When it comes to crypto trading platforms, Binance vs Uphold are two of the biggest names. But which one is better for your needs? This comprehensive comparison analyzes their features, fees, security, support and more.

Summary

Our analysis aims to help you decide if market-leading exchange Binance or asset conversion platform Uphold best fits your investment style and priorities. By evaluating their strengths and weaknesses across key categories, we offer side-by-side insights to inform your choice.

For high-volume traders seeking an advanced platform with deep liquidity across hundreds of altcoins, Binance stands out. But Uphold’s direct value transfers between crypto, fiat and metals give it an edge for easy portfolio diversification.

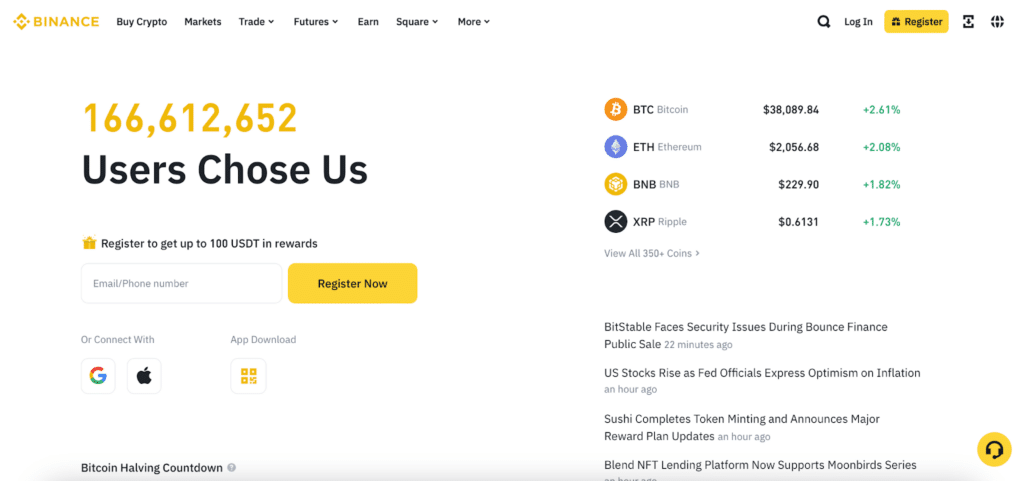

Binance Overview

We’ve given Binance a rating of 4.5/5 stars based on its low trading fees, extensive altcoin support and strong security infrastructure.

- Founded in 2017 and headed by Changpeng Zhao

- World’s largest crypto exchange with daily volumes over $15 billion

- Over 500+ altcoins available for trading against BTC, stablecoins and fiat

- Cutting-edge features like lending, staking, savings accounts and NFT marketplace

Uphold Overview

Uphold also scores highly at 4/5 stars due to its easy account setup, variety of payment methods and conversion features for fiat, crypto and precious metals.

- Founded in 2015 and led by JP Thieriot

- Supports over 250+ cryptos plus precious metals and 30+ fiat currencies

- Direct value transfers between supported assets sets it apart

- Intuitive mobile app and debit card make payments simple

Feature Comparison: Binance vs Uphold

| Features | Binance | Uphold |

| Platform Type | Centralized Exchange | Centralized Exchange |

| Available Cryptos | 500+ | 250+ |

| Fiat Currencies | 40+ | 30+ |

| Precious Metals | No | Yes (Gold, Silver, Platinum) |

| Staking Coins | Yes | Yes |

| Limited Trading | Spot, Margin, Futures, P2P | Spot |

| Payments Card | Yes | Yes |

| Supported Countries | Most except USA | Most including USA |

Binance clearly wins when it comes to crypto asset range. But Uphold stands apart with precious metal conversions alongside standard spot trading.

Fee Structure

Binance uses a multi-tiered fee structure based on 30-day trading volume and BNB holdings. Fees start from a flat 0.10% per trade but holding BNB can reduce that to 0.075%. The more volume you handle, the lower your rate.

Uphold employs an easy-to-understand pricing model charging around 1% per trade. Deposit/withdrawal fees vary depending on your payment method and location. But direct conversions between assets carries no extra charges.

Heavy traders will save more in fees on Binance. But for casual investors, Uphold’s transparent and nominal costs per transaction offer reliability.

Security and Regulation

As leading platforms, both Binance and Uphold take security and compliance seriously.

Binance holds registrations, licenses and partnerships worldwide. These include France’s Digital Asset Service Provider (DASP) license, Abu Dhabi’s Financial Services Regulatory Authority (FSRA) license and Italy’s Organismo Agenti e Mediatori (OAM) license.

Uphold conducts full KYC verification and is registered as an MSB (Money Services Business) with FinCEN (US Treasury). It’s also regulated in the UK by the Financial Conduct Authority as an e-money business.

With robust measures in place, you can feel confident entrusting your funds to either platform.

Customer Support

| Metric | Binance | Uphold |

| Availability | 24/7 | 24/5 |

| Live Chat | Yes | Yes |

| Email Support | support@binance.com | support@uphold.com |

| Response Time | <12 hours | <24 hours |

Binance and Uphold both offer email and in-platform ticket support alongside instant chat. With round-the-clock availability, Binance has the edge for urgent inquiries. But Uphold also provides prompt replies within a day.

Mobile App

Binance markets itself as an “all-in-one” crypto app with a 4.8/5 rating on major mobile platforms. It enables quick trades alongside wallet, savings and staking features. With 120+ million users, its popularity speaks for itself.

While lower-rated at 3.6/5 stars, Uphold still offers full trading and payments capabilities from iOS and Android devices. Users compliment its easy linking to bank accounts but note some transparency issues.

For on-the-go usability, Binance pulls ahead as the category leader. But Uphold covers the basics through its mobile experience.

Supported Countries

Binance restricts access to some jurisdictions based on local regulations. Currently, it blocks US-based users but accepts most other nations. Users in China mainland also face restrictions.

Conversely, Uphold holds licenses enabling it to operate in key Western markets like the US and UK. This gives it an advantage in financial hubs with more conservative regulatory standards.

User Experience

Binance provides a world-class trading interface alongside institutional-grade charting and analysis tools. Multiple order types, customizable layouts and integrations with TradingView appeal to active investors and professionals.

However, Binance falls short for complete beginners with its densely-packed dashboards. There’s a risk of information overload without much hand-holding.

Uphold opts for simplicity with an easy-to-navigate dashboard highlighting your supported assets. Thanks to direct value conversions, building a diversified portfolio takes just a few clicks.

The platform uses plain language, making account setup intuitive even for first-time crypto users. Uphold also offers helpful guidance resources such as video tutorials and a knowledge base.

Ultimately, technologically-adept traders will appreciate Binance for its depth. But investors who prioritize a simplified experience may prefer Uphold.

Community and Reviews

With over 120 million users, Binance naturally fosters a thriving community environment. It offers an official English Telegram channel with 300,000+ members and a similarly popular Reddit page. High ratings on consumer sites like TrustPilot also showcase positive sentiment. Users praise its altcoin options, discounts and perks for holding BNB tokens.

Although much smaller at 10 million users, Uphold also maintains an active online community. Its help center features video tutorials and detailed user guides. Most consumer feedback centers around Uphold’s convenience and transparent pricing. But some cite confusion over hidden transfer fees between external wallets.

Final Thoughts

Both Binance and Uphold enable seamless crypto trading with solid security measures in place. If you seek advanced charting tools, diverse DeFi applications and deep liquidity across altcoins, Binance leads as the top global exchange. Power users will appreciate its robust API integrations and low-fee structure.

But for effortless portfolio diversification into crypto, fiat and precious metals under one roof – Uphold takes the trophy. Its direct asset transfers and simple user interface provide an easy entry point for beginners.

Ultimately the choice between Binance and Uphold depends on individual priorities. Assess your needs to pick the right fit based on investment style, supported assets, fees and accessibility.

FAQs

Is Uphold or Binance better?

For novice investors, Uphold takes the cake with its simplified trading experience between crypto, fiat and metals. But advanced traders will benefit more from Binance in terms of features and reduced fees at scale.

Is there something better than Binance?

Binance is widely considered the industry leader among centralized exchanges. For sheer variety of altcoins and trading tools, few platforms can match it. That said, decentralized exchanges like Uniswap provide benefits around ownership and control.

Is it safe to keep crypto on Uphold?

Uphold employs robust security protocols including mandatory identity verification, two-factor authentication and encryption. As an FCA-regulated entity in the UK, it provides reliable protections for client assets held on platform.

Should I use Uphold or Coinbase?

While both provide simple purchasing avenues into crypto, Uphold has wider support for altcoins, fiat currencies and even precious metals. Its transparent “anything-to-anything” conversion model also differentiates it from Coinbase’s spread-based brokerage structure.