Binance and KuCoin are two leading cryptocurrency exchanges. This Binance vs KuCoin comparison will help you choose the best platform for your trading needs. With so many coins and platforms to choose from, finding the right crypto exchange to suit your needs is essential.

Summary

This article compares features, fees, coins, security, customer support and more between the two leading exchanges – Binance vs KuCoin. Read on to find out which platform is better suited for you.

Platform Details

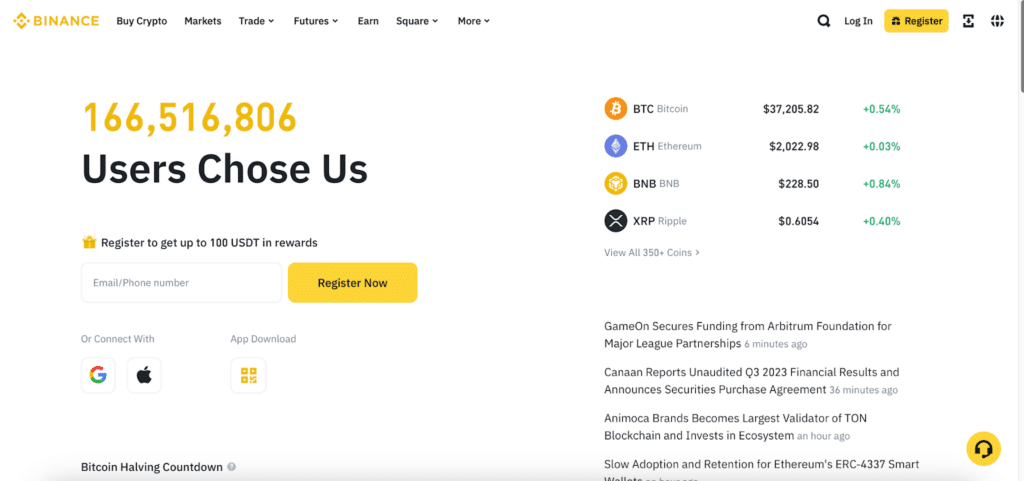

Binance

Launched in 2017, Binance quickly became the largest global crypto exchange by trading volume, which it has maintained for years. The platform is feature-rich, catering to all types of crypto users with spot, derivatives and margin trading.

Key Features

- Competitive trading fees with discounts

- Staking and crypto loans

- Margin trading with leverage up to 5x

- Derivatives including Bitcoin futures and options

- NFT marketplace for minting and trading NFTs

- Excellent liquidity across trading pairs

With over 100 cryptos and stablecoins trading against multiple fiat currencies, Binance lives up to its tagline as an all-in-one ecosystem for crypto traders and enthusiasts.

KuCoin

Created in 2013 and launched in 2017, KuCoin positions itself as an advanced cryptocurrency exchange for seasoned traders. While not as large as Binance, KuCoin provides a full-suite trading platform focusing on new and small cap altcoins.

Key Features

- Low trading fees with discounts for holding KCS

- Margin Trading with up to 10x leverage

- Crypto lending marketplace to earn interest

- Derivatives trading on crypto futures

- Exclusive KuCoin trading bots

KuCoin offers services for active traders alongside relative newcomers looking to diversify their portfolio with emerging tokens and DeFi coins.

Feature Comparison: Binance vs KuCoin

While their offerings look similar at first glance, there are marked differences that make each exchange unique. Let’s break it down:

| Features | Binance | KuCoin |

| Cryptocurrencies Listed | 800+ | 600+ |

| Spot Trading | Yes | Yes |

| Derivatives (Futures/Options) | Yes | Yes |

| Margin Trading | Yes (5x leverage) | Yes (10x leverage) |

| Staking | Yes | Yes |

| Crypto Loans | Yes | Yes |

| NFT Marketplace | Yes | No |

| Decentralized Exchange | Yes (Binance DEX) | No |

Fee Structure

A key element for choosing an exchange is the fee structure. Let’s examine trading and withdrawal fees between Binance vs KuCoin.

Trading Fees

Both exchanges utilize a maker-taker fee schedule with discounts based on 30-day trading volume and platform tokens held. The maximum trading fee if neither condition is met is 0.10% on Binance and 0.10% on KuCoin – the same.

- Binance offers an extra 25% off in fees for paying with BNB

- Holding KCS tokens reduces fees up to 20% on KuCoin

- High volume traders get custom VIP rates

Withdrawal Fees

- Withdrawal fees vary based on the cryptocurrency for both

- Most tokens have a fixed blockchain fee to withdraw

- Some smaller cap coins have no withdrawal fees

Due to the dynamic calculation of withdrawal fees for different cryptos on each network, there is no clear distinction between Binance and KuCoin. Fees fluctuate slightly based on market conditions but remain nominal for most major coins.

Fiat Fees

Fiat gets tricky since availability varies across countries for each platform. Broadly,

- Card deposits on Binance range from 1% – 3.5%

- Bank Transfers/ACH deposits are free

- Binance withdrawal fees range from a flat $15 for Wire Transfers to 1% for PayPal

- KuCoin does not support fiat withdrawals to bank accounts

- Buying crypto with debit/credit cards costs 3.5% – 5% on KuCoin

- Deposits through SEPA are free

For someone looking cash out to their bank, Binance supports this capability while KuCoin currently does not. Both platforms offer multiple entry points based on your geography.

The norm across the industry is a fee for depositing by card but free deposits for Bank Transfers. Consider transaction speed (instant for cards vs slower for bank transfers) against the fee for the best option given your funding source.

Security and Regulation

Any crypto investor worth their salt prioritizes security above all else when selecting an exchange. Here’s how Binance vs KuCoin stack up when it comes to safety of funds and regulatory compliance.

Regulation

Centralized crypto exchanges are ratcheting up compliance and regulation efforts worldwide.

- Binance delisted derivatives and margin products across Europe and Canada following regulatory pressures but offers limited services through other subsidiaries.

- KuCoin blocks users from accessing its platform if they do not pass KYC verification or are from restricted jurisdictions.

Both exchanges carry out mandatory KYC checks in keeping with global compliance standards. Users enjoy full services after submitting identity documents and clearing background checks.

Security

Exchanges build extensive security systems to protect customer assets in their custody.

Binance provisions an emergency insurance fund from 10% of trading fees (SAFU fund) in case assets are compromised. KuCoin takes out insurance policies to cover user funds as well.

However, both exchanges have suffered breaches resulting in customer funds being stolen:

- Binance saw a hot wallet breach in 2019 losing 100 Bitcoins worth $45 million

- KuCoin suffered a hacking attack in 2020 with over $275 million stolen

Despite the unfortunate incidents, KuCoin and Binance reimbursed affected users promptly from their insurance reserves. Both exchanges also apply industry-standard security protocols including:

- Majority of funds are held in cold storage

- 2FA login

- Crypto withdrawal address whitelisting

- Optional U2F authentication

There is always a non-zero risk associated with storing funds on any online exchange. However, Binance and KuCoin demonstrate their commitment to protecting customer assets through robust systems, insurance policies and a track record of reliable compensation post adversities.

Customer Support

Users rely on responsive customer support teams for assistance on exchanges dealing with real assets. We assess the customer service offerings for Binance and KuCoin:

Languages Supported

- English, Chinese, Korean, Japanese, Russian, Spanish, French, Turkish, Vietnamese, and Portuguese on Binance

- English, Chinese, Korean, Japanese, Russian, Spanish, French and Vietnamese on KuCoin

Contact Channels

- 24/7 live chat

- Email support tickets

- Active Telegram communities for both

Self-Help Resources

- Extensive support center and academy content on Binance

- Well-organized help center on KuCoin

Response times vary, but most queries via chat or tickets get answered within 24 hours for VIP users and under 72 hours for others.

The Verdict: Binance invests more resources in building educational guides and tutorials in its Support Center and Academy. But KuCoin also has detailed self-help content complementing 24/7 multilingual assistance.

User Experience

Seamless mobile trading apps provide the convenience for users to execute crypto strategies anytime, anywhere. Let’s see how the apps compare.

Ease of Use

- Sleek interfaces on both with intuitive navigation

- Powerful charting and order options

- Stream portfolio and price alerts

Functionality

- Support for all major account services like trading, deposits/withdrawals

- Robust features for serious traders requiring desktop-like options

- Limitations in very complex reporting or risk analysis features

With 4.8 stars on over 2 million reviews for Binance and 4.7 stars for KuCoin, both apps have very good user ratings on iOS and Android app stores.

These exchanges know their audience of active crypto traders who rely on robust mobile experiences for executing strategies on-the-go. The apps cater well, with almost all desktop functionalities packed in.

Supported Countries

Binance and KuCoin aim to offer global access but have limitations for certain countries and regions. Let’s see the country’s availability for these heavyweights.

Binance

Overall, Binance restricts access to users in about 8 countries and territories:

- Canada

- China

- Turkey

- U.S. (Only Binance.US operates here)

- Netherlands

- Germany

- Italy

- Iran

KuCoin

KuCoin primarily blocks users from 4 countries:

- U.S.

- Israel

- Iraq

- Iran

So between the two exchanges, KuCoin edges out in terms of geographic availability by excluding fewer countries from accessing their exchange.

Do note that both platforms keep updating supported regions frequently to continually improve access. Check directly on their websites for exclusions before signing up.

Community Sentiment

Here’s a snapshot of community feedback for each exchange across crypto forums and Twitter:

KuCoin

- Praised for range of coins and fast listing of small caps

- Great platform for pro futures and margin traders

- Concerns on international access and liquidity

Binance

- Very liquid with high trading volumes across assets praised

- Users highlight depth in derivative products

- UX for basic Buy/Sell seen as overwhelming by some

Both enjoy loyal user bases that champion the platforms’ capabilities and offerings. Users acknowledge the pros alongside cons of each exchange fairly.

Final Thoughts

Comparing features between the two leading crypto exchanges, Binance vs KuCoin, yielded great insight. While both cater well to active traders with low fees, extensive crypto offerings and robust platforms, there are peculiar differences.

Binance claims victory with higher trading volumes, more crypto assets, a thriving NFT marketplace and overall brand dominance in the industry. Yet KuCoin is nimble, listing coins quicker and has exclusive trading bots to automate portfolio management.

Instead of declaring one exchange an all-out winner, embrace their unique capabilities. Hobby investors may prefer KuCoin to access newly launched tokens earlier, while professional traders deploy Binance’s derivatives tools to maximize profits.

For best results, sign up with both Binance and KuCoin. This way you can enjoy exclusive benefits, access more tokens and take advantage of promotions on each platform tailored for your crypto investing style.

FAQs

Which one is better: KuCoin or Binance?

Both KuCoin and Binance are excellent, highly reputable crypto exchanges to use. Binance wins out slightly when comparing features due to higher trading volumes, more crypto assets listed, a thriving NFT marketplace and the overall brand dominance. Yet KuCoin has strengths too – quicker new token listings and exclusive trading bots for portfolio automation.

How risky is using KuCoin?

As a prominent global crypto exchange operational since 2017, KuCoin incorporates industry best practices around platform security and user fund safeguards. They suffered a major breach in 2020 but reimbursed affected users quickly. Overall, they are as safe and compliant as leading centralized exchanges can aim to be. Start by enabling maximum account security including 2FA.

Why is KuCoin gaining popularity?

KuCoin owes growing popularity to filling a niche – catering to altcoin traders through quick listings of new and small cap coins. Their exclusive Trading Bots for automating trades and competition style Futures Brawl trading are also big draws. Low fees and solid platform features retain their position among the top global exchanges.

What is a better alternative to using Binance?

For users seeking a similar all-in-one crypto exchange as an alternative to Binance –

- Coinbase matches Binance’s impeccable security standards while offering a simpler onboarding process better suited to crypto beginners.

- FTX equals Binance’s wide array of sophisticated trading products like options and leveraged tokens but permits margin trades at up to 101x leverage.

- Crypto.com competes using crypto rewards debit cards with up to 8% cashback and 12% interest rate on stablecoins.

Evaluate features like token availability, fees, security protocols, derivatives offerings and geographic access to determine the best Binance alternative fitting your crypto investing or trading profile.