As experienced financial advisors, we understand that exploring potential stock market investment opportunities can seem daunting for both novice and seasoned investors alike. However, in today’s more accessible investing landscape, adding US equities exposure via a broad market index like the S&P 500 is a compelling option worth considering for one’s portfolio. Based on our combined analysis and advisory expertise, we will walk step-by-step through the process to securely buy S&P 500 in the UK.

Summary

The S&P 500 index tracks the performance of 500 of the largest US companies across technology, healthcare, finance, and more sectors. It is a broad representation of the US stock market. Investing in the S&P 500 provides exposure to leading US companies in a diversified way. This can be done easily in the UK through brokers like eToro, which allows commission-free trading.

We will show you the steps from opening an account, funding it, and placing trades to monitoring your investment. Factors like fees, taxes and risk versus rewards are also covered. Overall, the S&P 500 is a solid long-term investment for those seeking US stock market exposure.

What is S&P 500

The S&P 500, short for Standard & Poor’s 500, is a stock market index that tracks the stocks of 500 large-cap US companies. It covers about 80% of the total market capitalization of the US stock market, making it a broad representation of the overall market. The S&P 500 is market capitalization weighted, meaning the larger the market cap of a company, the more it impacts the index’s performance. It includes leading companies across sectors like technology, healthcare, financials and more.

Key Metrics:

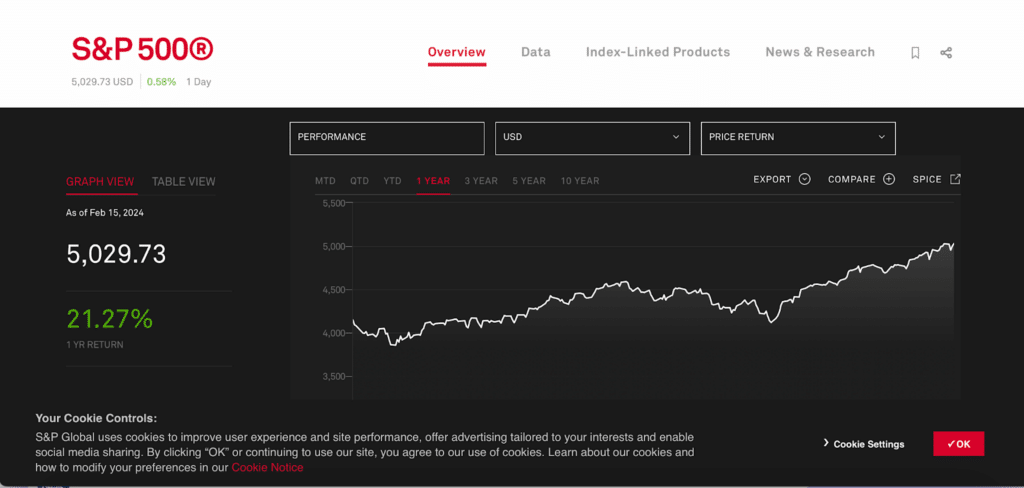

- Current Price: The current price of the S&P 500 index is 5,029.73 as of February 15, 2024.

- Day Range: On February 15th, 2024, the S&P 500 index traded in a range of 4,999.44 to 5,032.72.

- 52-Week Range: Over the past year, the index has traded between a range of 3,808.86 to 5,048.39.

- 5-Day Performance: Over the last 5 trading days, the index has risen 0.64%.

- 1 Month Performance: Over the last month, it has increased by 5.20%.

- 3 Month Performance: Over the past 3 months, the S&P 500 index has gained 11.57%.

- Year-to-Date Performance: Since the start of 2024, it has risen by 5.45%.

- 1 Year Performance: Over the past year, the index has risen by 22.96%.

- All-Time High: The all-time high close for the index is 5,048.39.

- Key Components: Top companies by weight in the index are Apple (7.3%), Microsoft (7.0%), Amazon (3.9%), Nvidia (3.2%), and Alphabet (4.4%).

How has the S&P 500 performed

Historically, the S&P 500 has delivered annualized returns of around 10% over the long run. However, performance varies from year to year. Over the past 10 years, for example, annual returns have ranged from over 30% to negative returns during crisis periods. It is considered a solid long-term investment for those seeking stock market exposure.

Step-by-Step Guide to Buy S&P 500 in the UK

Step 1) Open an Account with a Brokerage

To invest in the US stock market from the UK, you need to open an account with an online brokerage platform like eToro, which provides access to global exchanges. Opening an account is quick and easy online.

Step 2) Fund Your Account

Once your account is open, you must fund it to start trading. eToro offers several payment options like credit card, PayPal, bank transfers etc. Fund the account with your desired investment amount.

Step 3) Decide How Many Shares to Buy

Unlike individual stocks, you can purchase fractions of the index based on how much you want to invest. Decide the dollar amount you want to allocate to S&P 500.

Step 4) Place Your Order

Use eToro’s trading platform to place a “buy” order for S&P 500. You can choose market order to buy at current market prices or use limit orders.

Step 5) Monitor Your Investment

Track the performance of your investment over time. Stay updated on factors impacting the US stock market through eToro’s news and analysis feed.

Step 6) Adjust Your Position

Revisit your investment plan periodically and rebalance your portfolio if needed based on personal strategy and risk tolerance.

This step-by-step guide will help you securely invest in the S&P 500 index.

Fees for Buying S&P 500

eToro offers commission-free trading on stocks, meaning no trading fees to buy or sell the S&P 500. There are no management fees either, as it simply tracks the index. Account inactivity fees may apply if not used for 12 months.

Taxes on Investing in S&P 500

Investing in US stocks has tax implications. Capital gains tax applies on profits above the threshold when holdings are sold. Dividend income is also taxable annually. Taxes should be reported to HMRC.

Pros and Cons of Investing in S&P 500 in UK

| Pros | Cons |

| Exposure to 500 top US companies | Subject to volatility risk |

| Low cost market access | Overweight in top companies |

| Diversification across sectors | Indirect currency exposure |

| Strong past long term performance | No control over holdings |

| Includes leading global brands | Concentrated country exposure |

| Tracks wider US economy trends | Weighting methodology favors largest companies |

| Liquidity to sell holdings | Technology sector dominates weighting |

| Low investment minimums | Contains only big companies, lacks small caps |

| Wide availability of index funds | Performance tied completely to US economy |

Should I Invest in S&P 500 in the UK?

The S&P 500 has declined recently, leading investors to weigh up buying opportunities versus further expected volatility. Additional Federal Reserve rate hikes are likely forthcoming, sparking recession worries despite current strong employment and inflation reduction.

However, the index has historically performed well over long periods. Shorter-term fluctuations are inevitable, though. Maintaining a cautiously positive outlook, a 2024 year-end target of $4,300 seems reasonable per analysts, but the next 12 months remain uncertain.

For UK investors, the broad S&P 500 index appears to be a relatively solid long-term bet for gaining US stock market access. However, staying diversified across assets while regularly reviewing holdings based on economic conditions is prudent.

For those interested specifically in Vanguard’s S&P 500 ETF highlighted earlier, see our guide: How to Buy Vanguard ETFs in the UK.

Beyond just the S&P 500, investors can also gain exposure to the technology-heavy NASDAQ index. Learn more here: How to Buy NASDAQ in the UK.

In addition to stocks, another way to potentially diversify US investment exposure is through government bonds. Find out about accessing US Treasuries from the UK: How to Buy US Treasuries in the UK.

Conclusion

In summary, the diversified S&P 500 index offers potential US market returns. Commission-free trading via eToro provides easy, secure access. Though short-term fluctuations are expected, historical data suggests possible solid long-term results. Monitoring economic factors and adjusting periodically is prudent.

FAQs

What is the S&P 500?

An index of 500 large public US firms, covering 80% of total market cap. It benchmarks overall US market/economic strength.

What is the best S&P 500 investment platform in the UK?

eToro supports fractional, zero-commission S&P 500 trading, beating competitors on fees, tools and security.

Is the S&P 500 a wise investment in the UK?

Over the long term, the S&P 500 has performed well historically. However, volatility is common in the short term. Appropriate precautions should be taken.

How are S&P 500 returns taxed in UK?

Gains and dividends are subject to capital gains and income tax per HMRC rules when thresholds are crossed.