In today’s accessible investment landscape, the stock market stands as a potentially lucrative avenue for returns. For investors seeking broad exposure and index-matching performance, the S&P 500 has emerged as a premier benchmark. Our research has identified the best platforms for investing in the S&P 500, suited to different investor needs.

Summary

Based on in-depth analysis, we have ranked the leading platforms for investing in the S&P 500 index. Key factors considered include regulatory compliance, trading tools, fees, asset offerings, and user experience. According to our research, the top platforms are:

- eToro – Best overall platform with low fees, copy trading, and a large asset selection.

- Fidelity – Excellent for research tools and retirement accounts like IRAs.

- TD Ameritrade – Great educational resources for beginner investors.

- E*Trade – User-friendly mobile app and zero commission ETFs.

- Robinhood – Popular for commission-free trading and options.

When choosing a platform, it’s crucial to compare fees, account minimums, available assets, and unique features to find the right fit. Overall, eToro stands out for its low-cost access to diversified assets, social trading capabilities, and strong security.

Why Invest in the S&P 500?

The S&P 500 includes 500 of the largest U.S. companies, covering approximately 80% of the American equities market. It is a market-capitalization weighted index, giving more weight to companies with a higher market cap. Key benefits of investing in the S&P 500 include:

- Diversification – Exposure to 500 leading companies across 11 sectors.

- Long-term growth – Historically, the index has steadily increased over decades.

- Lower volatility – Broad exposure reduces risk compared to picking individual stocks.

- Benchmarking – The S&P 500 is a benchmark for overall U.S. stock market performance.

- Dividend income – Many S&P companies offer consistent dividend payouts.

- Passive investing – Index funds track the S&P 500, allowing passive exposure.

Instead of stock picking, the S&P 500 offers a diversified way to invest in the broader U.S. economy and equity markets.

Investors Guide: Best Platforms for Investing in the S&P 500

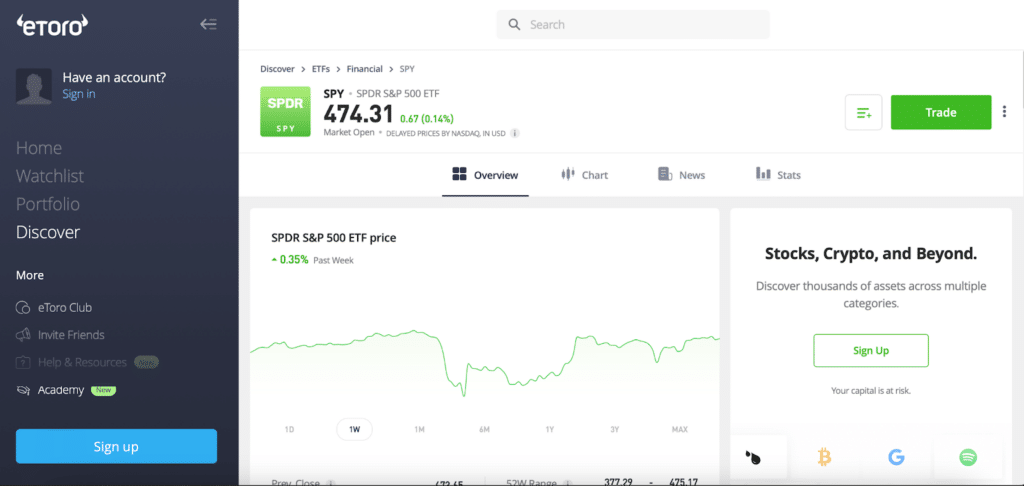

eToro – Best Overall

eToro emerges as the best overall platform based on its regulatory compliance, zero commission policy, and user-friendly experience. Here are some key details:

- Fees – 0% commission to buy and sell ETFs and stocks, small spreads

- Assets – Stocks, ETFs, indices, commodities, currencies, and cryptocurrencies

- Account Minimum – $50 minimum deposit

- Regulation – Registered with SEC and FINRA along with other tier-1 regulators

- Key Features – CopyTrader, virtual portfolio, mobile app, and social community

With low fees, fractional share investing, and innovative social features, eToro stands out as a top choice for S&P 500 investing.

Fidelity – Excellent Research and IRAs

Fidelity is ideal for investors who want robust research tools and tax-advantaged accounts. Key details include:

- Fees – $0 commissions for online stock and ETF trades

- Assets – Stocks, funds, bonds, CDs, options, IPOs and more

- Account Minimum – $0 minimum for a standard brokerage account

- Regulation – Registered with the SEC and FINRA

- Key Features – Industry-leading research, IRAs, financial planning tools

With $0 commissions and powerful research, Fidelity appeals to active investors looking to buy and sell S&P stocks and ETFs.

TD Ameritrade – Top Educational Resources

TD Ameritrade shines for its education offerings and virtual trading. Here’s an overview:

- Fees – $0 commissions on online stock, ETF, and options trades

- Assets – Stocks, funds, forex, futures, bonds, and CDs

- Account Minimum – $0 minimum deposit

- Regulation – Registered with SEC and FINRA

- Key Features – PaperMoney virtual trading, webcasts, courses, and in-depth education

TD Ameritrade empowers new investors through immersive education and virtual trading practice.

E*Trade – User-Friendly Mobile App

E*Trade appeals with its easy-to-use mobile app and commission-free ETFs.

Key details:

- Fees – $0 commissions on online stock, ETF, and options trades

- Assets – Stocks, bonds, mutual funds, ETFs, and options

- Account Minimum – $500 minimum deposit

- Regulation – Registered with SEC and FINRA

- Key Features – Simple mobile app, commission-free ETFs, digital assistants

E*Trade makes S&P 500 investing accessible through its intuitive mobile platform and selection of commission-free ETFs.

Robinhood – Leader for Commission-Free Trading

Robinhood specializes in zero-commission trading and is ideal for options and active traders. Here’s an overview:

- Fees – $0 commissions and low spreads on trades

- Assets – Stocks, ETFs, options and cryptocurrencies

- Account Minimum – $0 minimum deposit

- Regulation – Registered with SEC and FINRA

- Key Features – Intuitive mobile app, commission-free trades, fractional shares

With easy account setup and customizable alerts, Robinhood offers an efficient platform for S&P 500 options and active trading.

Investing in S&P 500 ETFs

For easy diversification, exchange-traded funds (ETFs) that track the S&P 500 are recommended. Popular choices include:

- SPDR S&P 500 ETF (SPY) – Most heavily traded ETF with over $350 billion in assets.

- Vanguard S&P 500 ETF (VOO) – Offers among the lowest expense ratios at 0.03%.

- iShares Core S&P 500 ETF (IVV) – Another large ETF with over $290 billion in assets.

These ETFs closely track the S&P 500 index with minimal divergence. They provide low-cost exposure for buy-and-hold investors.

Key Steps for New Investors

For beginners looking to invest in the S&P 500, key steps include:

- Open a brokerage account – Choose a platform like eToro or Fidelity and complete account setup.

- Deposit funds – Fund your account via wire transfer, e-check, or debit card. Ensure funds clear.

- Select your investment – Research and select an S&P 500 ETF like SPY or index mutual fund.

- Place a buy order – Input the ticker symbol and order details and execute the trade.

- Monitor your investment – Track your investment’s performance over time. Reinvest dividends.

- Rebalance periodically – Rebalance to maintain your target asset allocation over time.

Conclusion

With the right brokerage account, investing in the S&P 500 can be straightforward and affordable. Low-cost ETFs like SPY and VOO provide diversified, passive exposure to this key U.S. benchmark. By comparing platforms like eToro and Fidelity, investors can find the ideal blend of fees, account features, and investment choices to fit their strategy. Maintaining proper portfolio diversification and utilizing tax-advantaged accounts can further enhance long-term returns.

FAQs

What are the fees for investing in the S&P 500?

This depends on the platform. Many offer $0 stock and ETF trades. The expense ratio is around 0.03 – 0.09% for popular ETFs. Additional fees may include foreign transaction fees or maintenance fees.

What taxes apply to S&P 500 capital gains and dividends?

For U.S. investors, capital gains and dividends are typically taxed at preferential rates. Short-term gains under 1 year are taxed as ordinary income. Long-term gains over 1 year are generally taxed at 0%, 15% or 20% based on income level and filing status.

Is investing in the S&P 500 riskier than bonds?

Yes, stocks carry more risk than bonds. The S&P 500 has averaged around 10% annual returns over decades but can see temporary declines exceeding 20% in volatile markets. Maintaining a balanced portfolio with stocks and bonds is recommended.