In today’s market, investing in commodities like gold and silver can be a smart portfolio diversification strategy. Here’s our guide on how to buy gold with Revolut app and key factors to evaluate before investing.

Summary

Revolut allows users to buy and sell gold through its platform. However, it charges a 0.25% base fee on transactions and spreads over 1.5%, making it potentially pricier than alternatives. Additionally, Revolut’s commodities service is not regulated by the FCA, which could be a concern to some investors.

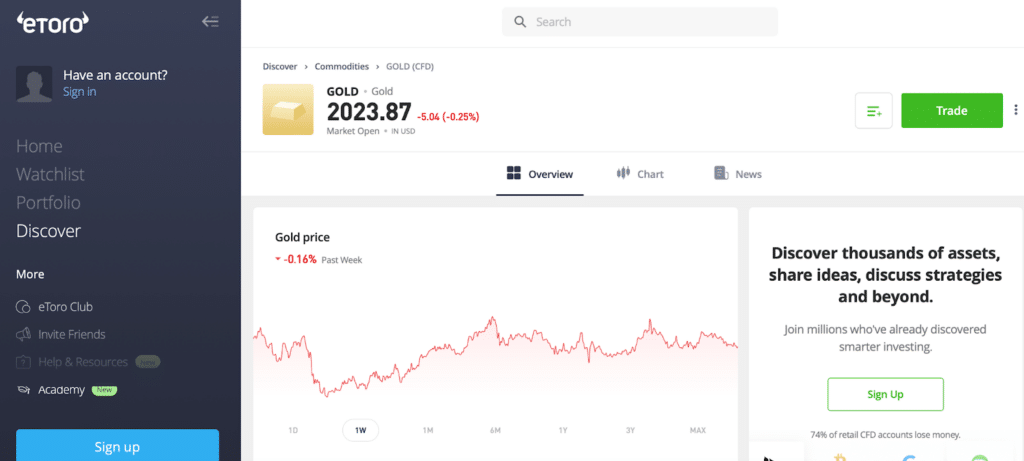

After evaluation, eToro emerges as a recommended platform for gold investment with its FCA compliance, competitive fees starting from 1%, and over 3,000 tradable assets. For UK and EU traders focused on regulation, security, and costs, eToro represents an excellent solution.

Can I Buy Gold with Revolut?

Yes, Revolut provides an option to buy and sell gold, along with silver, platinum, and palladium. Users can add these commodity positions to their investment portfolio.

However, Revolut applies a 0.25% transaction fee and has above-average spreads exceeding 1.5% in many cases. This can diminish net returns compared to other gold investing platforms.

Also, Revolut’s commodities trading facility does not come under FCA regulation. This differs from providers like eToro, which are FCA-compliant, giving additional assurance around security processes.

How to Buy Gold with Revolut

Here are the key steps to buying gold with Revolut:

- Register for a Revolut account and complete the KYC verification process.

- Fund your Revolut balance via bank transfer or card payment. Ensure you have enough for fees and your planned gold purchase amount.

- Access the “Commodities” section under Revolut’s Investing tab.

- Search for gold and input your chosen investment amount in USD.

- Review order details like quantity of gold and total fees. Confirm purchase.

How to Buy Gold with eToro

If you are looking for a secure, cost-effective platform to invest in gold and diversify your portfolio, eToro is an excellent choice compared to Revolut. Here is a simple step-by-step guide to getting started buying gold with eToro:

- Go to the eToro website and register for an account. Complete identity verification as part of the sign-up process.

- After logging in, find the ‘Deposit Funds’ option at the bottom left of your screen. Select currency and payment method.

- Transfer money from your bank account to eToro to fund your balance. Ensure you have enough for your planned gold investment amount plus fees.

- Use the Search bar to find “Gold” and research the available Gold ETFs, like GLD. Click “Trade” to open an order ticket.

- Enter your chosen investment amount denominated in USD for gold buying power. Set stop losses if desired.

- Review order and fee specifics including tight spreads from just 1% on gold instruments. Confirm when ready.

- Monitor your gold investment performance frequently and adjust stops or sizes accordingly based on your strategy. Selling also follows a similar streamlined process.

Revolut Gold Fees

Revolut levies a 0.25% transaction fee for gold buys and sells. On a £1000 trade size, this amounts to £2.50.

In addition, average spreads exceed 1.5%, further eating into investor profits, especially for short-term holdings. Combined fees can be sizeable relative to other regulated platforms.

Taxes on Investing in Gold

In the UK, gold is exempt from capital gains tax if it meets certain purity standards. Any profits from buying gold on Revolut and selling for more later would not incur capital gains liability.

However, commodity trading must still be declared to HMRC under applicable self-assessment requirements. Proper record-keeping of purchase and sale transactions is advisable.

Is Revolut Suitable for Commodity Investment?

Revolut may not represent the most suitable solution for commodity exposure, given its above-average fees and lack of FCA oversight. Traders focused on tighter spreads and compliance may prefer exploring regulated alternatives like eToro instead.

Conclusion

In summary, Revolut facilitates direct gold purchases but charges relatively high fees without FCA regulation. eToro is a compelling alternative with lower costs, tighter spreads from 1%, and FCA compliance for added security. For accessible, regulated commodity investing, eToro merits consideration.

FAQs

What are Revolut’s fees for buying gold?

Revolut charges a 0.25% base transaction fee plus a spread exceeding 1.5% on average for gold trades, which can quickly add up.

Is Revolut regulated for commodities trading?

No, Revolut’s commodities investment feature does not come under FCA regulation, unlike providers like eToro. This poses additional risks for investors.

What is the best gold investment platform?

eToro represents an excellent regulated and low-fee alternative to Revolut for gold exposure and commodities trading in general. With spreads from 1% and zero commission on Gold ETFs, it stands out as a top choice.