As the world of finance continues to evolve, many individuals seek ways to diversify their investment portfolios with cryptocurrencies. While HSBC Bank does not directly facilitate crypto purchases, the institution enables account holders to access the crypto market by facilitating transfers to regulated cryptocurrency exchanges. Our guide will walk you through the process to buy crypto with HSBC, ensuring a secure and compliant journey.

Summary

Buying cryptocurrencies directly through HSBC Bank is not a common practice, as the bank does not offer this service internally. Instead, individuals typically utilize specialized cryptocurrency exchanges or platforms to invest in digital assets. This guide focuses on understanding and managing cryptocurrency investments in conjunction with HSBC’s traditional banking services, providing insight into external platforms for purchasing cryptocurrencies.

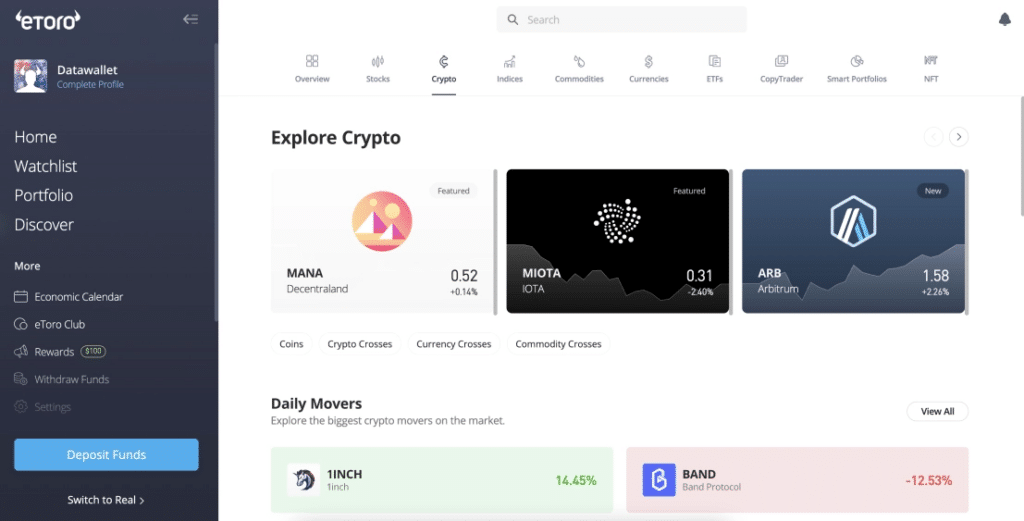

Based on market research by experts, eToro stands out as a reputable and regulated platform suitable for HSBC account holders worldwide.

Advantages of Using eToro for Crypto Investments

As a leading social trading platform, eToro offers several advantages for HSBC customers looking to invest in cryptocurrencies such as:

- eToro is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Crimes Enforcement Network (FinCEN) in the US. This ensures a high level of security, transparency, and compliance for users.

- eToro provides access to a diverse range of over 3,000 assets, including popular cryptocurrencies like Bitcoin, Ethereum, and Solana, as well as stocks, ETFs, and other financial instruments.

- eToro offers a user-friendly platform with various deposit methods compatible with HSBC accounts, such as bank transfers, SEPA transfers, and debit card payments. This seamless integration allows for hassle-free funding and trading of digital assets.

Can you buy crypto with HSBC Bank?

Yes, HSBC Bank does facilitate the purchase of cryptocurrencies for its account holders. While the bank does not offer direct crypto trading services, it enables secure transactions to authorized and regulated crypto exchanges. HSBC account holders can transfer major currencies, including GBP, EUR, and USD, to these platforms, providing a reliable avenue for acquiring digital currencies like Bitcoin, Ethereum, and others.

Step-by-Step Guide on How to Buy Crypto with HSBC Bank

To streamline your cryptocurrency investment journey with HSBC Bank, we recommend using eToro, a globally regulated trading platform accessible in numerous countries.

Step 1: Register an Account on eToro

Visit eToro’s website and complete the sign-up process to create your account.

Step 2: Complete Identity Verification

Comply with eToro’s Know Your Customer (KYC) requirements by providing the necessary identity verification documents. This process may take up to a few business days for approval.

Step 3: Link HSBC Bank Account to eToro

Navigate to the ‘Deposit’ section on eToro’s platform and initiate the process to link your HSBC Bank account. This will allow you to transfer funds seamlessly between your bank account and eToro for deposits and withdrawals. [Visual guide or image indicating the location on the platform]

Step 4: Deposit Funds

Once your HSBC Bank account is linked, you can deposit funds into your eToro account. Note that eToro supports various deposit options, including bank transfers, SEPA transfers, and debit card payments. Be mindful of any minimum or maximum deposit amounts specified by the platform.

Step 5: Purchase Cryptocurrency

With your deposited funds, utilize eToro’s user-friendly interface to search for and invest in your desired cryptocurrency. eToro offers a wide selection of digital assets, ensuring you can diversify your portfolio according to your investment goals.

While every exchange might differ in its verification process, the purchase process for cryptocurrencies is generally similar once this step is completed.

Also read:

About HSBC Bank

HSBC Bank is a global financial institution with a rich history dating back to 1865. Headquartered in London, HSBC operates in over 64 countries and territories, serving millions of customers worldwide. The bank offers a comprehensive range of services, including retail banking, wealth management, commercial banking, and global banking and markets.

Key Metrics

- HSBC Bank ranks as the 7th largest bank in the world by total assets, holding over $2.9 trillion as of 2022.

- The bank serves approximately 38 million customers across its global network.

- HSBC operates over 7,500 branches and employs more than 220,000 individuals worldwide.

- In 2022, HSBC reported a profit before tax of $18.9 billion, demonstrating its strong financial performance.

- The bank’s global presence spans 64 countries and territories.

- HSBC holds a market capitalization of approximately $130 billion, solidifying its position as a leading financial institution.

- The bank’s mobile banking app has been downloaded over 10 million times, reflecting its commitment to digital innovation.

- HSBC was ranked as the 6th largest bank in Europe by total assets in 2022.

- The bank’s wealth management division manages over $1.6 trillion in client assets.

- HSBC operates a robust global network of over 200 data centers, ensuring seamless operations and service delivery.

What is HSBC’s status on cryptocurrencies?

HSBC Bank does not currently offer direct cryptocurrency services or partnerships with exchanges through its banking platform. However, the bank facilitates secure transfers of major currencies, such as GBP, EUR, and USD, to regulated crypto exchanges, enabling account holders to invest in digital assets like Bitcoin, Ethereum, and others.

Does HSBC work with crypto?

While HSBC Bank does not directly offer cryptocurrency trading services, it supports its account holders in accessing the crypto market by facilitating transfers to authorized and regulated crypto exchanges. If you are unsure about HSBC’s specific policies or have additional questions, it is recommended to contact the bank directly to clarify their current status on cryptocurrency transactions.

Conclusion

In the rapidly evolving world of finance, HSBC Bank provides a reliable gateway for its account holders to explore the world of cryptocurrencies. Although the bank does not offer direct crypto trading services, it enables secure transfers of major currencies to regulated exchanges, allowing clients to diversify their investment portfolios with digital assets.

By following the steps outlined in this guide, including utilizing a reputable platform like eToro, HSBC customers can navigate the process of buying cryptocurrencies seamlessly and compliantly. However, it is crucial to approach cryptocurrency investments with caution and continue educating yourself on the risks and opportunities within this dynamic market.

FAQs

Can I use my HSBC debit or credit card to buy cryptocurrencies directly?

No, HSBC does not currently allow direct cryptocurrency purchases using its debit or credit cards. However, you can use your HSBC account to transfer funds to a regulated crypto exchange like eToro and then purchase cryptocurrencies within the platform.

What types of cryptocurrencies can I buy through HSBC Bank’s facilitated transfers?

HSBC Bank does not impose restrictions on the types of cryptocurrencies you can purchase through authorized exchanges. Popular options include Bitcoin, Ethereum, Solana, and others offered by the respective exchange platforms.

Are there any limits on the amount I can transfer from my HSBC account to a crypto exchange?

HSBC Bank may have specific limits or restrictions on the amount you can transfer for cryptocurrency investments. It is recommended to check with the bank or the exchange platform for any applicable limits or fees.

What are the risks associated with investing in cryptocurrencies through HSBC Bank’s facilitated transfers?

Like any investment, cryptocurrencies carry inherent risks, including market volatility, regulatory uncertainties, and potential security breaches. It is essential to conduct thorough research, understand the risks involved, and only invest what you can afford to lose.