A detailed review outlining what the best five cryptocurrency exchanges in Greece are. Learn about the top platforms and compare their fees, features, security, customer support options, and more.

Summary of 5 Best Crypto Exchanges in Greece

In Greece, experts advise opting for exchanges regulated by the Hellenic Capital Market Commission (HCMC) for purchasing and trading Bitcoin and other cryptocurrencies. By utilizing bank transfers, credit cards, or debit cards to deposit Euros (EUR), individuals can legally buy, stake, and trade digital assets.

For novices embarking on their crypto ventures in Greece, we’ve assessed the top 5 trading platforms prevalent in the region:

- eToro – Best Overall Crypto Exchange in Greece

- Uphold – Best Alternative Crypto Exchange

- Bybit – Best Derivatives Crypto Exchange

- Binance – Best for Deep Liquidity

- OKX – Best for DeFi Compatibility

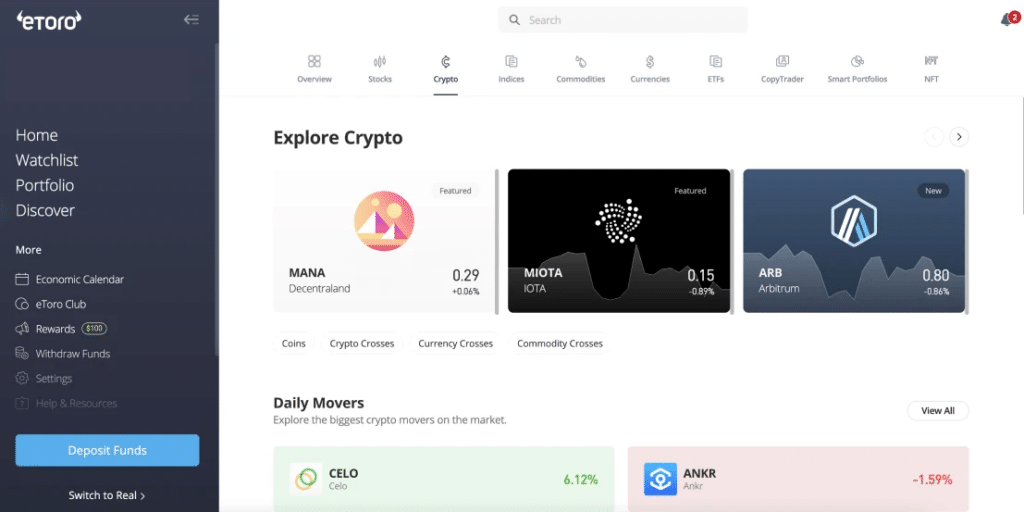

eToro Overview:

Rated as the premier crypto exchange in Greece, eToro is known for its strong regulatory compliance, diverse selection of over 3,000 assets, and convenient Euro (EUR) deposit options.

- Offers access to over 3,000 financial assets including major cryptocurrencies like Bitcoin, Ethereum, XRP, crypto market indexes, commodities, stocks, ETFs, and more

- Fully compliant and aligned with European regulations, including Cyprus Securities and Exchange Commission (CySEC) licensing

- Used by over 30 million registered users globally, establishing a reputable standing in the crypto industry

- Implements a variable spread fee model ranging from 1% for crypto and up to 5% for exotic assets

- Enables Euro deposits through multiple convenient methods including SEPA bank transfers, debit card, credit card, PayPal and Skrill

Why we like it:

eToro emerges as our top choice for Greek crypto investors thanks to its trustworthy reputation established through stringent regulatory compliance. By securing CySEC licensing and fully aligning with European financial authority mandates, users can have confidence in the platform’s security and asset protection protocols.

Moreover, eToro opens the door to over 3,000 diverse assets spanning major cryptocurrencies, crypto indexes, commodities, stocks, ETFs and more. This makes eToro exceptionally appealing for building diversified investment portfolios on a single platform. Dedicated users can also interact with the eToro social investing platform to discuss strategies and analyze emerging market trends.

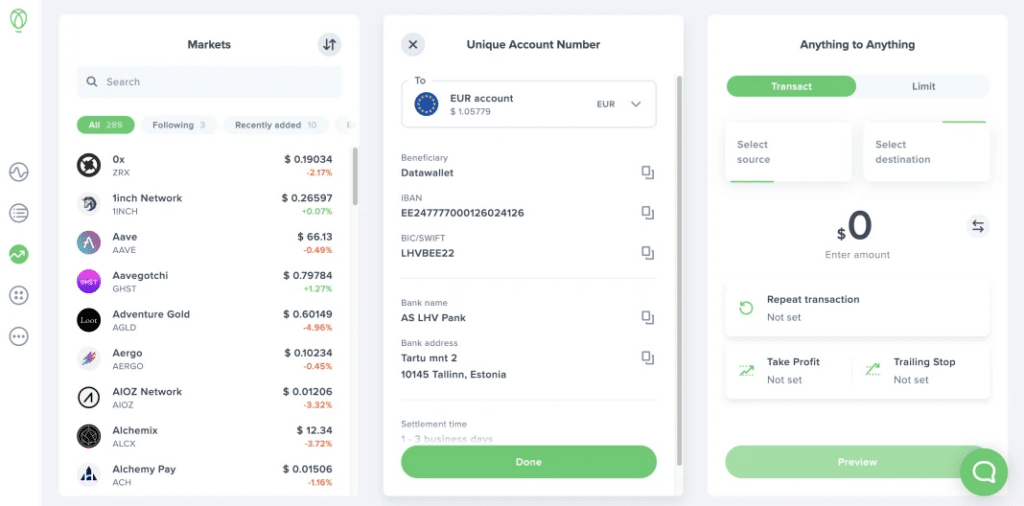

Uphold Overview:

Emerging as the security and transparency focused crypto trading platform, Uphold offers a robust selection of over 250 digital assets and intuitive staking options with yields up to 25% APY.

- Provides access to over 250 cryptocurrencies, including all major coins like Bitcoin, Ethereum, XRP, Solana, Polkadot and more

- Supports trading and conversions between 27 different fiat currencies beyond Euros like USD, GBP, JPY, CHF, CAD and more

- Offers crypto staking on over 30 coins with industry-leading yields up to 25% APY

- Registration under the Republic of Lithuania adheres to wider European financial regulations

- Implements a 1% trading fee on all transactions in addition to a 1% spread fee

- Allows Euro deposits via SEPA and local bank transfers, alongside Apple Pay, Google Pay, credit/debit cards and more

Why we like it:

As an established global crypto platform catering to over 10 million clients, Uphold prioritizes transparency and trustworthiness to users in Greece and worldwide. The platform offers audited Proof-of-Reserve reports to demonstrate 1:1 reserves backing of all supported assets, underscoring its commitment to effective consumer protections.

We also applaud Uphold for its diverse array of over 250 cryptocurrencies complemented by staking yields of up to 25% APY across 30+ coins. This positions Uphold as an ideal one-stop platform for Greek clients interested in crypto trading, conversions, passive yields, and convenient Euro funding through multiple channels.

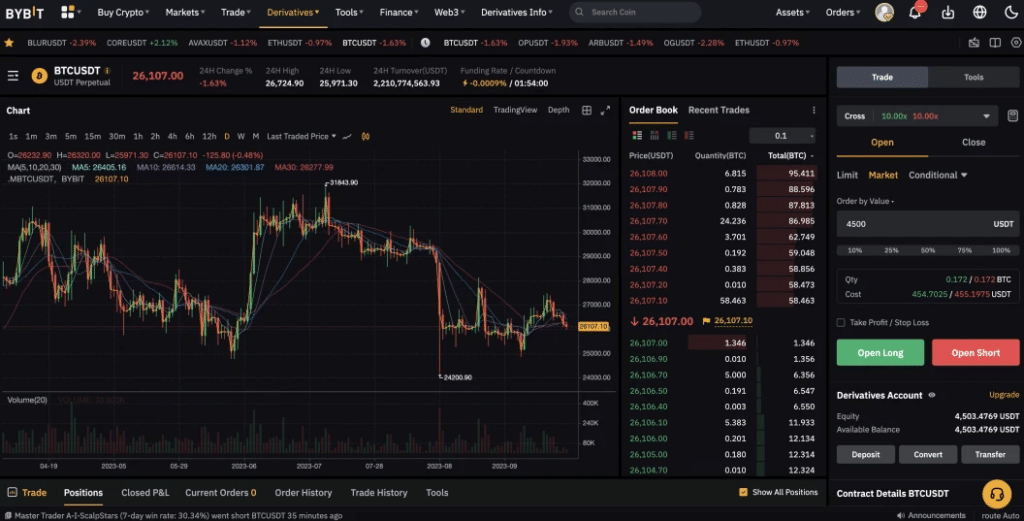

Bybit Overview:

Bybit excels as a versatile platform suited for newcomers and professional crypto traders alike interested in perpetual futures contracts. With quick Euro deposits, strong security, and over 770 digital asset options, Bybit suits the diverse Greek crypto market.

- Provides perpetual futures trading on over 770 cryptocurrency pairs with up to 100x leverage

- Supports major coins like Bitcoin, Ethereum, XRP, Cardano, Solana, Polkadot, Dogecoin and more

- Ideal for newcomers with a user-friendly interface, demo trading, and educational resources

- Also caters to advanced traders via Contracts for Difference (CFDs), options trading and more

- Holds regulatory approvals from Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA)

- Implements competitive maker fee of 0.01% and taker fee of 0.06% to benefit market liquidity

- Allows fast Euro deposits through SEPA, bank wire, debit card, credit card, Paysafe card, Google Pay plus over 20 other methods

Why we like it:

Our analysts highlight Bybit as an appealing crypto derivatives platform for both novice and experienced traders in Greece. By offering demo accounts, a beginner-friendly interface and crypto educational resources, newbies can safely learn techniques using virtual funds. At the other end of the spectrum, professional traders have access to advanced options, futures contracts, up to 100x leverage and CFDs.

Moreover, Bybit holds licenses from CySEC and FCA to cement its regulatory compliance. This, paired with tight security protocols, makes Bybit a reliable venue. Low maker/taker fees further incentivize traders while fast payments processing enables quick Euro deposits through an array of traditional and alternative channels.

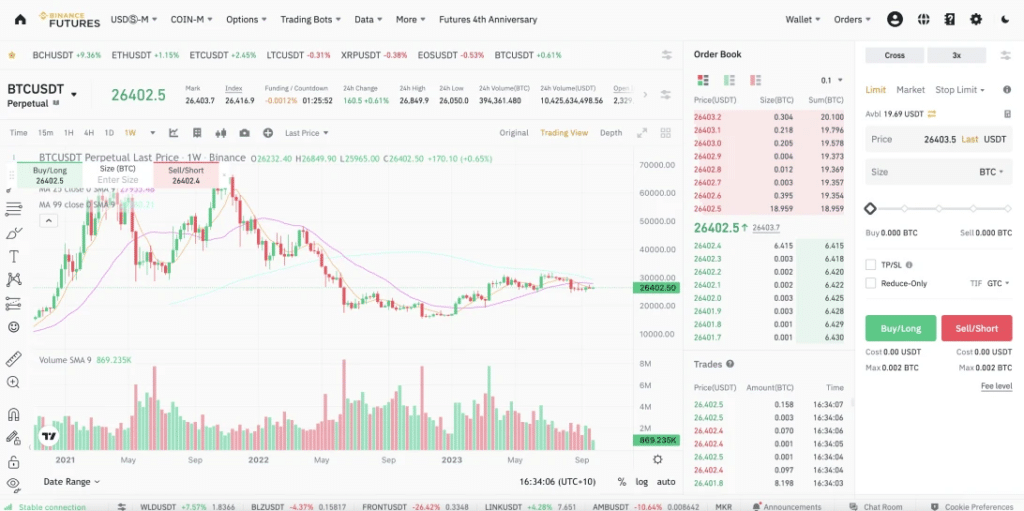

Binance Overview:

Binance leads in offering an expansive crypto ecosystem including staking, earning, and leveraged trading, with language support tailored for Greek users. However, regulatory uncertainties remain.

- Supports spot trading on over 350 cryptocurrencies including Bitcoin, Ethereum, BNB, XRP, Cardano, Solana, Dogecoin, Shiba Inu and more

- Access to futures and margin trading across cryptocurrency and fiat currency pairs, commodities and synthetic tokens, up to 125x leverage

- Diverse ecosystem features lending, staking, savings accounts, DeFi integration, NFT marketplace, Visa card and more

- Offers Greek language site – binance.com/el-gr – with dedicated customer assistance for locals

- Implements spot trading fees as low as 0.1%, with maker fees of 0.02% and taker fees of 0.04% for futures contracts

- Allows Euro deposits through SEPA transfers, bank wire, and debit/credit card payments

Why we like it:

As the world’s largest cryptocurrency exchange serving over 120 million users worldwide, Binance makes a compelling case for Greek traders seeking diverse features beyond basic buying/selling of coins. Its massive selection of over 350 coins and tokens opens the door to next-generation DeFi coins, NFTs, metaverse tokens and more emerging assets alongside staple cryptocurrencies.

The expansive Binance ecosystem also enables convenient access to cryptocurrency lending, staking, savings accounts, Visa debit card integration, P2P transactions and institutional-grade offerings – all from a single platform interface. By providing Greek language site translations and dedicated local customer support channels, user-friendliness is also upheld.

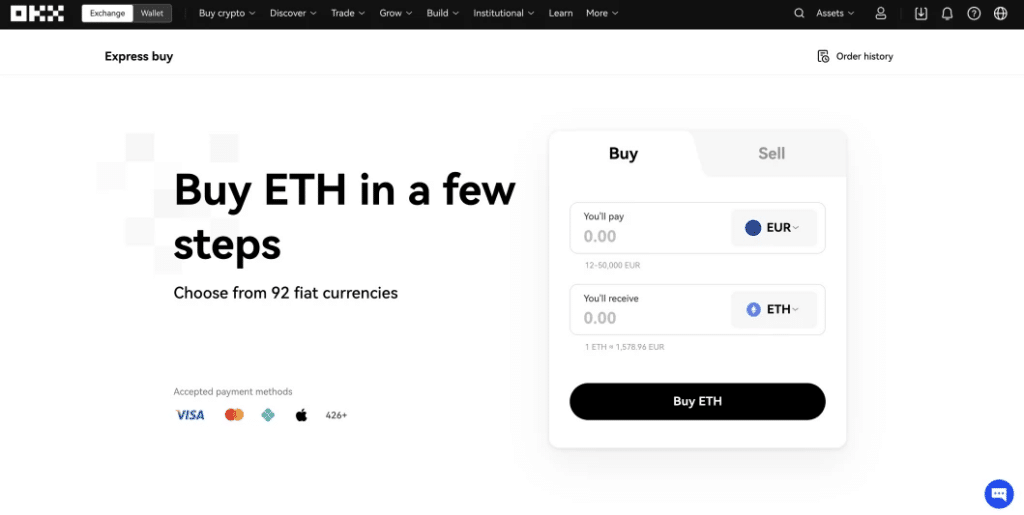

OKX Overview:

OKX positions itself as highly suitable for institutional, professional traders with its DeFi and API integration. The wide range of cryptocurrencies, security measures, and Euro funding options make it appealing.

- Offers spot and derivatives trading including futures, perpetual swaps and options across over 300 cryptocurrencies

- Advanced features such as stage trading, iceberg orders and Futures Grid Strategy caters to institutional clients

- Seamlessly connects to DeFi protocols like AAVE, Compound, and Curve via OKX Wallet for permissionless transactions

- Places strong emphasis on robust security infrastructure including cold wallet storage and encryption

- Competitive fee structure with maker and taker fees of 0.1% and 0.2%, respectively

- Range of Euro deposit methods available, including bank transfers, debit/credit card payments

Why we like it:

OKX emerges among the top choices in our review catering to professional crypto traders, institutional investors, and blockchain enterprises based in Greece. By combining robust security protocols, DeFi compatibility and a full suite of advanced trading features, OKX is uniquely equipped to serve these more sophisticated investors.

We specifically applaud OKX for its seamless integration with leading DeFi protocols. By enabling direct connectivity to the permissionless world of decentralized finance, traders based in Greece gain exposure to unprecedented opportunities for yield generation and tokenized asset classes. Paired with deep liquidity across a vast range of cryptocurrencies, OKX is a one-stop-shop venue for Greek professionals.

How to Purchase Cryptocurrencies in Greece:

For beginners aiming to invest in digital currencies within Greece, adhere to this detailed, step-by-step guide for quick and secure transactions:

- Select a reliable, EU-approved exchange like eToro or Uphold

- Registration: Use your email for registration, choose a strong password, and verify identity.

- Deposit Euros: Fund your account via domestic bank transfers, debit/credit cards, or digital wallets.

- Buy Crypto: Pick your desired cryptocurrency and amount then complete purchase.

- Transfer to Wallet: For optimal security, move newly bought crypto to a private wallet.

Legality and Regulation of Crypto Investing in Greece:

Cryptocurrency is legal in Greece and the country has shown support of blockchain technologies like other EU members. While Greece has no specific cryptocurrency regulations, the HCMC oversees entities like crypto exchanges as part of European financial regulations. Crypto profits made by businesses require taxation, while individual investors currently have no crypto asset reporting requirements.

Is Crypto Legal in Greece?

Yes, cryptocurrencies are entirely legal to buy and sell in Greece for both companies and individuals. While specific regulations are still being formulated, crypto exchanges and related entities fall under the jurisdiction of the HCMC in alignment with broader EU regulations.

How is Crypto Taxed in Greece?

At present, cryptocurrency taxation only applies to corporate entities in Greece that actively trade digital assets or generate revenue related to cryptocurrencies. These companies must report crypto profits and losses on annual tax submissions. However, Greece does not currently impose capital gains taxes or require tax reporting for individual/retail investors trading cryptocurrencies.

Conclusion

In closing, Greece provides a viable landscape for both retail and institutional cryptocurrency investors seeking exposure to this rapidly evolving asset class. By leveraging trusted platforms that adhere to regulations from the Hellenic Capital Market Commission and broader European authorities, users can have confidence in seamless Euro transactions.

Our comprehensive review analysis of the top crypto exchanges available to Greek clients confirms that platforms like eToro, Uphold, Bybit, Binance and OKX each cater to unique trader requirements. Whether you are a complete beginner or a sophisticated blockchain enterprise, Greece boasts reputable venues to buy, sell and trade digital currencies across Windows and mobile devices.

FAQS:

What crypto platform is used in Greece?

Major global platforms like eToro, Uphold, and Binance are widely used in Greece for convenient Euro deposits and hundreds of coins to trade. For compliance, CySEC and HCMC-approved exchanges are the safest options.

Can I use Paxful in Greece?

Paxful is accessible in Greece but since it’s based in Estonia with less transparency, it has a higher risk profile. For enhanced security and compliance, experts recommend HCMC and EU-regulated exchanges instead.

Which is one of the top crypto exchanges?

According to extensive reviews, eToro consistently emerges as a top and best overall choice for crypto investors in Greece thanks to its regulatory compliance and 3,000+ tradable assets.