This comprehensive eToro review looks at the leading social trading and multi-asset brokerage platform founded in 2007. With over 30 million registered users, eToro has become one of the largest global social trading networks through its innovative features.

eToro Review of Pros and Cons

| Pros | Cons |

| Easy copy trading platform | Slightly higher spreads |

| Beginner friendly | No automated trading |

| Regulated in tier-1 jurisdictions | Limited advanced trading tools |

| Wide selection of assets | Inactivity fees after 12 months |

| Fractional share trading |

Key Metrics

- Global Rank: #1,403

- Category Rank in UK (Investing): #2

- Bounce Rate: 52.29%

- Pages per Visit: 5.02

- Average Visit Duration: 4 minutes 16 seconds

- Top Country by Traffic: United Kingdom (14.09%)

- Gender Distribution: 68.36% male, 31.64% female

- Age Distribution: 29.01% age 25-34 years old

- Top Traffic Source: Direct (82.92%)

- Top Referral Site: 11.62% from sports betting sites

- Top Display Publisher: 21.11% from search engines

- Top Social Source: Youtube (60.3%)

- Technologies Used: 75 total across 17 industries, including 18 advertising, 14 analytics, 11 social media related

eToro Fees

eToro’s fees are slightly higher compared to other multi-asset brokers. The average spread on EUR/USD is 1 pip, which is higher than the industry average. eToro also charges a conversion fee of 50 basis points for converting from one currency to another.

For stock and ETF trading, eToro offers zero-commission trading for US stocks but charges 0.09% for other international stocks.

For crypto trading, eToro charges a flat 1% fee for buying and selling crypto positions. The 0.1% crypto-to-crypto conversion fee is lower than most competitors.

Overall, eToro’s fee structure caters more towards casual traders and investors rather than active or high-volume traders.

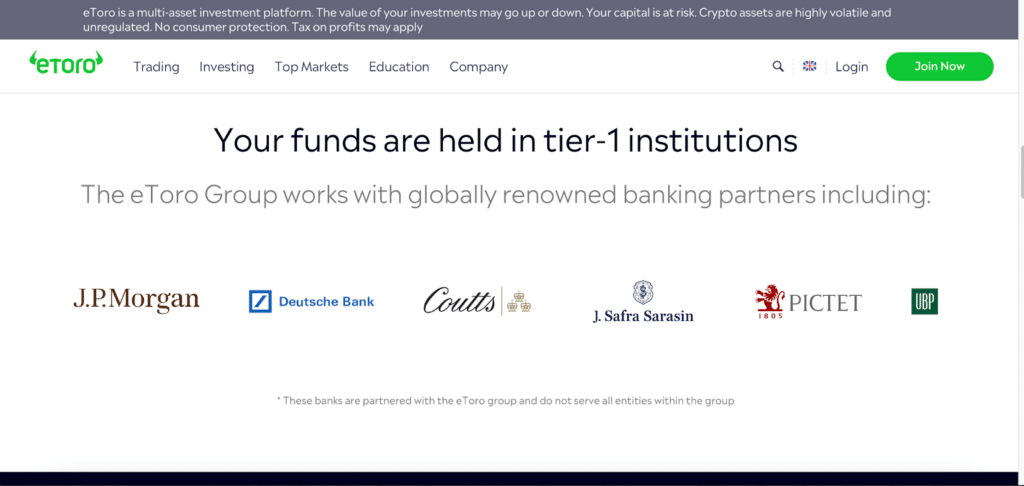

eToro Security

eToro implements robust security measures including two-factor authentication, SSL encryption, and industry standard account protections.

As a regulated broker, eToro segregates all client funds from its operational accounts. This ensures that client money and assets are protected in the unlikely event that eToro becomes insolvent.

eToro also carries an insurance policy up to $1 million per client to cover losses in the case of broker default or bankruptcy. This provides an extra layer of security for client deposits and positions.

Overall, eToro meets high security standards, giving clients confidence in the safety of their funds and positions.

eToro Verification Process

The account verification process at eToro is straightforward and can be completed in minutes.

To open an account, you’ll need to provide your name, email, date of birth, and residential address. eToro will then verify your identity using automated protocols.

Once your profile is verified, you can make a deposit to fund your account via wire transfer, e-wallet services, or debit/credit card.

eToro also offers tiered account verification if you want to extend your withdrawal limits. This involves providing proof of ID and proof of residence.

Overall, eToro has a fast and beginner-friendly verification process. You can open an account and start trading in a matter of minutes.

eToro Customer Service

eToro offers customer support through live chat, email, and telephone support. Live chat and phone support are available 24/7 for all account-related inquiries.

Average phone wait times are less than 1 minute and chat inquiries are usually answered within a few minutes. eToro’s customer service representatives are responsive, knowledgeable, and provide helpful guidance.

eToro also provides an extensive FAQ knowledgebase, community forum, and AI chatbot to address common customer queries.

Overall, eToro offers excellent multichannel customer support and resources for a smooth user experience.

eToro User Experience

eToro offers an intuitive user experience that is beginner-friendly but also packed with features for advanced traders.

The web and mobile platforms have a clean, easy-to-navigate interface. Traders can easily search for instruments, place trades, and manage their account all from a single screen.

Charts, research, and risk management tools are also seamlessly integrated into the experience. Popular features like copy trading make it simple for anyone to apply proven trading strategies.

For advanced traders, eToro offers ProCharts with over 65 technical indicators, customized watchlists, and order entry templates.

Overall, eToro delivers a great blend of usability and power for traders of all skill levels.

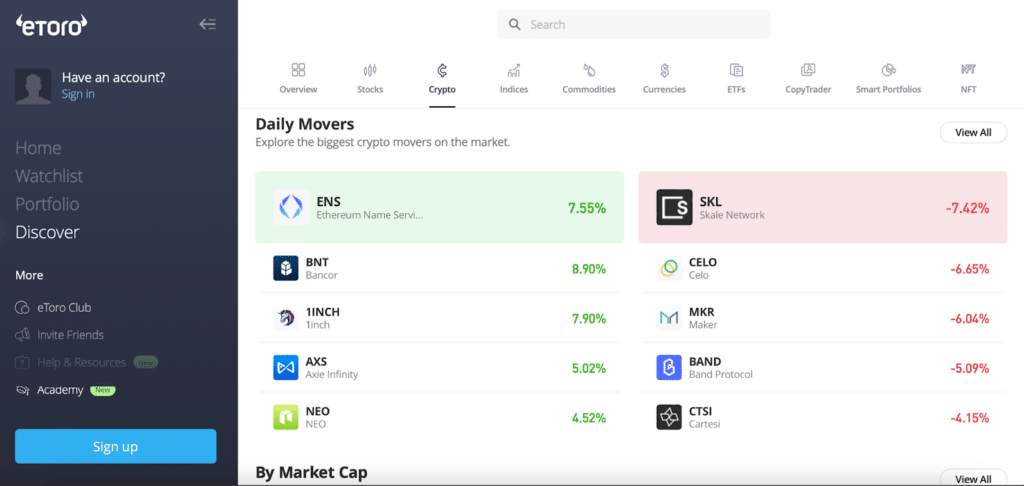

Available Assets on eToro

eToro supports trading in:

- 47 currency pairs

- 19 commodities

- Over 2,000 global stocks

- Over 40 cryptocurrency CFDs

- Over 130 ETFs

eToro offers CFD and physical crypto trading. Popular cryptos available include Bitcoin, Ethereum, Litecoin, and XRP.

For equities, eToro offers fractional share trading and commission-free trading on major US stocks.

Overall, eToro provides access to a diverse range of asset classes under one account.

Regulatory Compliance and Legal Status

eToro operates through regulated subsidiaries around the world. Key licenses include:

- FCA regulated in the UK

- ASIC regulated in Australia

- CySEC regulated in Cyprus

By meeting strict licensing requirements in multiple tier-1 jurisdictions, eToro adheres to best practices in operational transparency, capital reserves, and risk management.

This strong regulatory oversight gives eToro customers peace of mind that their funds and trading activities are protected by applicable laws and regulations.

Liquidity and Volume

As a major brokerage, eToro provides ample liquidity for most major markets including forex, major stock indices, and larger-cap stocks and cryptos.

eToro acts as the counterparty to customer trades as a market maker, ensuring fast execution even during periods of peak volatility. For less liquid assets, spreads may widen slightly but overall liquidity remains robust.

eToro sees over $2 trillion in annual trading volume across its 30+ million users. This high level of user activity contributes to healthy liquidity across eToro’s trading platforms.

Staking and Lending Options

eToro offers staking services that allow clients to earn rewards on supported proof-of-stake cryptocurrencies.

Currently, eToro supports staking for 12 popular cryptos including Cardano, Ethereum, and Polkadot. Staking rewards are credited to your eToro account daily.

For lending, eToro customers can lend their stocks or crypto assets to generate extra income. Lenders can earn attractive interest rates with minimal effort.

By offering staking and lending, eToro provides users with opportunities to put their assets to work and generate passive income.

eToro Web Experience

eToro’s web platform provides a streamlined experience for self-directed trading as well as social trading. Key features include:

- Intuitive layout with clean aesthetic

- Integrated charts with 65+ indicators

- Access to copy trading tools and portfolios

- News and research tools built-in

- Secure watchlists and order templates

- Extensive account management functions

The web platform is easy to navigate while still providing the necessary tools for manual traders. The convenience of built-in copy trading is a major perk for passive investors.

eToro Mobile App Experience

eToro’s mobile app closely mirrors the functionality of the web platform while enhanced for touchscreen usability.

You can easily open and close positions, manage your account, deposit/withdraw funds, and utilize copy trading on the go. Charts are interactive and include drawing tools for quick technical analysis.

The app allows seamless syncing between devices which complements eToro’s multi-platform experience.

For beginners, the mobile app offers an excellent introduction to trading in an easy-to-use package.

Final Recommendation

For copy, social, and crypto trading, eToro is an industry leader. The platform makes it simple for anyone to implement proven trading strategies.

With its user-friendly interface and extensive educational resources, eToro is ideal for new traders. Seasoned investors will also appreciate the convenience of managing multiple asset classes on a single platform.

Overall, eToro is highly recommended for beginners and casual traders looking for an accessible but well-rounded trading experience. The availability of crypto, fractional shares, copy trading, and staking provides unique advantages that give eToro its competitive edge.

eToro Alternatives

| Platform | Pros | Cons |

| NAGA | Similar social and copy trading – Comparable fees | Less polished platform – Narrower asset selection |

| WeBull | Commission-free stocks/ETFs | No copy trading – Less crypto and education |

| Public | For beginning traders like eToro | Fewer assets Less research – No copy trading |

FAQs

Is eToro legit?

Yes, eToro is a legitimate brokerage registered with top-tier financial regulators in the UK, Australia, and the EU. With a track record of over 15 years in business, eToro is trusted by millions of traders worldwide.

Is it safe to invest with eToro?

Yes, eToro implements robust security measures to keep client funds and data secure. As a regulated brokerage, client assets are segregated from company funds and protected by investor compensation schemes. Overall, eToro meets high safety standards for investing and trading.