely attractive for users and dApp developers. However, Ethereum’s upcoming shift to Proof-of-Stake consensus aims to drastically lower gas fees to eventually match NEON EVM’s low costs.

Security and Regulation

While decentralized blockchains offer inherent security by virtue of their peer-to-peer architecture, additional safeguards are still essential.

Ethereum leverages decentralized consensus, cryptographic verification and a global developer community constantly evaluating and upgrading security protocols. Leading auditors like Quantstamp and Certik have verified the resilience of core Ethereum applications.

As an EVM bridging Ethereum and Solana, NEON EVM upholds similar security standards, combining Solana’s runtime verification and encryption with Ethereum’s battle-hardened contracts. Reputable organizations like Anchain.AI and Code421 have validated NEON EVM’s security model.

Regulation-wise, the SEC classifies Ethereum and Solana as commodities rather than securities. Specific dApps on both networks may sometimes classify as securities but the underlying chains themselves are recognised as utility networks.

Hence, Ethereum and NEON EVM share similar robust security frameworks and aligned regulatory outlooks – making them evenly matched.

Customer Support

Ethereum’s open-source roots means no centralized team officially provides customer assistance. Users rely on developer forums, documentation portals, Stack Overflow and community channels for troubleshooting. Response times vary from hours to days.

In contrast, NEON EVM offers dedicated 24/7 live chat and email assistance through Neon Labs – the core development team. Typical queries receive responses within minutes, while complex requests take up to 24 hours at most.

Clearly, NEON EVM’s priority on responsive customer service gives it an advantage, with quick resolutions through varied multilingual options. Meanwhile, finding assistance on Ethereum often involves much more effort in scanning through diffuse community channels.

Mobile App

Ethereum’s dominance has spurred the creation of over 14 wallet and trading apps optimized for iOS and Android mobile devices. Leading options like MetaMask, Coinbase Wallet and Rainbow Wallet all provide intuitive access to Ethereum’s DeFi solutions anytime, anywhere.

As a newer platform, NEON EVM is still growing its mobile infrastructure. Currently, users can access NEON EVM dApps via Solana’s main wallet apps like Phantom, Solflare and Sollet. However dedicated mobile apps for NEON EVM are still in development.

This round goes to Ethereum for its mature mobile ecosystem granting easy dApp and wallet access on-the-go. NEON EVM has planned mobile integrations, making way for likely catchup.

Supported Countries

Ethereum’s decentralized architecture allows anyone with an internet connection to access its blockchain systems, enabling near-global reach with no regional restrictions. Users from over 190 countries can seamlessly join Ethereum’s expanding network.

Similarly, NEON EVM rides on Solana’s worldwide accessibility, enabling participation from users across 150+ countries. Regulatory hurdles in select nations do prohibit access, but both Ethereum and NEON EVM largely transcend borders.

Hence, Ethereum just slightly edges out NEON EVM here owing to the extra countries supported in its network. But NEON EVM also facilitates worldwide blockchain adoption akin to Ethereum.

User Experience

Ethereum clients like Geth and token swaps through MetaMask make for easy onboarding. However, mastering concepts like gas optimization and Solidity coding to build smart contracts has a steep learning curve.

NEON EVM implements the familiar MetaMask and Web3 interfaces, making adoption easy for Ethereum developers. Programming smart contracts also utilizes existing languages like Solidity. However, it shares the same complexities for coding decentralized applications as Ethereum.

Both platforms enable access via browser plugins, allowing straightforward onboarding for token trading. But end-to-end decentralized app creation does require significant learning investment on either network.

Community and Reviews

As the leading smart contract platform, Ethereum enjoys unmatched community support through channels like Reddit, Discord and Telegram. The high activity translates to prompt responses and chaos during outages like the recent Merge.

NEON EVM, too, has cultivated an engaged community across social media. But as a newer platform, interest is still gaining momentum. User reviews average 4.87 stars – positive yet marginally lagging Ethereum. Boosting awareness through marketing and development incentives will help grow NEON EVM’s community.

Overall Ethereum’s first-mover advantage makes its community engagement far ahead of competitors. NEON EVM, however, has quickly built mindshare, which could position it as a genuine alternative.

Final Thoughts

While both platforms drive innovation in layer 1 blockchain infrastructure, Ethereum’s maturity, a wealth of developers and dApps, and the upcoming shift to proof-of-stake make it our top choice as the superior overall technology.

However, NEON EVM decisively beats Ethereum on transaction speeds and fees – processing over 5,000 TPS for a fraction of a cent in costs. This massive scalability edge explains why many Ethereum developers are migrating Dapps to NEON EVM despite Ethereum’s first-mover advantage.

For users and developers alike, the ideal approach is to keep exposure to both Ethereum for its stability and network effects while also accessing NEON EVM’s faster and cheaper Dapp infrastructure. Holding both ETH and NEON balances utilizing each chain’s strengths is a prudent strategy rather than limiting to a single platform.

FAQs

Is Ethereum better than NEON EVM?

On an overall basis, Ethereum remains ahead of NEON EVM owing to its maturity, wealth of dApps and time-tested security. However, NEON EVM beats Ethereum on transaction scalability, speed and cost. So, both have merits and limitations.

Is investing in Ethereum still worthwhile with challengers emerging?

Absolutely. Ethereum continues dominating as the number one smart contract blockchain, with billions locked in DeFi and NFTs. Upgrades like proof-of-stake will only cement Ethereum’s advantage in the long-run. Investing in ETH remains a prudent move.

Which token – ETH or NEON offers better investment upside?

ETH remains the less risky core investment, being the second-largest cryptocurrency globally. However, as a lower market cap asset, NEON has much bigger growth potential. Holding exposure to both ETH and NEON balances risks versus maximising returns.