Decentralized exchanges (DEXs) have exploded in popularity in recent years. Two of the biggest names in the space are Uniswap vs PancakeSwap. But which one is better for trading and providing liquidity? Our in-depth comparison examines the key differences between these leading DEX platforms.

Summary

Uniswap pioneered the automated market maker (AMM) model, while PancakeSwap brought this innovation to Binance Smart Chain. Both deliver easy swapping between tokens, liquidity pools, yield farming and more.

Key differences include Ethereum vs BSC as the underlying base layer, trading volume and liquidity depth, native token utility and platform growth potential. While Uniswap stands out for its first-mover advantage and dominance in trading volume, PancakeSwap offers extremely low fees and a faster, simpler user experience.

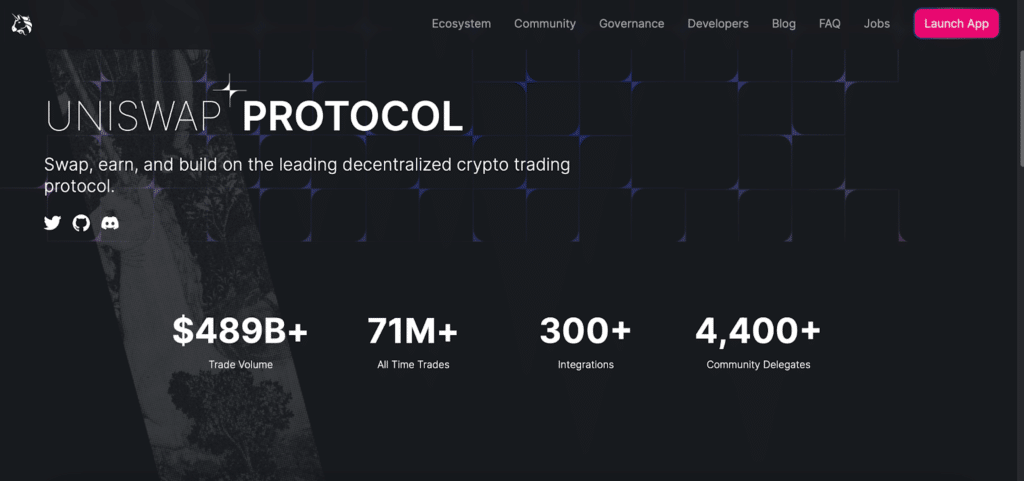

Uniswap Overview

- Launched in 2018

- Decentralized Ethereum-based exchange

- Uses an automated market maker (AMM) system

- Allows users to trade without intermediaries

- Over $6 billion total value locked

- 1.5+ million lifetime traders

- $4 billion in all-time trade volume

- UNI governance token with 60% of supply distributed to community members

Key Features

- Easy swapping between ERC20 tokens

- Liquidity pools instead of order books

- Earn fees by supplying assets to pools

- UNI token for protocol governance

- Built-in price charts

- Mobile app available

Uniswap set the standard for decentralized, automated trading. As one of the first wildly successful DeFi apps, it pioneered the AMM model which removes the need for buyers and sellers. Instead, liquidity pools facilitate near-instant swaps using smart contracts.

By creating deep liquidity for thousands of Ethereum token pairs, Uniswap provides the leading on-chain trading experience. It continues to see high development activity, especially with the launch of Uniswap v3 in May 2021.

PancakeSwap Overview

- Launched in 2020

- Decentralized exchange on Binance Smart Chain

- Forked from Uniswap’s codebase

- Uses an AMM model for swapping tokens

- Over $1 billion total value locked

- More than 1 million users

- $19 million+ in all-time trade volume

- CAKE governance and reward token

Key Features

- Trading between BEP20 tokens with low fees

- Liquidity pools and yield farming incentives

- Lottery, NFT marketplace and other features

- CAKE token for rewards, voting and platform fees

- Built-in price charts and analytics

- Mobile app available

As a fork of Uniswap, PancakeSwap adopted the same AMM model but built it on the Binance Smart Chain. This allowed for faster transactions, lower fees and an Ethereum-compatible alternative booming with DeFi activity.

PancakeSwap has proven extremely popular for trading and yield farming BSC-based tokens. With over 2 million users, it aims to be the leading DEX on Smart Chain.

Uniswap vs PancakeSwap: Feature Comparison

When it comes to features, the core trading functionality is very similar between Uniswap and PancakeSwap since the latter was forked from Uniswap’s codebase.

The biggest differences stem from the Ethereum vs Binance Smart Chain. BSC’s higher throughput and lower fees make PancakeSwap seamless for new users. However, Uniswap still dominates in overall liquidity depth.

Advanced features like PancakeSwap’s lottery and upcoming NFT capabilities provide additional reasons to use the platform beyond just trading.

| Feature | Uniswap | PancakeSwap |

| Platform | Ethereum | Binance Smart Chain |

| Consensus Mechanism | Proof of Work | Proof of Staked Authority |

| Block Time | 15 sec | 3 sec |

| Transaction Speed | Slower | Very Fast |

| Fees | Higher | Extremely Low |

| Trading Volume | Higher | Growing Rapidly |

| Liquidity Depth | Deep | Shallow for Some Pairs |

| Token Selection | Very High | Mainly BEP20 |

| Advanced Features | v3 Concentrated Liquidity | Lottery, NFT Marketplace |

| User Experience | More Complex | Simpler |

| Mobile App | UniSwap | PancakeSwap |

Fee Structure Comparison

The cost to trade on each DEX depends on the underlying blockchain:

Uniswap Fees

- 0.30% fee per trade

- Additional gas fees which vary by trade size and Ethereum congestion

- Gas fees can be $20-$100+ during high traffic

PancakeSwap Fees

- 0.20% fee per trade

- Additional BNB fees less than $0.10 on average

- Extremely low fees due to Binance Smart Chain

Trading fees are slightly lower on PancakeSwap, but the real difference comes down to gas fees. Uniswap users often pay high gas fees based on Ethereum network demand. But PancakeSwap fees rarely surpass a few cents thanks to BSC.

For larger trades, these accumulated gas savings on BSC can make PancakeSwap dramatically cheaper despite Uniswap’s 0.1% lower trading fee.

Security and Regulation

As decentralized exchanges, neither Uniswap nor PancakeSwap require KYC or account registration. This enhances privacy but means added responsibility for managing your own wallets and funds.

Smart contracts powering both platforms have undergone rigorous auditing to ensure they function as intended. No major security breaches have occurred on either DEX since their launches.

Regulatory uncertainty remains an ongoing issue in the DeFi space. Due to their decentralized nature, platforms like Uniswap and PancakeSwap currently operate outside the purview of government regulators across most jurisdictions. However, regulatory discussions are evolving so this could change in the future.

Customer Support

Given their decentralized nature, neither DEX offers direct customer support channels like live chat, phone or email.

Instead, users rely on developer communities and documentation for assistance. Both exchanges provide information to help users trade, provide liquidity and more:

- Uniswap: Extensive documentation plus developer chat rooms and forums

- PancakeSwap: Docs, GitBooks guides and public Discord server

Support is limited to community-based help. However, the platforms themselves are non-custodial, so users have sole control of their wallets and funds without relying on customer service teams.

Mobile App Experience

Uniswap and PancakeSwap both offer iOS and Android mobile apps:

Uniswap App

- 1M+ downloads on Google Play

- 4.7 rating on Google Play and App Store

- Full trading features from desktop site

- Sleek interface and charts

PancakeSwap App

- 1M+ downloads on Google Play

- 4.4 rating on Google Play and App Store

- Performs all swaps, farms and pools

- Easy access and navigation

The apps provide excellent on-the-go access to trading and liquidity pools. PancakeSwap’s app also includes convenient access to its lottery, NFT marketplace and other special features.

Reviews indicate both apps reliably replicate the core DEX experience. Uniswap’s mobile interface offers a somewhat more polished and streamlined experience.

Supported Countries

Given their decentralized nature, Uniswap and PancakeSwap are technically available to users worldwide. However, users must still comply with crypto regulations in their specific country. Access from sanctioned nations may also be blocked.

Uniswap and PancakeSwap can be accessed via VPN in unsupported countries, but users trade at their own legal risk in this scenario.

User Experience

Ease of use is a key consideration when evaluating DEXs.

Uniswap sets the benchmark for decentralized trading in terms of functionality. However, its interfaces incorporate more advanced features and charts. The trading portal and liquidity pools are highly flexible for seasoned DeFi users. Yet the numerous metrics and options create a steeper learning curve for beginners.

PancakeSwap offers a similar but more straightforward trading experience. Simple swap and liquidity interfaces make it extremely easy for new users.

The cheerful design and lack of congestion on BSC result in a smooth, intuitive feel during swapping or farming. Trading and providing liquidity takes just a few clicks.

Overall, PancakeSwap prioritizes simplicity, which makes the platform more accessible for first-time DEX users.

Community and Reviews

Uniswap and PancakeSwap boast two of the largest and most active communities in DeFi.

Uniswap

- 150K followers on Twitter

- 65K members in Discord community

- Ranked #1 DeFi protocol by community size

- Positive sentiment and support for new users

PancakeSwap

- 1.2M followers on Twitter

- 244K members on Telegram

- Fast-growing and engaged community

- Active assistance for new users

Both DEXs foster strong communal environments that create a welcoming space for traders and liquidity providers. PancakeSwap’s larger social media presence and follower counts signal extremely rapid growth.

Final Thoughts

Uniswap and PancakeSwap both deliver quality decentralized exchange experiences with their own unique advantages.

For Ethereum-based trading, Uniswap is the top choice. It provides access to thousands of ERC20 tokens with unparalleled liquidity and proven exchange infrastructure.

PancakeSwap offers a faster, simpler alternative to Binance Smart Chain. Extremely low fees and a straightforward interface make PancakeSwap the best choice for new DeFi users.

So which is better overall? There is no definitive answer. Each DEX excels in certain areas that appeal to different users and needs.

FAQs

Is it safe to use Uniswap and PancakeSwap?

Yes, both Uniswap and PancakeSwap utilize audited smart contracts and have proven secure over years of usage. As non-custodial platforms, users maintain control of their funds.

How do fees compare between the two?

PancakeSwap offers substantially lower fees overall. Uniswap charges around $20-$100 per swap due to Ethereum gas costs. Thanks to BSC, pancakeSwap fees rarely exceed $0.10.

Can I use both platforms?

Yes, you can use Uniswap and PancakeSwap, depending on your needs. Uniswap for ERC20 tokens, PancakeSwap for BEP20. Holding both UNI and CAKE can allow participation in governance and rewards.