In today’s accessible investment world, the stock market stands as a potentially lucrative option for individuals seeking to grow their wealth. As an ANZ Bank customer, you have the opportunity to enter the world of stock trading and tap into the potential of both domestic and international markets. Our experts at Coincipher have conducted extensive research to provide you with a comprehensive guide on how to buy stocks with ANZ Bank.

Summary

Based on our market research, we highly recommend using eToro as the most suitable platform for buying stocks with ANZ Bank. eToro stands out for its user-friendly interface, low fees, and wide range of investment options, including over 3,000 stocks, ETFs, and commodities. Additionally, eToro is regulated by top-tier authorities such as ASIC, ensuring a secure and compliant trading environment.

Step-by-Step Guide on How to Buy Stocks with ANZ Bank

Step 1: Research and Analysis

Before diving into stock trading, it’s crucial to conduct thorough research on the companies you’re interested in. Analyze their financial health, historical performance, market position, and recent news or events that may impact their stock price. This step lays the foundation for making informed investment decisions.

Step 2: Select a Brokerage

Choose a reputable brokerage platform that aligns with your investment goals and preferences. Our experts recommend eToro as the best platform for buying stocks with ANZ Bank. eToro offers a user-friendly interface, competitive fees, and a wide selection of stocks from various markets. To get started, visit eToro’s registration page and sign up for an account.

Step 3: Fund Your Account

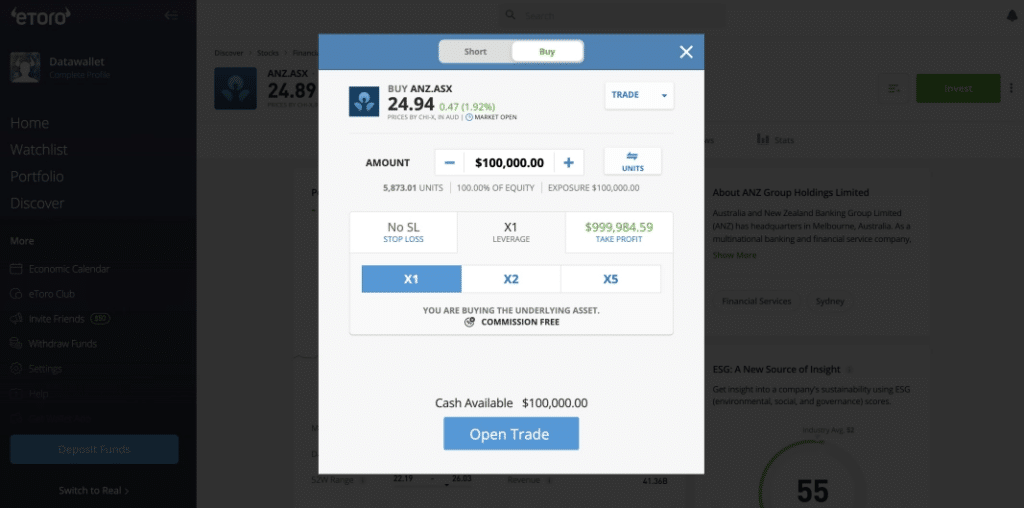

Once you have opened an account with eToro, the next step is to fund it with the desired investment amount. Navigate to the “Deposit Funds” section on the eToro dashboard, select your preferred currency and payment method (e.g., Bank Transfer, Credit Card, or POLi), and initiate the transfer from your ANZ Bank account.

Step 4: Determine the Number of Shares to Buy

Consider your investment strategy and budget when deciding on the number of shares to purchase. eToro allows you to buy fractional shares, enabling you to invest in even the most expensive stocks with a smaller budget.

Step 5: Place an Order

Using the eToro platform, search for the stock you wish to buy and click on the “Trade” button. Specify the number of shares you want to purchase and choose the order type (e.g., market order, limit order). Review the order details and confirm the transaction.

Step 6: Review and Confirm

Before finalizing your purchase, double-check all the details, including the stock symbol, number of shares, and order type. Ensure that everything is accurate and aligns with your investment plan. Once satisfied, confirm the order.

Step 7: Monitor Your Investment

After purchasing your desired stock, it’s essential to regularly monitor its performance. Stay informed about the company’s financial reports, industry trends, and any news or developments that may impact the stock’s value. eToro provides real-time price updates and various tools to help you track your investments effectively.

Step 8: Reassess and Adjust

Periodically review your investment strategy and portfolio to ensure they align with your financial goals and risk tolerance. As market conditions change or new opportunities arise, consider adjusting your holdings accordingly. eToro offers a user-friendly platform to easily manage and modify your investments as needed.

Learn more:

Fees for Buying Stocks with ANZ Bank

When buying stocks through eToro, it’s important to be aware of the associated fees. eToro charges a 0% commission on stock trades, making it an attractive option for cost-conscious investors. However, keep in mind that other fees, such as withdrawal fees or currency conversion fees, may apply. Always review eToro’s fee schedule to understand the costs involved.

Taxes on Investing in Stocks with ANZ Bank

In Australia, capital gains tax (CGT) applies to profits earned from selling stocks. If you hold a stock for more than 12 months before selling, you may be eligible for a 50% CGT discount. It’s crucial to keep accurate records of your transactions and consult with a tax professional to ensure compliance with Australian tax laws.

Conclusion

Buying stocks with ANZ Bank is a straightforward process that involves diligent research, strategic decision-making, and ongoing monitoring. By following our step-by-step guide and utilizing a reliable platform like eToro, you can confidently enter the stock market and work towards achieving your financial goals. Remember to regularly review your investments, stay informed about market trends, and be prepared to adapt to changing conditions.

FAQs

Can I buy international stocks with ANZ Bank?

Yes, by using a platform like eToro, you can access a wide range of international stocks, allowing you to diversify your portfolio beyond the Australian market.

Is there a minimum amount required to start buying stocks with ANZ Bank?

eToro has a minimum deposit requirement of $200, which allows you to start investing in stocks with a relatively low initial investment.

Can I buy fractional shares with ANZ Bank?

Yes, eToro enables you to buy fractional shares, allowing you to invest in even the most expensive stocks with a smaller budget.

How long does it take to transfer funds from my ANZ Bank account to eToro?

The transfer time may vary depending on the payment method used. Bank transfers typically take 2-3 business days, while credit card deposits are usually instant.