In today’s accessible investment world, the stock market stands as a potentially lucrative option for individuals seeking to grow their wealth. Among the various investment opportunities, the S&P 500 has emerged as a popular choice due to its diverse portfolio of top-performing U.S. companies.

For those looking to invest in the S&P 500, Revolut offers a convenient platform. However, our experts have conducted extensive research and found that eToro may be a more suitable choice for many investors. Let’s talk about the process of how to buy S&P 500 with Revolut while also highlighting the advantages of using eToro as an alternative.

Summary

Based on our market research, investing in the S&P 500 through Revolut can be a straightforward process, offering investors exposure to a robust portfolio of leading U.S. companies. However, Revolut’s relatively high fees, including a 0.25% transaction commission and potentially high spreads, can make it costlier compared to other popular platforms.

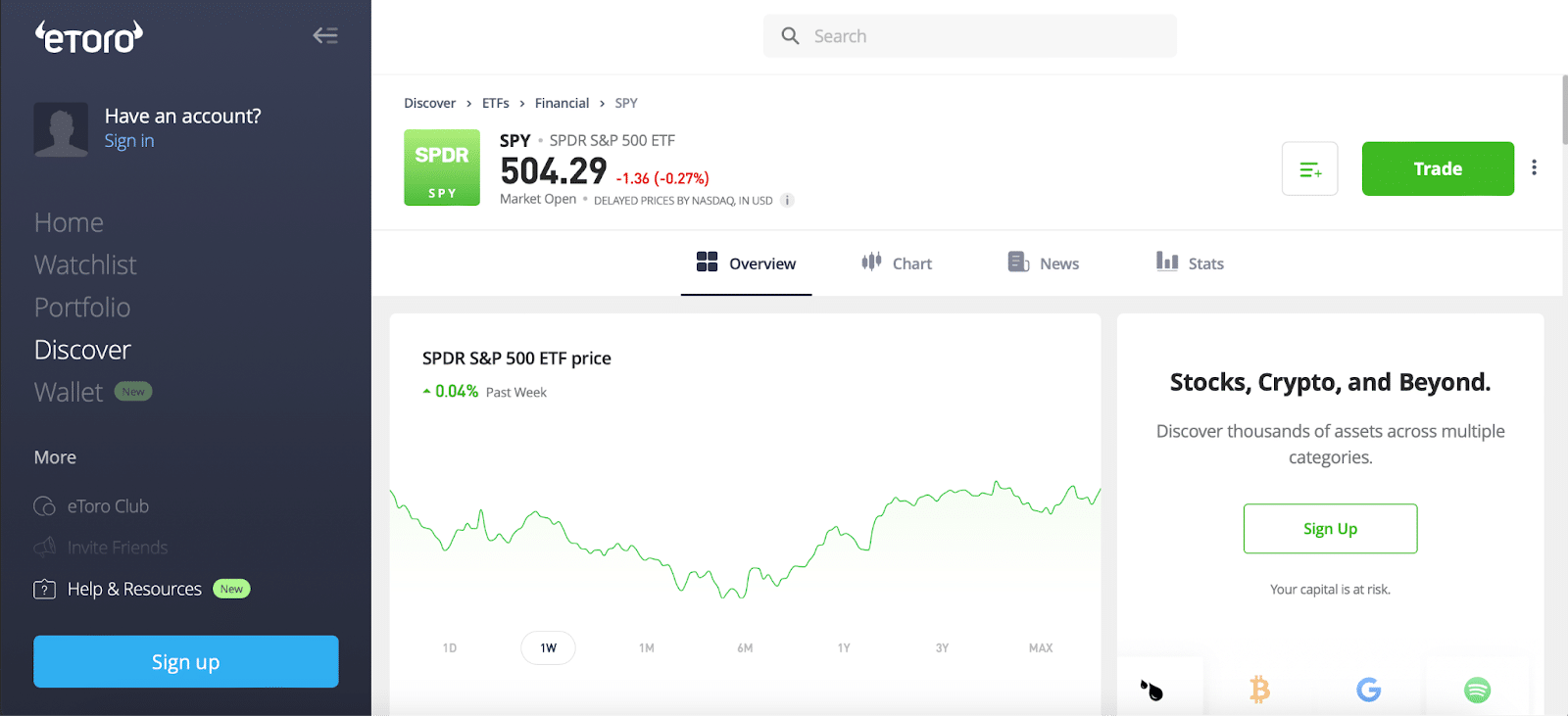

Our experts recommend eToro as the best overall platform for buying S&P 500 due to its user-friendly interface, low trading fees, competitive spreads, and a wide selection of over 4,500 tradable assets. By carefully evaluating the associated costs and features of different platforms, investors can make an informed decision that aligns with their investment goals and budget.

Step-by-Step Guide on How to Buy S&P 500 with Revolut

Step 1: Research and Analysis

Before investing in the S&P 500, it is crucial to understand what it represents. The S&P 500 is a stock market index that tracks the performance of 500 large U.S. companies across various sectors. While it is not an individual stock, investing in the S&P 500 allows you to gain exposure to a diverse range of companies, potentially minimizing risk compared to investing in a single stock.

Step 2: Select a Brokerage

To buy S&P 500 with Revolut, you’ll need to choose a reliable brokerage platform. While Revolut offers the ability to invest in the S&P 500 through ETFs, our research suggests that eToro may be a more cost-effective and feature-rich alternative. eToro provides a user-friendly platform, low trading fees, competitive spreads, and access to a wide range of tradable assets, including the S&P 500.

Step 3: Fund Your Account

Once you have registered with eToro, the next step is to fund your account. eToro accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets like PayPal. To fund your account, click on the “Deposit Funds” button, usually located in the bottom left corner of the screen. Select your preferred currency and payment method, then complete the transfer from your Revolut account or another funding source.

Step 4: Determine the Amount to Invest

Consider your investment strategy and budget when deciding how much to invest in the S&P 500. eToro allows you to invest as little as $50, making it accessible for beginners and those with limited funds. However, it’s essential to invest responsibly and only commit an amount you are comfortable with.

Step 5: Place an Order

After funding your account, navigate to the S&P 500 ETF you wish to invest in on the eToro platform. Click on the “Trade” button and specify the amount you want to invest. Review the transaction details, including any fees or spreads, before confirming your order.

Step 6: Review and Confirm

Double-check your order details to ensure accuracy. Once you are satisfied, click “Open Trade” to complete your purchase of the S&P 500 ETF.

Step 7: Monitor Your Investment

Regularly monitor the performance of your S&P 500 investment on the eToro platform. Stay informed about market trends, economic indicators, and any news that may impact the index’s performance.

Step 8: Reassess and Adjust

Periodically review your investment strategy and consider adjusting your portfolio based on your financial goals and changing market conditions. eToro provides tools and resources to help you make informed decisions about your investments.

Also read:

- How to Buy S&P 500 in the UK

- How to Buy the S&P 500 with CommSec

- Best Platforms for Investing in the S&P 500

Fees for Buying S&P 500 with Revolut

When buying S&P 500 with Revolut, investors should be aware of the associated fees. Revolut charges a 0.25% commission on transactions, and the spread between the buying and selling prices can sometimes exceed 1.5%. These fees can add up and impact your overall returns. In contrast, eToro offers lower fees, with no trading commissions and variable spreads that typically average around 1% across various assets, including the S&P 500.

Taxes on Investing in S&P 500

The taxation of S&P 500 investments varies depending on your country of residence and the specific tax laws in place. In general, capital gains from selling S&P 500 ETFs may be subject to capital gains tax, while dividends received from the underlying companies may be subject to income tax. It’s crucial to consult with a tax professional or refer to your local tax authority for specific guidance on how your S&P 500 investments will be taxed.

Conclusion

In conclusion, buying S&P 500 with Revolut involves careful research, strategic decision-making, and ongoing monitoring. This comprehensive guide has provided a step-by-step approach to investing in the S&P 500, emphasizing the importance of understanding the index, selecting a reliable brokerage, and making informed investment decisions.

While Revolut offers the ability to invest in the S&P 500, our experts recommend considering eToro as a more cost-effective and feature-rich alternative. Successful investing in the S&P 500 requires continual evaluation and adjustment, staying abreast of market trends, and being prepared to adapt to changing conditions.

FAQs

Can I buy fractional shares of the S&P 500 with Revolut?

Yes, Revolut allows you to buy fractional shares of the S&P 500 ETFs, enabling you to invest smaller amounts and own a portion of the index.

Is it risky to invest in the S&P 500?

Investing in the S&P 500 carries some level of risk, as with any investment in the stock market. However, the index’s diversification across 500 large companies can help mitigate some of the risks associated with individual stocks.

How often should I monitor my S&P 500 investment?

It’s a good practice to regularly monitor your S&P 500 investment, staying informed about market trends and any news that may impact the index’s performance. However, avoid making frequent changes based on short-term fluctuations, as a long-term investment approach is often more effective.

Can I invest in the S&P 500 with a small amount of money?

Yes, platforms like eToro allow you to invest in the S&P 500 with as little as $50, making it accessible for investors with limited funds. However, it’s essential to consider the potential impact of fees on smaller investments.