As leading crypto analysts in the industry, our team closely examines the intersection of traditional finance and digital asset investing. We’ve conducted extensive research into how major banks like La Banque Postale fit into the rapidly evolving landscape of blockchain finance. Our on-the-ground expertise affords an insider perspective into how its customers buy crypto with La Banque Postale.

Summary

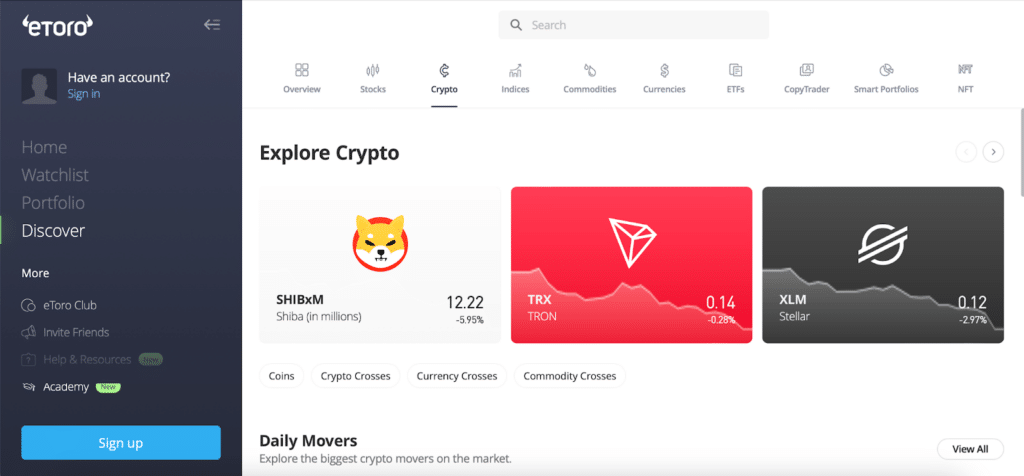

La Banque Postale does not directly offer crypto trading. However, customers can buy crypto by transferring funds to AMF-regulated platforms. Our analysis shows that eToro is a good option for La Banque Postale clients interested in crypto. eToro is regulated in France and facilitates easy Euro deposits and withdrawals. It also offers over 3,000 cryptos, stocks, and ETFs to invest in.

Can You Buy Crypto Through La Banque Postale?

La Banque Postale enables customers to invest in cryptos like Bitcoin. To align with French financial regulations, La Banque Postale partners with certified crypto platforms overseen by the Autorité des Marchés Financiers (AMF).

These AMF-regulated partners allow streamlined crypto purchases using flexible Euro payment methods like SEPA transfers and debit/credit cards.

Step-by-Step Guide: How to Buy Crypto with La Banque Postale

Follow this 5-step process to buy crypto vwith La Banque Postale using regulated platform eToro:

- Register on eToro.com and complete identity verification.

- Deposit Euros via SEPA transfer or card payment from La Banque Postale account.

- Ensure funds clearance – wait for transfers to process.

- Use eToro search tool to find your desired cryptocurrency.

- Buy crypto using your deposited funds.

For similar insights, we recommend checking out our guides on buying crypto with other mainstream banks:

About La Banque Postale

La Banque Postale is a major French bank focused on retail banking. It offers checking accounts, savings products, consumer loans, and more. As of 2022, La Banque Postale had over 10 million active customers. Its mobile banking app has over 2 million users. In 2020, La Banque Postale acquired a 95% stake in platform CNP Assurances for €5.25 billion.

Key Figures

- €1.06 billion in net profit in 2022

- €9.5 billion in business line NBI (net banking income) in 2022, a 4.8% increase

- 16 basis points cost of risk, which is low

- 14.4% group RONE (return on normalized equity), a 6.2 point increase

- €74.9 billion in outstanding loans, an 8% increase

- €15.1 billion in home loan originations, a 19.2% increase

- €2.6 billion in consumer finance originations, a 10.6% increase

- €23.4 billion in CIB (corporate and investment banking) originations, a 10.2% increase

- €29.7 billion in life insurance new money, a 15.6% increase

- €3.4 billion in net new money invested in on and off-balance sheet savings products

La Banque Postale’s Stance on Crypto

La Banque Postale doesn’t directly sell crypto. However, it enables customers to invest in crypto by transferring funds to AMF-approved platforms. These partners comply with French crypto regulations. The bank works with platforms dealing with major cryptos like Bitcoin and Ethereum. Customers should be aware of deposit/withdrawal fees, trading commissions, spread costs and purchase limits imposed.

Does La Banque Postale Work With Crypto?

While La Banque Postale doesn’t directly offer crypto products, it supports regulated access to crypto markets in line with French law. Clients can invest in crypto by using platforms accredited by the AMF as Digital Asset Service Providers (DASPs).

If unsure whether La Banque Postale partners with a certain platform, customers can call the bank directly to check. The bank’s stance aligns with France’s forward-looking approach in fostering a secure, regulated crypto environment.

What Fees Are Involved?

When buying crypto via La Banque Postale and platforms like eToro, be aware of deposit, withdrawal, trading, and spread fees.

eToro offers affordable Euro deposits through methods like SEPA transfer. Its crypto spread fees (around 1%) are also competitive, making eToro cost-efficient overall.

What If La Banque Postale Wasn’t Crypto-Friendly?

If La Banque Postale didn’t enable crypto investments, customers would need to take intermediate steps before buying crypto:

Open Account at a Crypto-Friendly Bank

Opening a basic account at a digital asset-friendly bank provides funding source for crypto purchases. One can then continue this guide once transfers are enabled between the two accounts.

Use Compatible Money Transfer Service

Services like Wise to allow funds transfers from La Banque Postale to platforms. This step would precede depositing funds to the crypto platform.

Conclusion

La Banque Postale provides regulated crypto access despite not directly offering crypto trading. Partner platforms like eToro allow easy Euro transfers alongside extensive crypto and asset selection. Together, they enable secure, compliant French crypto investments.

FAQs

Can I buy crypto directly through La Banque Postale?

No. La Banque Postale doesn’t currently sell cryptocurrencies directly. However, you can invest in crypto by transferring funds to regulated platforms in France.

What are some costs to watch out for with crypto trading?

Be mindful of deposit/withdrawal charges, trading fees per transaction, and spread costs between buy/sell prices when trading crypto.