Our crypto experts at Coincipher conducted a comprehensive analysis to bring you the 5 best crypto exchanges in Croatia. By the end of this comprehensive analysis, you’ll be well-equipped to make an informed decision on the best crypto exchange to suit your trading needs and preferences.

Summary of 5 Best Crypto Exchanges in Croatia:

In Croatia, experts advise opting for exchanges regulated by the Croatian National Bank for purchasing and trading Bitcoin and other cryptocurrencies. By utilizing bank transfers, credit cards, or digital wallets to deposit Euros (EUR), individuals can legally buy, stake, and trade digital assets.

For novices starting on their crypto ventures in Croatia, we’ve assessed the top 5 trading platforms prevalent in the region:

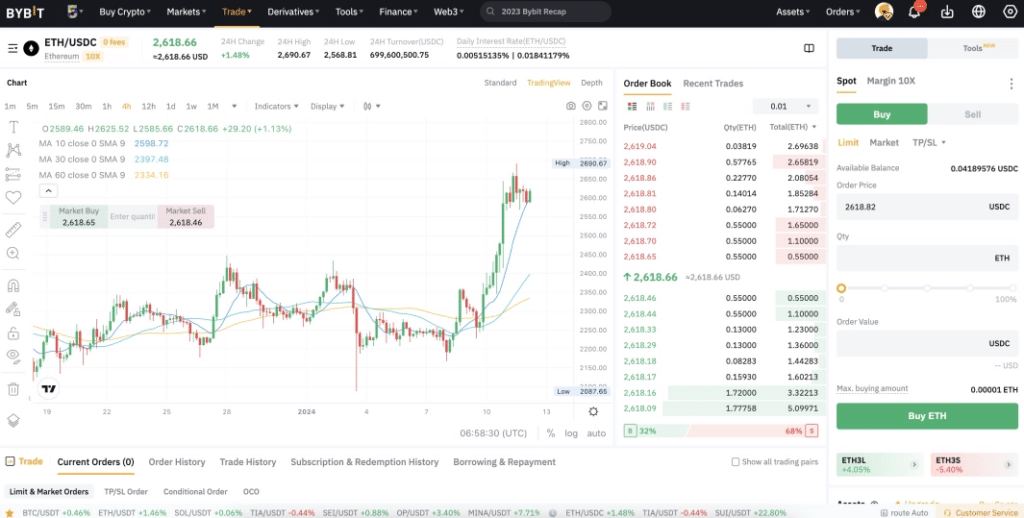

- Bybit – Best Overall Crypto Exchange in Croatia

- Uphold – Best for Beginners

- MEXC – Top Choice for High Leverage

- Gate.io – Best Crypto Platform for Altcoins

- OKX – Good Choice for Institutional Investors

| Exchange | Cryptocurrencies | Trading Fees | Deposit Methods | Key Features |

| Bybit | 1,000+ | 0.01% – 0.06% | Bank Transfer, Credit/Debit Card | Staking, Options, Futures, Lending |

| Uphold | 250+ | 1% Trading Fee, 1% Spread | Debit/Credit Card, Google Pay | Staking, Gold & Silver Investing |

| MEXC | 300+ | 0.02% – 0.06% | Bank Transfer, Debit/Credit Card | 200X Leverage, Staking, Options |

| Gate.io | 1,700+ | 0.08% – 0.1% | Bank Transfer, Credit Card | Widest Altcoin Variety, Futures, Options |

| OKX | 300+ | 0.1% Trading Fee, 0.1% Spread | Bank Transfer, Debit/Credit Card | Options, Futures, OKX Wallet, DeFi Support |

Bybit Overview

Rated as the premier crypto exchange in Croatia, Bybit is known for its robust security, diverse cryptocurrency offerings, competitive fees, and adherence to European regulatory standards. The platform offers a user-friendly interface suitable for both new and experienced investors.

Best features

- Supports trading of over 1,000 cryptocurrencies

- Competitive maker/taker fees of 0.01% and 0.06%

- Multiple EUR deposit methods including bank transfer, SEPA, debit/credit cards

- Offers staking, options, futures, and lending services

- Adheres to CySEC regulations across Europe

Why we like it: Bybit stands out for its extensive cryptocurrency selection, low fees, and strong regulatory compliance, making it the top choice for Croatian investors.

Key Metrics

- 20+ million global users

- $10 billion+ in daily trading volume

- Maker fees as low as 0.01%

- Taker fees as low as 0.06%

- Supports 1,000+ cryptocurrencies

- Up to 25x leverage on perpetual contracts

- Multiple EUR deposit options

- Regulated by CySEC across Europe

- User-friendly interface for all skill levels

- Robust security protocols

Uphold Overview

Uphold is a highly accessible and international cryptocurrency exchange, servicing over 150 countries with a user base surpassing 10 million. The platform offers an expansive portfolio of over 250 digital assets and attractive staking options, enabling investors to earn up to 25% APY.

Best features

- Supports 250+ cryptocurrencies, 4 precious metals, and 27 fiat currencies

- Staking rewards up to 25% APY on 30+ cryptocurrencies

- 1% trading fee and 1% spread

- Deposit EUR via bank transfer or credit/debit card

- Adheres to European regulations and is operational in Croatia

- Audited proof-of-reserves ensures 1:1 backing of digital assets

Why we like it: Uphold’s wide range of supported assets, high staking rewards, and commitment to transparency and regulatory compliance make it an excellent choice for beginners.

Key Metrics

- 10+ million global users

- 250+ supported cryptocurrencies

- 4 supported precious metals

- 27 supported fiat currencies

- Up to 25% APY staking rewards

- 1% trading fee

- 1% spread fee

- Audited proof-of-reserves

- Operates in 150+ countries

- Registered with global financial authorities

MEXC Overview

MEXC is a notable choice for Croatian investors, offering a wide selection of over 300 cryptocurrencies and high-leverage futures trading up to 200x. The platform adheres to rigorous regulatory standards, ensuring a secure trading environment.

Best features

- 300+ supported cryptocurrencies

- Up to 200x leverage on futures trading

- Competitive maker/taker fees of 0.02% – 0.08%

- Supports EUR deposits via bank transfer, debit/credit card

- Offers spot trading, margin trading, staking, and IEOs

- Licensed in Estonia and based in Seychelles

Why we like it: MEXC’s high-leverage futures trading, extensive cryptocurrency selection, and competitive fees make it an attractive option for experienced traders.

Key Metrics

- 300+ supported cryptocurrencies

- Up to 200x leverage on futures

- $2+ billion in daily trading volume

- 0.02% – 0.06% maker fees

- 0.06% – 0.08% taker fees

- Supports EUR deposits

- Offers spot, margin, futures, and staking

- Licensed in Estonia

- Based in Seychelles

Gate.io Overview

Gate.io is celebrated for its extensive variety of over 1,700 cryptocurrencies, catering to users seeking diverse crypto options. The platform offers competitive fees starting at 0.1% for spot trades and provides advanced features like automated trading bots.

Best features

- Supports 1,700+ cryptocurrencies, the widest selection among Croatian exchanges

- Competitive maker/taker fees starting at 0.1% and 0.2% respectively

- EUR deposits via bank transfer, debit/credit card

- Advanced features like automated trading bots and startup section

- Based offshore in Seychelles, adheres to international standards

Why we like it: Gate.io’s unparalleled cryptocurrency selection, low fees, and advanced trading features make it a top choice for altcoin enthusiasts and experienced traders.

Key Metrics

- 1,700+ supported cryptocurrencies

- 0.1% starting maker fee

- 0.2% starting taker fee

- High 24-hour trading volume

- Large global user base

- Supports EUR deposits

- Offers automated trading bots

- Dedicated startup section

- Based in Seychelles

- Available in Croatia

OKX Overview

OKX is a comprehensive financial platform offering over 300 cryptocurrencies, substantial liquidity, and a vibrant DeFi ecosystem. The exchange provides various trading options and sophisticated portfolio management tools.

Best features

- 300+ supported cryptocurrencies including major assets and stablecoins

- Competitive 0.08% spot trading fee

- EUR deposits via bank transfer and credit card

- Vibrant DeFi ecosystem with OKT Chain for high-yield investments

- Offers spot, margin, futures, and options trading

- Active NFT marketplace and DeFi portfolio management tools

Why we like it: OKX’s extensive cryptocurrency selection, advanced DeFi offerings, and diverse trading options make it a valuable platform for experienced investors seeking profitable opportunities.

Key Metrics

- 300+ supported cryptocurrencies

- Supports major assets like BTC, ETH, SOL, and stablecoins

- 0.08% spot trading fee

- Substantial liquidity

- Vibrant DeFi ecosystem with OKT Chain

- Offers spot, margin, futures, options trading

- Active NFT marketplace

- Sophisticated DeFi portfolio tools

- Adheres to international standards

- Supports EUR deposits

Also read:

How to Purchase Cryptocurrencies in Croatia

For beginners aiming to invest in digital currencies within Croatia, adhere to this detailed, step-by-step guide for lawful and secure transactions:

- Select a reliable exchange: Choose a platform that is approved by Croatia’s regulatory authorities, as highlighted in our guide. Bybit stands out as the best overall choice.

- Registration: Use your email for registration, establish a strong password, and complete any necessary KYC procedures.

- Deposit EUR: Fund your account using domestic bank transfers, credit/debit cards, or digital wallets.

- Buy Crypto: Select the desired cryptocurrency and quantity, then confirm the purchase.

- Secure Your Assets: Transfer your digital currencies to a secure crypto wallet to enhance security.

Legality and Regulation of Crypto Investing in Croatia

Croatia legally defines cryptocurrencies but has yet to implement a comprehensive regulatory framework. The Croatian National Bank recognizes virtual currencies as digital representations of value accepted for exchange but does not consider them legal tender or foreign payment instruments. Current regulations primarily focus on anti-money laundering measures targeting crypto exchanges and wallet providers.

Is Crypto legal in Croatia?

Yes, cryptocurrencies are legal in Croatia, but they are not recognized as legal tender or foreign payment instruments by the Croatian National Bank. The country is working towards establishing a more robust regulatory framework, with recent steps requiring crypto firms to register in alignment with the EU’s upcoming Markets in Crypto Assets Regulation (MiCA).

How is Crypto taxed in Croatia?

In Croatia, crypto-assets are taxed based on general national tax law principles, as specific rules for cryptocurrencies have not been established. The Croatian Tax Administration classifies cryptocurrencies as equivalent to financial assets, applying capital gains tax rules to crypto transactions.

Capital gains from crypto-assets are subject to a 10% personal income tax (PIT), payable by the end of February following the year of gain realization. However, gains from crypto-assets held for over two years are exempt from this tax. Crypto-to-FIAT transactions are taxable if the disposal value exceeds the acquisition value, but capital losses within two years can offset gains. Exchanges of crypto for goods, services, or other cryptocurrencies are only taxed when converted to FIAT currency.

Conclusion

Navigating the cryptocurrency landscape in Croatia requires careful consideration of the available exchanges, their features, and the evolving regulatory environment. By selecting a trustworthy platform like Bybit, Uphold, MEXC, Gate.io, or OKX, investors can confidently engage in crypto trading while adhering to the country’s legal framework. As Croatia progresses towards more defined regulations and taxation for cryptocurrencies, these top exchanges offer secure and feature-rich environments for both novice and experienced traders.

FAQs

Are cryptocurrencies legal in Croatia?

Yes, cryptocurrencies are legal in Croatia, but they are not recognized as legal tender or foreign payment instruments by the Croatian National Bank.

What is the best cryptocurrency exchange in Croatia?

Bybit is widely considered the best overall cryptocurrency exchange in Croatia, offering a wide selection of cryptocurrencies, competitive fees, and a user-friendly interface.

How are cryptocurrencies taxed in Croatia?

Crypto-assets are subject to a 10% personal income tax on capital gains, payable by the end of February following the year of gain realization. Gains from crypto-assets held for over two years are tax-exempt.

Can I buy cryptocurrencies with EUR in Croatia?

Yes, the top crypto exchanges in Croatia support EUR deposits via methods like bank transfer, SEPA, and credit/debit cards.

What should I look for when choosing a crypto exchange in Croatia?

When selecting a crypto exchange in Croatia, consider factors such as supported cryptocurrencies, fees, security measures, regulatory compliance, user interface, and additional features like staking or advanced trading options.