For those interested in exploring the world of cryptocurrencies, understanding how to buy crypto with CommBank is crucial. While CommBank does not offer direct crypto purchasing services, there are alternative methods and specialized platforms that enable customers to invest in cryptocurrencies safely and smoothly. Read on to learn the current limitations of buying crypto through CommBank and provide insights into the best external platforms for purchasing digital assets.

Summary

The current state of cryptocurrency purchasing through CommBank presents a unique challenge, as the bank does not facilitate direct crypto investments. However, this should not deter those eager to explore the world of digital assets. Specialized cryptocurrency exchanges and platforms have emerged as the go-to solution for buying cryptocurrencies, providing a secure and user-friendly environment for investors.

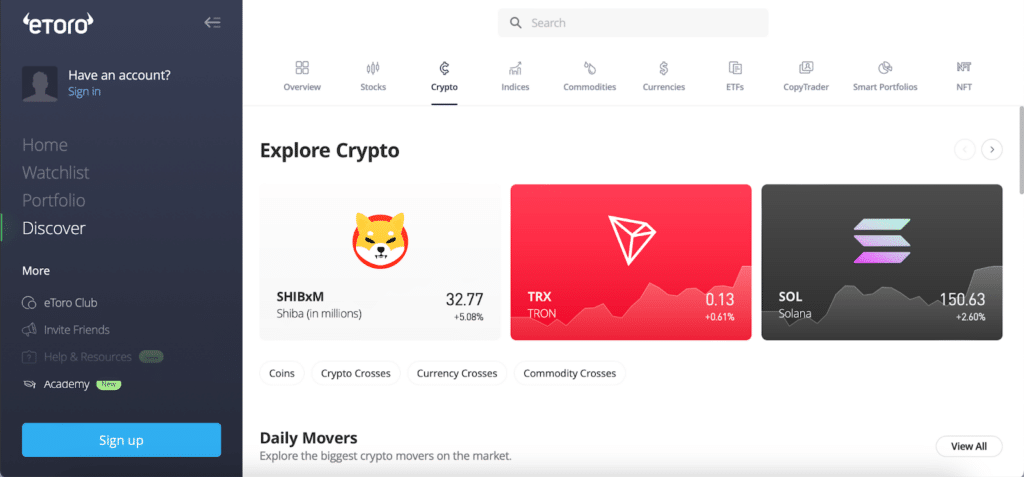

Our team of experts at Coincipher has conducted thorough market research to identify the most reliable and feature-rich platform for CommBank users: eToro. With its ASIC regulation, intuitive interface, and an impressive selection of over 4,500 assets, including cryptocurrencies, stocks, and ETFs, eToro stands out as the premier choice for expanding your investment portfolio. By signing up for an eToro account, you can confidently embark on your crypto investment journey, armed with the knowledge and tools necessary to navigate the exciting world of digital assets.

CommBank’s Crypto Partnerships

In November 2021, CommBank announced strategic partnerships with global crypto leaders Gemini and Chainalysis. These collaborations aimed to design a crypto exchange and custody service that would be offered to customers through a new feature in the CommBank app. The pilot program was set to start in the coming weeks, with plans to progressively roll out more features to customers in 2022. CommBank intended to provide access to up to ten selected crypto assets, including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. However, as of March 2024, the full integration of these services has not yet been realized.

Can you buy crypto with CommBank?

Currently, Commonwealth Bank does not offer direct cryptocurrency investing options through its online banking platforms. Nevertheless, it facilitates CBA account holders in engaging with the crypto market by enabling the transfer of AUD to exchanges regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC). CommBank clients keen on digital asset investments might consider eToro, which is compliant with AUSTRAC’s regulations. This platform facilitates efficient AUD deposits through bank and debit card transfers. With a selection of over 4,500 assets, including various cryptos, stocks, and ETFs, eToro presents a comprehensive platform for those aiming to expand their investment portfolios.

We highly recommend exploring the following internal guides for a comprehensive understanding of buying cryptocurrencies with various banks:

Step-by-Step Guide on How to Buy Crypto with CommBank

While CommBank does not offer direct crypto purchasing, the fastest and most secure way to acquire cryptocurrencies using your CommBank account is through the eToro platform. Here’s a step-by-step guide:

Step 1: Register an Account on eToro

Visit the eToro website and click on the “Sign Up” button. Provide your personal details and complete the registration process.

Step 2: Complete Identity Verification

To comply with eToro’s Know Your Customer (KYC) requirements, you’ll need to provide proof of identity and address. Upload a valid government-issued ID and a recent utility bill or bank statement. The verification process typically takes 1-2 business days.

Step 3: Link CommBank Account to eToro

Once your eToro account is verified, navigate to the “Deposit Funds” section. Select “Bank Transfer” as your deposit method and choose AUD as your currency. You’ll be provided with eToro’s Australian bank account details. Use these details to initiate a transfer from your CommBank account.

Step 4: Deposit Funds

Log in to your CommBank online banking portal and navigate to the funds transfer section. Enter eToro’s bank account details and the amount you wish to deposit. The minimum deposit on eToro is $200 AUD. Once the transfer is processed, the funds will appear in your eToro account within 1-3 business days.

Step 5: Purchase Cryptocurrency

With your eToro account funded, you can now purchase cryptocurrencies. Navigate to the “Markets” section and select “Crypto” from the list of asset classes. Choose your desired cryptocurrency from the list of available options. Enter the amount you wish to invest and click “Open Trade” to complete your purchase.

About CommBank

Commonwealth Bank of Australia (CBA) is an Australian multinational bank with businesses across New Zealand, Asia, the United States, and the United Kingdom. It provides a variety of financial services, including retail, business and institutional banking, funds management, superannuation, insurance, investment, and broking services. CommBank is one of Australia’s “big four” banks and has been in operation since 1911.

Key Metrics

As of March 2024, CommBank boasts the following key metrics:

- Over 15 million customers

- More than 1,100 branches across Australia

- Over 4,000 ATMs nationwide

- Ranked #1 Australian bank by market capitalization

- Approximately 25% market share in the Australian banking sector

- Over $1 trillion in assets under management

What is CommBank’s status on cryptocurrencies?

While CommBank does not provide direct cryptocurrency services, it has partnered with regulated crypto exchanges like Gemini and Chainalysis to explore the potential integration of crypto trading features into its mobile app. However, as of March 2024, these services have not yet been fully implemented. CommBank allows its customers to transfer funds to AUSTRAC-regulated crypto exchanges, enabling indirect access to cryptocurrency investments.

Does CommBank work with crypto?

CommBank is cautiously supportive of cryptocurrencies, facilitating fund transfers to regulated crypto exchanges. However, the bank does not directly provide cryptocurrency trading or custody services. If you are unsure about CommBank’s current stance on crypto, it’s always a good idea to contact the bank directly for the most up-to-date information.

Conclusion

Buying cryptocurrencies with CommBank involves transferring funds to a regulated crypto exchange like eToro. By following the step-by-step guide outlined in this article, you can safely and securely invest in digital assets using your CommBank account. As with any investment, it’s crucial to approach cryptocurrencies with caution and to continually educate yourself on the risks and potential rewards of this exciting asset class. With CommBank’s support for transfers to regulated exchanges, you can confidently begin your crypto investment journey.

FAQs

Can I buy Bitcoin directly through my CommBank account?

No, CommBank does not currently offer direct Bitcoin purchases through its online banking platform. However, you can transfer funds from your CommBank account to a regulated crypto exchange like eToro to buy Bitcoin and other cryptocurrencies.

Is it safe to buy cryptocurrencies with CommBank?

While CommBank does not directly provide cryptocurrency services, it allows fund transfers to AUSTRAC-regulated exchanges, which ensures a level of safety and compliance. Always ensure you are using a reputable and regulated platform when buying cryptocurrencies.

What cryptocurrencies can I buy with CommBank?

Through regulated exchanges like eToro, you can access a wide range of cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and many more. The specific cryptocurrencies available may vary depending on the exchange you choose.

Are there any fees for buying crypto with CommBank?

CommBank may charge standard transaction fees for transferring funds to a crypto exchange. Additionally, the exchange you use will likely have its own set of fees for trading and withdrawing cryptocurrencies. Be sure to review the fee structures of both CommBank and your chosen exchange before making any transactions.