In today’s accessible investment world, the stock market stands as a potentially lucrative option for those seeking to grow their wealth. One company that has captured the attention of many investors is Prime Hydration, the sports drink brand co-founded by YouTube sensations Logan Paul and KSI. If you’re interested to buy Prime Hydration stocks, our experts have compiled a comprehensive guide to help you navigate the process.

Summary

Based on our market research, Prime Hydration is currently a privately held company and has not yet announced plans for an Initial Public Offering (IPO). As a result, it is not possible to directly buy Prime Hydration stocks at this time. However, we will explore alternative investment options and discuss the potential for a future Prime Hydration IPO.

What is Prime Hydration?

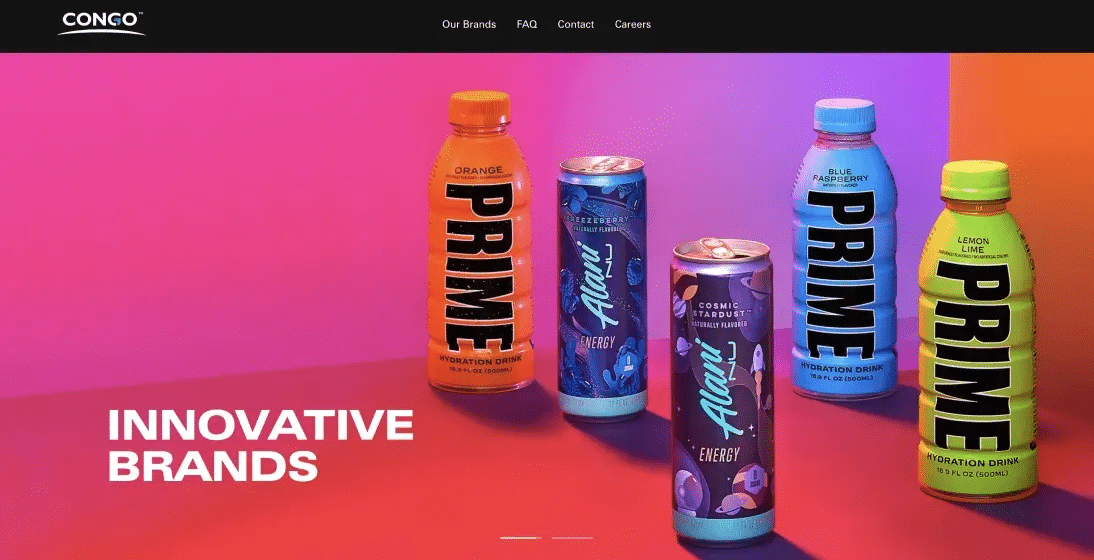

Prime Hydration is a range of sports drinks, energy drinks, and hydration mixes created by the company of the same name. The brand has gained significant popularity thanks to the influence of its co-founders, Logan Paul and KSI, and its strategic partnerships with high-profile organizations such as Arsenal, the Ultimate Fighting Championship, and the Los Angeles Dodgers. Prime Hydration’s products are known for their unique formulations, which include coconut water, electrolytes, B vitamins, and BCAAs.

Who Owns Prime Hydration?

Prime Hydration is owned by a partnership between well-known influencers Logan Paul and KSI, along with Congo Brands, a company led by U.S. entrepreneurs Max Clemons and Trey Steiger. This collaborative ownership structure has allowed Prime Hydration to leverage the influence and expertise of its founders to drive the company’s growth and success.

Prime Hydration Valuation

As a privately held company, Prime Hydration does not have a publicly listed stock price. However, based on the company’s reported revenue of $1.2 billion and its significant market impact, industry analysts estimate that Prime Hydration’s valuation could range between $8 billion and $12 billion. It’s important to note that this valuation is speculative and not based on official company disclosures.

Can you Buy Prime Hydration Stocks?

As of now, Prime Hydration has not announced any intentions to pursue an IPO. Despite the company’s rapid growth and success in the sports and energy drink market, it remains a privately held entity. While there is growing interest from investors, any speculation about a future IPO is purely based on market rumors and not on official statements from the company or its founders.

Alternative Investment Options

While it is not currently possible to directly invest in Prime Hydration stocks, there are alternative investment options for those interested in the beverage and consumer goods industry:

- Consider investing in publicly traded companies that operate in the same market, such as Coca-Cola, PepsiCo, or Monster Beverage Corporation. These companies have a proven track record and offer investors exposure to the broader beverage industry.

- Invest in exchange-traded funds (ETFs) that focus on the consumer goods sector. ETFs provide diversification by holding a basket of stocks from multiple companies within the industry. Some examples of relevant ETFs include the Consumer Staples Select Sector SPDR Fund (XLP) and the Vanguard Consumer Staples ETF (VDC).

- Learn how to buy Vanguard VTI ETF, which tracks the entire U.S. stock market and includes companies from various sectors, including consumer goods.

- If you’re based in the UK, explore how to buy Vanguard ETFs in the UK, as Vanguard offers a range of ETFs that can provide exposure to the consumer goods sector.

- For investors in Australia, consider learning how to buy the S&P 500 with CommSec, as the S&P 500 index includes several major consumer goods companies.

How to Invest in Alternative Options

Step 1: Research and Analysis

Begin by conducting thorough research on publicly traded beverage companies, consumer goods ETFs, or broader market ETFs that align with your investment goals and risk tolerance. Examine their financial health, historical performance, and growth prospects.

Step 2: Select a Brokerage

Choose a reputable brokerage platform, such as eToro, that offers access to the desired investment options. Consider factors like fees, user-friendliness, and the range of available tools and resources.

Step 3: Open and Fund Your Account

Sign up for an account with your chosen brokerage platform and complete the necessary verification process. Once your account is approved, fund it with the amount you wish to invest.

Step 4: Search for the Investment

Use the brokerage platform’s search function to find the specific company, ETF, or index you want to invest in. For example, search for “Coca-Cola,” “Vanguard Consumer Staples ETF (VDC),” or “Vanguard VTI ETF.”

Step 5: Place Your Order

Determine the number of shares or the amount you want to invest in the selected investment option. Choose your preferred order type (e.g., market order or limit order) and confirm the transaction.

Step 6: Monitor and Manage Your Investment

Regularly monitor the performance of your investment and stay informed about the relevant developments. Make adjustments to your portfolio as needed based on market conditions and your financial goals.

Remember to diversify your investments and never invest more than you can afford to lose. It’s also advisable to consult with a financial advisor to ensure that your investment decisions align with your overall financial strategy.

Conclusion:

Although Prime Hydration stocks are not currently available for public investment, the company’s rapid growth and market impact have generated significant interest among investors. While we await official announcements regarding a potential Prime Hydration IPO, investors can explore alternative options such as investing in publicly traded beverage companies, consumer goods ETFs, or broader market ETFs like Vanguard VTI.

As with any investment, it’s essential to conduct thorough research, consider your risk tolerance, and make informed decisions based on your financial goals. Stay tuned for updates on Prime Hydration’s potential future as a publicly traded company.

FAQs

What is an IPO, and why is it important for investing in Prime Hydration?

An Initial Public Offering (IPO) is the process by which a privately held company offers shares of its stock to the public for the first time. An IPO would allow investors to directly buy Prime Hydration stocks and participate in the company’s growth and success.

How can I stay informed about a potential Prime Hydration IPO?

To stay updated on any potential Prime Hydration IPO, follow financial news outlets, monitor the company’s official website and social media channels, and keep an eye out for press releases or announcements from the company or its founders.

What are the risks associated with investing in a company like Prime Hydration?

Investing in any company carries risks, including market volatility, competition, and changes in consumer preferences. As a privately held company, Prime Hydration also lacks the transparency and regulatory oversight that publicly traded companies are subject to. It’s essential to thoroughly research the company and understand the potential risks before making an investment decision.