Trying to keep up with fast-moving crypto markets can feel overwhelming. These best crypto telegram bots offer useful automation right inside the messaging app. But with many options, finding the best match is key. As leading experts, we compare the 10 best crypto Telegram bots for 2024.

Summary

These best crypto telegram bots provide quick access to data, tracking tools, trading automation, and more within Telegram. Leading options include:

- Finestel – Signal broadcasting, portfolio tracking, copy trading

- Unibot – AI/ML trading strategies and social analytics

- Wagie Bot – Rules-based trading for beginners

- Mizar – Copy trading and DEX automation

- Maestro – Custom trading algorithms and analytics

- Cornix – Native Telegram trading and monitoring

- Cryptohopper – Easy prebuilt trading bots

- Coinrule – Build and backtest custom bots

- Tradesanta – Strategy building and optimization

- Quadency – Robust automation for institutions

What are Crypto Telegram Bots?

Crypto telegram bots are automated programs inside Telegram providing crypto-related services like price alerts, portfolio tracking, trading, news, and more. Their convenience explains their growing popularity. Major types of crypto telegram bots include:

- Price trackers

- Trading bots

- Portfolio bots

- Tax calculators

- News aggregators

- Airdrop bots

- Wallet bots

- Exchange bots

They streamline access to essential information and tools for traders and investors right within Telegram.

10 Best Crypto Telegram Bots Compared

| Bot | Key Features | Best For | Fees |

| Finestel | Signals, copy trading, tracking | Signal providers, traders | Custom pricing |

| Unibot | AI/ML trading, analytics | Hands-off investors | $29/month + performance fee |

| Wagie Bot | Rules-based trading | Beginners | $9/month |

| Mizar | Copy trading, DEX bots | New traders | 15% profit fee |

| Maestro | Custom algorithms | Advanced traders | $25/month + performance fee |

| Cornix | Native Telegram trading | Telegram traders | $25/month + fees |

| Cryptohopper | Prebuilt bots | Beginners | $19/month |

| Coinrule | Custom bot building | Traders who code | $29-$79/month |

| Tradesanta | Strategy testing | Advanced coders | $14-$30/month |

| Quadency | Automation, analytics | Institutions | $20-$200/month |

Finestel

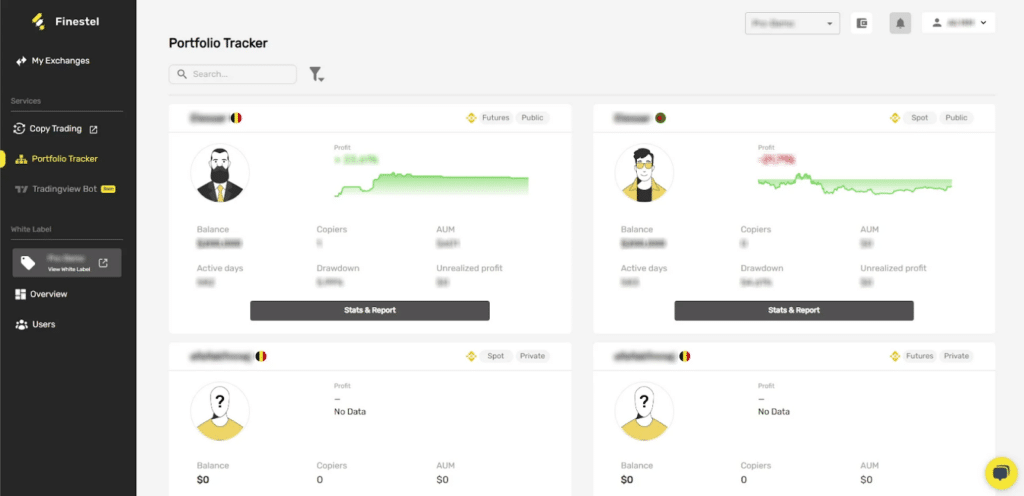

- Key Features: Finestel provides a suite of advanced automation features for crypto trading natively within Telegram. This includes automated signal broadcasting across multiple channels/groups, seamless trade execution mirroring signals, customisable portfolio tracking, and fully branded performance reports.

- Benefits: Finestel streamlines publishing signals with one click to Telegram audiences at scale. It also allows mirroring trade signals to client accounts for copy trading purposes. The bot enables easy portfolio monitoring and scheduled reports customized to user needs. You get complete visibility into client base metrics and copy trading operations.

- Pricing: Finestel offers flexible, customized pricing plans. Contact them directly for details.

- Why Choose Finestel: Finestel stands out for crypto businesses seeking an integrated solution to automate signal broadcasting, copy trading, client reporting, and more natively inside Telegram. The intuitive interface provides serious tools catering to client acquisition and management for signal providers.

Unibot

- Key Features: Unibot leverages AI and machine learning to optimize fully automated crypto trading strategies. It analyzes a vast array of data from news reports, social media platforms, and financial statements to identify actionable trading opportunities. Unibot also provides intuitive dashboards for tracking detailed portfolio metrics and risk analysis.

- Benefits: Unibot consistently beats market benchmark returns by 5-7% via data-driven insights that minimize risks. The AI model detects early trading signals and trends ahead of the market. Users can customize Unibot’s pre-built strategies to match individual risk tolerance and goals. The platform is suitable even for those new to crypto trading.

- Pricing: Unibot offers a free version with basic functionality. The Pro plan unlocks all features for $29/month alongside a 1% performance fee on profitable trades.

- Why Choose Unibot: Unibot stands out for its cutting-edge use of AI to optimize automated trading results and the fact it makes advanced algorithms accessible even to crypto trading beginners. The extensive datasets driving Unibot provide an edge.

Wagie Bot

- Key Features: Wagie Bot focuses on basic automated crypto trading for beginners. It offers rules-based trading using preset strategies along with options for manual trade execution and simple portfolio tracking. By design, Wagie emphasizes core functionality over intricate tools.

- Benefits: Wagie Bot is easy to set up and suitable for dipping one’s toes into basic algorithmic trading for the first time. It enables lower-risk approaches for new traders to test the waters. The bot is very affordable compared to more advanced alternatives.

- Pricing: Wagie Bot offers a free demo plan for paper trading. The paid subscription unlocks live trading functionality for $9 per month without any performance fees.

- Why Choose Wagie Bot: If seeking a crypto bot with minimal complexity to implement basic automated strategies, Wagie Bot’s simplicity stands out from the crowd specifically targeting crypto trading newcomers.

Mizar

- Key Features: Mizar offers a full toolkit spanning copy trading, DEX aggregation, sniper bots, and CeFi/DeFi automation – all accessible directly within Telegram. It also includes proprietary research tools like Token Sniffer for evaluating emerging cryptos.

- Benefits: Mizar provides free access to its public token analysis research reports. Traders benefit from mirroring successful portfolio managers while leveraging Mizar’s expertise in identifying promising projects early. No coding skills are required.

- Pricing: Mizar has no monthly subscription fees and charges 15% performance fees on profits from copied trades. This aligns with incentives.

- Why Choose Mizar: The lack of monthly fees and focus on emerging opportunities in DeFi, along with seamless Telegram access, differentiate Mizar for investors seeking to tap growing spaces like DEXs through proven copy trading methods.

Maestro

- Key Features: Maestro lets experienced crypto traders fully customize automated trading systems across any major chain. Its robust toolset includes building detailed algorithms, backtesting through historical simulations, implementing refined strategies, and optimization.

- Benefits: Maestro essentially offers professional-caliber analytics and automation tools comparable to institutional trading platforms – but designed for retail traders. The one-time competitive pricing makes this institutional-grade functionality accessible.

- Pricing: Maestro is priced at a one-time fee of $250 alongside additional monthly maintenance fees and potential performance fees. However, discounts are available.

- Why Choose Maestro: For advanced crypto traders seeking an unfair advantage, Maestro delivers a sophisticated platform to thoroughly develop, refine, test, automate, and optimize customizable trading algorithms tailored to their specific needs in changing market conditions.

Cornix

- Key Features: Cornix allows you to fully perform crypto trading, portfolio monitoring, customizable alerts and notifications natively within Telegram. Unlike other tools, it does not require leaving the Telegram interface at all.

- Benefits: Cornix offers convenience by enabling crypto trading flows inside Telegram without switching between apps. Users get custom alerts based on price movements and related triggers. The extensive customization lets users tailor Cornix to their needs. The public community chat features help members learn and share knowledge.

- Pricing: Cornix offers a limited free version. The premium subscription costs $25 per month with additional fees based on transaction volume, but with no profit sharing. High-volume traders get discounted rates.

- Why Choose Cornix: For telegram-centric crypto traders preferring a native experience within their messaging app rather than external dashboards, Cornix delivers full functionality without compromising user experience by necessitating external apps.

Cryptohopper

- Key Features: Cryptohopper equips newcomers with cloud-based automated crypto trading bots using easy preset templates needing no coding skills. Users simply mirror proven strategies or configure indicators for automation.

- Benefits: Beginners benefit through Cryptohopper’s simplified configuration using pre-built templates. The cloud infrastructure means no complex setup. Being able to trade continuously offers flexibility and efficiency. As a well-known brand, Cryptohopper provides responsive customer support.

- Pricing: Prices range from a free starter plan to $19 per month for the advanced features within the Pro version. No profit-sharing exists.

- Why Choose Cryptohopper: Cryptohopper prioritizes accessibility and an intuitive journey for newcomers to start algorithmic crypto trading rapidly without technical barriers. The range of education resources provide guidance.

Coinrule

- Key Features: Coinrule enables traders to build, backtest, automate, and optimize customized crypto trading bots tailored to their own strategies and algorithms. It offers access to over 150 strategy templates along with backtesting tools using historical market data to refine the bots before actual deployment.

- Benefits: The main advantage of Coinrule is the ability to create highly personalized automated trading systems using customizable indicators and parameters of the user’s choice. The platform is very transparent in letting users validate their trading theories and bot configurations through extensive backtesting before risking real capital. The large community also shares strategies.

- Pricing: Coinrule offers a free starter plan for basic configuration. The Pro package supporting full bot automation costs $29 per month. For the highest tier with additional features, the Enterprise plan costs $79 monthly. There are no performance fees.

- Why Choose Coinrule: For crypto traders seeking to graduate from manual to automated methodologies tailored to their outlooks, Coinrule provides an ideal launchpad to construct intricate bots reflecting personal perspectives powered by verifiable, data-backed testing capabilities that build conviction in the process.

Tradesanta

- Key Features: Tradesanta gives experienced crypto traders advanced infrastructure to build, rigorously test, analyze, automate, optimize and scale customized crypto bots tailored to their strategies. Quant-style analytics provide insight into performance.

- Benefits: Traders benefit through robust automation solutions to execute proven systematic methodologies. Strategies enforce predetermined rules minimizing emotional decisions. Features backtesting bots over historical data identify strengths or anomalies. Ongoing optimization increases efficiency.

- Pricing: Depending on desired features, prices range from $14 per month up to $30 monthly. Discounts for annual subscriptions are available. No profit sharing exists.

- Why Choose Tradesanta: With Tradesanta’s toolbox, seasoned crypto traders gain an unfair advantage by automating disciplines through methodical algorithms — enabling fact-based adjustments. Quantifying human judgment calls maintains consistency in volatile markets.

Quadency

- Key Features: Quadency delivers sophisticated trading automation for institutions and dedicated crypto businesses through algorithmic trading across all major exchanges, portfolio tracking, risk analysis, and aggregated analytics across platforms.

- Benefits: Quadency streamlines firm-level trading coordination while minimizing risks with its suite of management tools tailored for business operational needs – from Susquehanna International Group to market makers and OTC specialists. The diverse functionality scales.

- Pricing: Packages are customized based on firm requirements, typically ranging from $200 per month to higher-tier enterprise pricing through direct consultation. Quadency also shares a percentage of gains depending on the package.

- Why Choose Quadency: Quadency provides specialized tools for crypto companies to orchestrate firm strategies through its comprehensive automation bridging trading, risk monitoring, compliance and reporting under one roof. Quadency’s proven infrastructure manages billions in assets. The offering provides capabilities even portfolio managers at elite alternative funds would use based on crypto market evolution.

Next Steps for Traders

With so many tokens now available, discerning the top contenders from the pack is key. Check out our guide to the Best Crypto to Buy Now for insightful analysis.

As part of managing a diverse crypto portfolio, bridging assets across different blockchains is a common need. Learn about the Best Crypto Bridges to simplify transfers.

Safeguarding investments should be a top priority for any crypto owner. Explore recommendations of the Best Crypto Wallets to secure holdings.

Conclusion

The top crypto trading bots on Telegram provide powerful automation to simplify trading. However, no tool replaces developing your own skills and wisdom over time. Use bots as aids while building market knowledge yourself. With informed expectations of both capabilities and limitations, integrating bots can complement manual strategies on your own terms.

FAQs

Are crypto bots on Telegram safe?

Like any automated tool, bots carry risks. Research security practices and start small to understand their strategies before linking real money. Use hardware wallets to secure larger holdings.

Can beginners use crypto trading bots?

Beginner-friendly options like Wagie Bot, Cryptohopper and Mizar offer preset configurations requiring little expertise to operate for basic trading. Focus on core functionality over complex tools initially.

What should I look for in a crypto trading bot?

Key factors include security, fees, supported exchanges, customization options, ease of use, automation features, customer support, transparency, and past performance. Align factors to your specific experience level, trading style and goals.