In today’s accessible investment world, the stock market stands as a potentially lucrative option. Our team of experts at Coincipher has conducted extensive research to identify the best stock trading platforms in the Netherlands. We understand the importance of finding a reliable and user-friendly platform that caters to the unique needs of Dutch investors. In this comprehensive guide, we will explore the top platforms, their key features, and how they can help you navigate the exciting world of stock trading.

Summary of the Best Stock Trading Platforms in the Netherlands

Based on our market research, these platforms provide the optimal combination of features, security, and user-friendliness for Dutch investors:

- eToro – Best Overall Platform in Netherlands

- Interactive Brokers – Best for Advanced Traders

- DEGIRO – Best for Low Fees

- Bux Zero – Best for Beginners

- Trade Republic – Best for Mobile Trading

The Importance of Diversification in Your Stock Portfolio

When investing in stocks, diversification is a crucial strategy to mitigate risk and optimize potential returns. By spreading your investments across various sectors, industries, and even geographical regions, you can minimize the impact of market volatility on your portfolio. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to balance stability and growth potential. Additionally, incorporating international stocks can provide exposure to emerging markets and reduce dependency on a single economy. Remember, a well-diversified portfolio is key to long-term financial success.

Best Stock Trading Platforms in the Netherlands

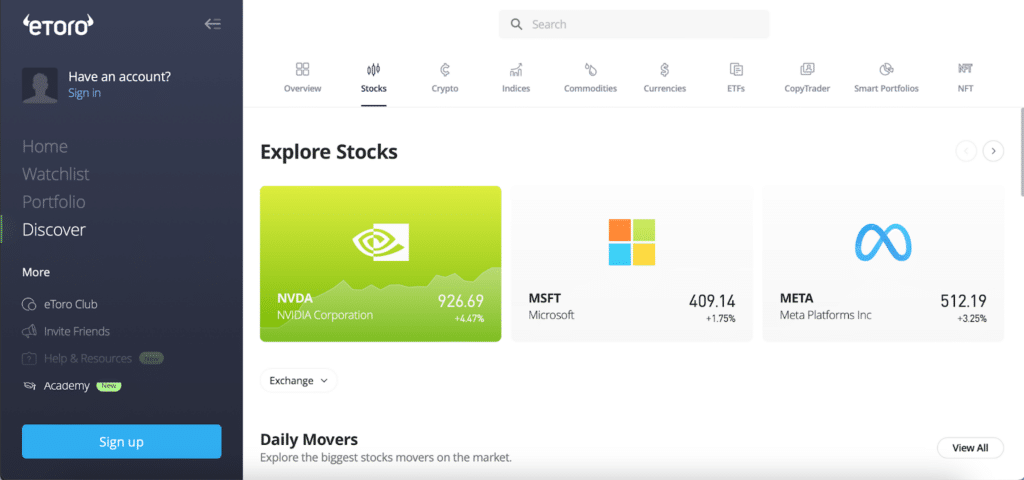

1. eToro

eToro is a leading social trading platform that has gained widespread popularity among Dutch investors. With a user-friendly interface and a wide range of investment options, eToro offers a seamless trading experience for both beginners and experienced traders.

Key Features:

- Social trading: eToro’s unique CopyTrader feature allows users to automatically copy the trades of successful investors.

- Wide asset selection: Access to over 3,000 stocks, ETFs, commodities, and cryptocurrencies.

- User-friendly platform: Intuitive interface and mobile app for easy trading on the go.

- Educational resources: Comprehensive guides, webinars, and a virtual trading account to practice strategies.

Why Choose eToro: eToro’s social trading features set it apart from other platforms, allowing users to learn from and mirror the strategies of successful traders. With a wide range of assets, robust regulatory oversight, and educational resources, eToro provides a comprehensive and user-friendly trading environment for Dutch investors.

2. Interactive Brokers

Interactive Brokers is a well-established platform known for its advanced trading tools and global market access. With a focus on security and low costs, Interactive Brokers caters to experienced investors seeking a professional-grade trading experience.

Key Features:

- Global market access: Trade stocks, options, futures, and more across 135 markets in 33 countries.

- Advanced trading tools: Powerful charting, real-time market data, and customizable alerts.

- Competitive pricing: Low commissions and financing rates, with no account minimums.

- Robust security: Two-factor authentication and regulatory oversight from top-tier authorities.

Why Choose Interactive Brokers: Interactive Brokers is an ideal choice for experienced traders seeking access to global markets and advanced trading tools. With its strong regulatory compliance and competitive pricing, Interactive Brokers provides a secure and cost-effective platform for Dutch investors.

3. DEGIRO

DEGIR is a Netherlands-based online broker that has gained popularity for its low fees and user-friendly platform. With a focus on transparency and accessibility, DEGIRO aims to make investing accessible to a wide range of Dutch investors.

Key Features:

- Low fees: Competitive pricing structure, with no account maintenance fees.

- Wide product range: Access to stocks, ETFs, bonds, options, and futures across multiple markets.

- Intuitive platform: User-friendly interface and mobile app for easy trading.

- Investor protection: Segregated client accounts and protection under the Dutch Investor Compensation Scheme.

Why Choose DEGIRO: DEGIRO’s commitment to low fees and transparency makes it an attractive choice for cost-conscious Dutch investors. With a wide range of investment products and a user-friendly platform, DEGIRO offers an accessible and reliable trading experience.

4. Bux Zero

Bux Zero is a commission-free trading app designed for beginners and casual investors in the Netherlands. With a focus on simplicity and accessibility, Bux Zero aims to make investing easy and enjoyable for everyone.

Key Features:

- Commission-free trading: No fees for buying and selling stocks and ETFs.

- Fractional shares: Invest in portions of shares, making it possible to invest with smaller amounts.

- User-friendly app: Intuitive mobile app with a sleek design and easy navigation.

- Educational content: In-app articles, tutorials, and guides to help beginners learn about investing.

Why Choose Bux Zero: Bux Zero is an excellent choice for beginners who want to start investing with small amounts and learn as they go. With its commission-free trading, user-friendly app, and educational content, Bux Zero provides a supportive and accessible platform for Dutch investors.

5. Trade Republic

Trade Republic is a mobile-first trading platform that combines simplicity with powerful features. With a focus on accessibility and low costs, Trade Republic aims to make investing easy and affordable for Dutch investors.

Key Features:

- Mobile-first design: Intuitive and user-friendly mobile app for seamless trading on the go.

- Wide range of assets: Access to stocks, ETFs, derivatives, and savings plans.

- Competitive pricing: Low flat fee of €1 per trade, regardless of the order size.

- Savings plans: Automatically invest a fixed amount on a regular basis, starting from €10 per month.

Why Choose Trade Republic: Trade Republic is a great choice for Dutch investors who value simplicity, accessibility, and low costs. With its mobile-first approach, wide range of assets, and competitive pricing, Trade Republic offers a convenient and affordable way to invest in the stock market.

To further explore the best stock trading platforms in other countries, we recommend reading the following internal links:

- Best Stock Trading Platforms in Australia

- Best Stock Trading Platforms in Italy

- Best Stock Trading Platforms in France

How to Buy Stocks in the Netherlands

Step 1: Research and Analysis

Begin by conducting thorough research on the company behind a stock. Explore the company’s financial health, history, products/services, and recent news or events impacting its market performance.

Step 2: Select a Brokerage

Choose a reputable brokerage platform that suits your investment needs. Consider factors like fees, available tools, customer service, and ease of use. We recommend eToro as the best platform for buying stocks in the Netherlands.

Step 3: Fund Your Account

Open an account with eToro and fund it with the desired investment amount. eToro accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets.

Step 4: Determine the Number of Shares to Buy

Based on your investment strategy and budget, decide on the number of shares you wish to purchase.

Step 5: Place an Order

Use the eToro platform to place an order for the purchase of your chosen stock. Specify the number of shares and the order type (market order, limit order, etc.).

Step 6: Review and Confirm

Double-check the details of your purchase order before confirming the transaction to ensure accuracy.

Step 7: Monitor Your Investment

Regularly monitor the performance of your investment in the selected stock. Stay informed about market trends and any news or developments related to the company.

Step 8: Reassess and Adjust

Periodically review your investment strategy and, if necessary, consider adjusting your portfolio based on changing market conditions or personal financial goals.

Fees for Buying Stocks in the Netherlands

The fees for buying stocks in the Netherlands vary depending on the brokerage platform. On average, fees range from 0% to 0.5% per trade. eToro, our recommended platform, offers zero commission on stock trades, with competitive spreads starting from 0.09%.

Taxes on Investing in Stocks in the Netherlands

In the Netherlands, capital gains from stock investments are subject to a flat tax rate of 30% on the deemed return, which is calculated based on the value of your investment portfolio. However, there is a tax-free allowance of €50,650 (as of 2023) per individual. It is crucial to consult with a tax professional to understand your specific tax obligations.

Conclusion

Investing in stocks in the Netherlands has become more accessible than ever, thanks to the rise of online trading platforms. By choosing a reputable platform like eToro, Dutch investors can access a wide range of stocks, benefit from user-friendly features, and enjoy competitive fees. Remember to conduct thorough research, diversify your portfolio, and regularly monitor your investments to make informed decisions. With the right approach and a reliable trading platform, you can potentially grow your wealth through stock market investing in the Netherlands.

FAQs

What is the minimum amount required to start investing in stocks in the Netherlands?

The minimum amount required to start investing in stocks varies depending on the brokerage platform. Some platforms, like eToro, have a low minimum deposit requirement of $50, making it accessible for beginners.

How can I learn more about stock market investing in the Netherlands?

Many brokerage platforms, including eToro, offer educational resources such as guides, webinars, and tutorials to help investors learn about stock market investing. Additionally, there are numerous online resources, financial news websites, and investment communities where you can gather information and insights.

What are the risks associated with stock market investing?

Investing in stocks carries inherent risks, such as market volatility, company-specific risks, and economic uncertainties. It is essential to understand these risks and align your investment strategy with your risk tolerance. Diversification and thorough research can help mitigate some of these risks.