In today’s accessible investment world, the stock market stands as a potentially lucrative option. At Coincipher, our team of experts provides investors with the key information and step-by-step guidance needed to buy Vanguard ETFs in the UK.

Summary

While Vanguard does not directly offer trading or investment accounts in the UK market, their ETF products are available on local share dealing platforms. These brokers essentially act as middlemen, allowing you to efficiently buy and sell ETF shares on stock exchanges like the LSE.

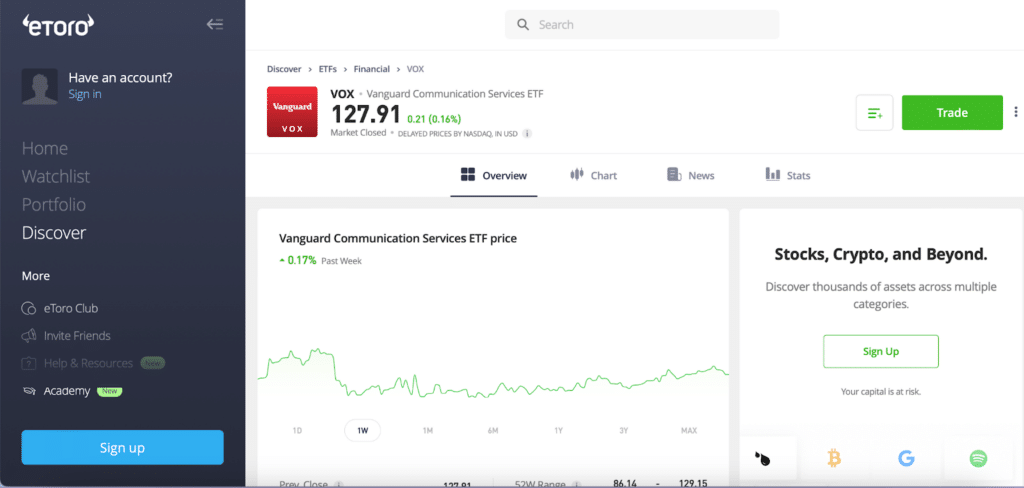

Given their competitive pricing, extensive ETF listings, and robust trading tools, we highly recommend opening an account with a leading platform like eToro. Signing up is straightforward and requires providing personal information and photo ID verification. You can then fund your account through various means like bank transfer or credit/debit card.

Do your due diligence in assessing any share dealing service before transferring funds. Check reviews, security measures, platform functionality, mobile app offering, product catalogues, and fee structures.

What are Vanguard ETFs

Vanguard ETFs are exchange-traded funds that track various market indexes while keeping fees low. They provide diversified exposure similar to index mutual funds but trade intraday-like stocks on exchanges. Vanguard offers equity, bond, commodity, and blended ETFs covering all major asset classes.

Key Metrics

- Net Expense Ratio: 0.03%

- Discount/Premium to NAV: -0.01%

- Total Assets Under Management: $1.474 trillion

- 30-Day Average Daily Volume: 3.454 million

- Dividend Yield: 1.37%

- Turnover Ratio: 3.00%

- 1 Year Fund Flows: $1.566 billion

- Max Drawdown Since Inception: -19.51%

- Return Over Past Year: 26.05%

- Return Year to Date: 4.92%

The Vanguard Total Stock Market ETF (VTI) offers broad exposure to the overall US market in a single fund. For guidance on purchasing this popular ETF yourself, see our article How to Buy Vanguard VTI ETF.

European investors may also find our related content useful, such as How to Buy Vanguard 500 (VOO) in Europe.

With over $1.4 trillion in assets under management, VTI takes an indexing approach designed to closely track the risk-return profile of the total US stock market.

Evaluating Vanguard ETF Products

With exposure to hundreds of underlying securities per fund, Vanguard ETFs enable even small investors to quickly build diversified portfolios. Assess their full range across categories like:

- Equity ETFs – Covering total stock markets, countries/regions, market caps, sectors, factors, and ESG criteria

- Bond ETFs – Broad bond market, government, corporate, high yield, and aggregate exposures

- Commodity/Real Asset ETFs – Baskets of raw materials, real estate, infrastructure, and precious metals

- Multi-Asset ETFs – Blends of stocks, bonds, and cash for balanced risk-reward

Compare historical returns and volatility, fund size, expense ratios, dividend yield, portfolio concentration, and other metrics when evaluating choices.

Narrow down ETFs fitting your risk appetite, return objectives, and wealth creation time horizons. For example, higher expected gains over long periods typically require bearing more volatility.

Can I Buy Vanguard ETFs in the UK

Yes, Vanguard ETFs purchased on US exchanges are available to UK investors through brokers like eToro. You simply fund your account and place trades on their platform.

Step-by-Step Guide to Buy Vanguard ETFs in the UK

Step 1: Research and Analysis

Analyze different Vanguard ETFs across sectors and benchmarks to fit your strategy. Compare historical returns, risk metrics, sector allocation, etc.

Step 2: Open eToro Account

Sign up at eToro.com providing personal details. Fund your account via payment methods like credit card or PayPal.

Step 3: Determine Number of Shares

Decide your investment amount for Vanguard ETFs. Calculate corresponding number of shares to buy.

Step 4: Place Buy Order

Use eToro’s platform to place a market or limit order for your chosen Vanguard ETF(s).

Step 5: Review and Confirm

Validate order details including share amount, symbols, cost basis etc. before final submission.

Step 6: Monitor Investment

Check in on your Vanguard ETF investments tracking performance and related financial news.

Step 7: Rebalance and Adjust

Periodically rebalance your ETF portfolio weights based on market movements and investment goals.

This guide outlines the key steps for securely buying Vanguard ETFs as a UK investor using eToro’s brokerage platform.

Best Vanguard ETFs to Buy in the UK

Here are some of the top Vanguard ETFs for British investors to consider purchasing:

- Vanguard S&P 500 UCITS ETF (VUSA): Offers broad exposure to 500 large US companies. Has delivered high historical returns.

- Vanguard FTSE All-World UCITS ETF (VWRL): Invests across over 3,000 global stocks for highly diversified exposure. Great foundational holding.

- Vanguard FTSE 250 UCITS ETF (VMID): Tracks the FTSE 250 index of mid-cap UK stocks. Provides focused UK exposure.

- Vanguard ESG Global All Cap UCITS ETF (V3AA): Environmentally and socially responsible ETF meeting ESG investing criteria.

When deciding which Vanguard ETFs to invest in, compare historical returns, risk attributes, regional exposure, sector allocation, number of holdings, expense ratios, and ESG ratings (if applicable).

Fees for Buying Vanguard ETFs

eToro charges no trading commissions. Other costs include 0.5% currency conversion and overnight carry fees for leveraged positions.

Taxes on Vanguard ETF Investments

In the UK, capital gains and dividends from Vanguard ETFs held in Share Accounts or Self-Invested Personal Pensions (SIPPs) are tax-exempt. Consult a tax advisor regarding your specific situation.

Conclusion

In conclusion, buying Vanguard ETFs in the UK requires careful research, opening an investing account with eToro, strategically placing orders, and monitoring progress. Our guide has covered the end-to-end process emphasizing informed decisions. Maintain awareness of financial markets to determine appropriate times for rebalancing your Vanguard ETF portfolio.

FAQs

What is the minimum to invest in Vanguard ETFs on eToro?

No minimum. You can start as low as $50 per trade.

How do I choose which Vanguard ETF to buy?

Assess historical returns, fees, number of holdings, and exposure across geographies, market caps, sectors, and asset classes.

Should I trade or invest long-term in Vanguard ETFs?

Long-term investing aligned with financial goals is generally best for individual investors. Time market appropriately.