Investing in the stock market can be a great way to grow your wealth over time. One of the most popular investments is the S&P 500, which tracks the performance of 500 of the largest US companies. This guide will provide a step-by-step walkthrough on how to buy the S&P 500 with CommSec, one of Australia’s leading online brokerages.

Summary

The S&P 500 is one of the most popular stock market indexes, comprised of 500 large US companies. This guide provides a step-by-step walkthrough on purchasing the S&P 500 through CommSec, an Australian online brokerage.

While regulated, CommSec has relatively high brokerage fees of $19.95 AUD per trade. eToro emerges as the best alternative platform for buying the S&P 500 with its user-friendly interface, zero-commission trades, and an array of investing tools.

Overview of the S&P 500

The S&P 500 is a stock market index that tracks the stocks of 500 large-cap US companies. It covers about 80% of the total market capitalization of the US stock market. The S&P 500 is one of the most commonly used benchmarks for the overall US stock market.

Some key things to know about the S&P 500:

- It includes 500 of the largest and most established companies in the US economy. Membership is based on market capitalization, liquidity, and sector representation.

- The index covers major sectors like technology, financials, healthcare, consumer discretionary, industrials, and more.

- Top holdings include Apple, Microsoft, Amazon, Tesla, Berkshire Hathaway, and other household names.

- The S&P 500 has historically delivered average annual returns of around 10-11%, making it an attractive long-term investment.

- It is Market Capitalization Weighted – larger companies have a greater impact on index performance.

- The index is rebalanced quarterly to accurately reflect the US stock market.

Additional Insights

- The S&P 500 is a market capitalization weighted, meaning larger companies like Apple and Microsoft have a greater impact on their performance.

- The index is float-adjusted, meaning only publicly available shares are included when weighing each company.

- Apart from the SPY ETF, other options for buying the S&P 500 include index mutual funds and index futures.

- The S&P 500 dividends have grown over time at an average annual rate of 6.12% over the past two decades.

- Historical annual returns for the S&P 500 are around 10-11%, but have varied widely yearly from +37% in 2019 to -37% in 2008.

- The S&P 500 reached its highest-ever level on January 5, 2023, closing at 4,079.09. Its lowest point was around 230 during the Great Depression.

- Key risks of investing in the S&P 500 include currency risk, market concentration, volatility, global crises, and regulatory changes.

Step-by-Step Guide to Buy the S&P 500 with CommSec

CommSec is one of Australia’s leading online brokerages for trading US stocks and ETFs. Here is a step-by-step guide to buying the S&P 500 through CommSec:

Step 1: Open a CommSec International Trading Account

- Visit the CommSec website and click on ‘Open an account’. Select ‘International trading’ to open an international trading account.

- Provide your personal details and verify your identity per CommSec’s KYC process.

- Accept the account terms and conditions to complete your account application.

Step 2: Fund Your CommSec Account

You can fund your CommSec international trading account via:

- Electronic funds transfer (EFT) from an Australian bank account

- BPAY from an Australian bank account

- Credit card (Visa or MasterCard)

Ensure you have sufficient funds for your intended purchase of S&P 500 shares.

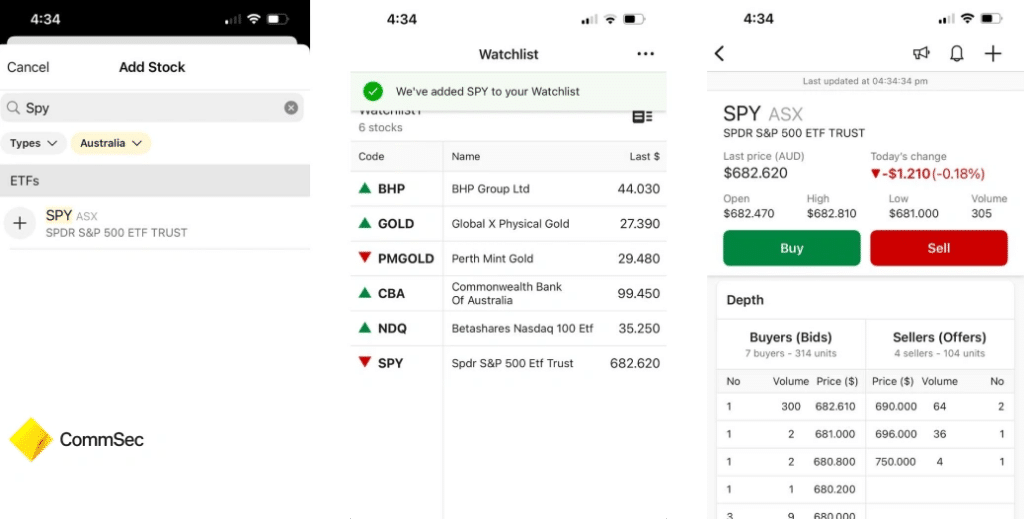

Step 3: Search for the S&P 500 ETF

On CommSec’s trading platform, search for ‘SPY’ which is the ticker for the SPDR S&P 500 ETF Trust. This ETF closely tracks the S&P 500 index.

Step 4: Place Your Order

Select ‘Buy’ and enter the number of ETF units you wish to purchase. You can choose a market order to buy at the current market price or a limit order to set a maximum price.

Step 5: Confirm and Submit Order

Review the order details thoroughly before submitting your buy order for the S&P 500 ETF. The units will be purchased at the next available price.

Step 6: Monitor Your Investment

Log in to your CommSec account to monitor the performance of your S&P 500 investment. You can also set price alerts.

With these simple steps, you can gain exposure to the broad US stock market through the S&P 500 index using CommSec. Maintain a long-term perspective and consider dollar-cost averaging to build your position over time.

Best Platform Alternative for Buying the S&P 500

While CommSec offers a reliable platform to buy the S&P 500 as an Australian investor, eToro stands out as the best alternative for this index investment.

Here’s why eToro is highly recommended for buying the S&P 500:

- User-friendly interface – eToro offers an intuitive and easy-to-use investing platform great for beginners.

- Regulated broker – eToro is authorized and regulated by the Australian Securities and Investments Commission (ASIC).

- No commissions – eToro allows you to buy ETFs like the SPDR S&P 500 ETF without any trading commissions.

- Social and copy trading – eToro has unique social features that let you learn from other experienced investors.

- Educational resources – eToro provides market analysis, financial guides and an investing academy to grow your knowledge.

- Secure platform – eToro employs robust security measures including SSL encryption and fund segregation.

- Wide range of assets – eToro offers trading across stocks, ETFs, cryptocurrencies, commodities, and more.

Open an eToro account easily and invest in the S&P 500 and other major markets.

Fees for Buying the S&P 500 on CommSec

Here are the key fees to keep in mind when buying the S&P 500 on CommSec:

- Brokerage fees – $19.95 AUD per trade for US-listed ETFs like SPY.

- FX conversion fee – A foreign exchange fee of 0.6% applies for converting your AUD to USD to trade US stocks.

- Account fee – An optional $25 quarterly fee applies for international trading accounts if you want real-time market pricing.

- Data fees – Charges apply for accessing real-time US market data, starting at around $1.50 per month.

- Inactivity fee – Accounts inactive for 2 years are charged $50 annually.

Compare brokerage costs across platforms to find the most cost-effective solution for your S&P 500 investment approach.

Taxes on Investing in the S&P 500

Here are some key tax implications for Australian investors:

- You will need to pay capital gains tax (CGT) on any investment profits when you sell your S&P 500 ETF units.

- CGT of up to 30% applies for investments held less than 12 months. Discounted rate of 15% applies for investments held longer.

- Dividends from US stocks and distributions from ETFs are subject to dividend withholding tax. This is deducted at source in the US.

- Tax reporting is required on your annual tax return for investment income and capital gains.

- Keep records of your investment transactions for tax purposes.

Consult a tax advisor to understand how this applies to your personal situation.

Conclusion

Investing in the S&P 500 can provide exposure to the broad US stock market. While CommSec provides a regulated platform, eToro is the best alternative for buying the S&P 500 with its user-friendly interface, zero commission fees, social trading, and an array of educational resources.

Consider your investment strategy, time horizon, taxes and risk tolerance when buying the S&P 500. Dollar-cost averaging can help build your position steadily over time. Stay updated on index changes, company earnings and market news to make informed investment decisions.

Frequently Asked Questions

What is the minimum amount needed to invest in the S&P 500?

The minimum amount to invest in the S&P 500 through CommSec is the cost of 1 ETF unit. Currently, 1 SPY ETF unit costs around $350 USD. However, you should factor in trading commissions and currency conversion fees, so a practical minimum is around $500 AUD.

How do I get paid dividends from the S&P 500 companies?

The SPY ETF accumulates dividends paid by the underlying 500 companies and distributes them periodically to ETF unitholders. The dividend distributions will be credited to your CommSec account as cash which you can use to reinvest or withdraw.

What are the risks of investing in the S&P 500?

Key risks include market volatility, exchange rate risk when converting back to AUD, and concentration risk as the index focuses on large US companies. Maintain a long-term perspective and diversify your portfolio across asset classes and geographies.

What is the best platform for hassle-free S&P 500 investing?

eToro stands out as the best all-round platform for easy and low-cost investing in ETFs tracking the S&P 500. With an intuitive interface, zero commissions, and automatic rebalancing tools, eToro simplifies passive S&P 500 investing for Australian investors.