In today’s accessible investment world, the stock market stands as a potentially lucrative option. As experienced investors and financial educators, we empower both novice and seasoned market participants to fully leverage the stock market’s profit potential. So, here is the essential information and a step-by-step guide if you plan to buy Neuralink stocks.

Summary

Neuralink is a private medical device company founded by Elon Musk that is developing brain-computer interface technology. It is not currently publicly traded, so retail investors cannot purchase shares directly. However, you can invest in related public companies like Alphabet and Tesla with connections to Neuralink. You can also set aside money to prepare for a future Neuralink IPO.

We recommend using Fidelity as a reputable online brokerage platform to invest in public stocks and future IPOs. Fidelity offers $0 trades, extensive research tools, and excellent customer service.

What is Neuralink?

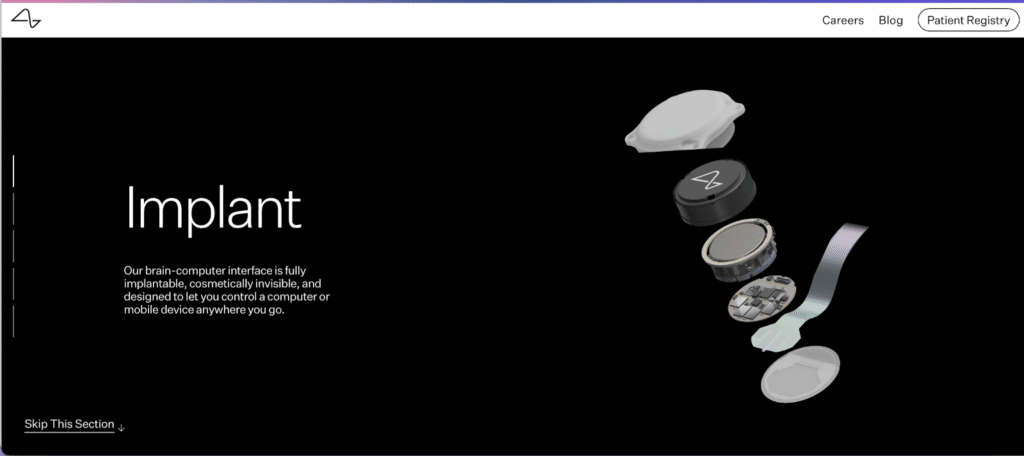

Neuralink is a medical device startup company founded in 2016 by Elon Musk and others. It is developing brain-computer interface (BCI) technology that involves inserting tiny electrodes into the brain to transmit signals to computers.

This technology aims to help paraplegics regain mobility or help the vision impaired see again. It has potential applications for artificial intelligence as well.

Neuralink is currently private and valued at around $2 billion as of late 2023. It is not profitable yet as it is still in the research and development phase. The company hopes to begin human trials soon.

Key Metrics

- Current price: $7.37e-13 USD

- 24h trading volume: $37,146.11 USD

- Market cap: Not available

- Rank by market cap: #3787

- Circulating supply: Not available

- Total supply: 420,000T NLINK

- Max supply: 420,000T NLINK

- Fully diluted market cap: $270,213.02

- Upside in last 24 hours: 2.68%

- Exchanges traded on: MEXC, PancakeSwap v2, Baby Doge Swap

Can I Buy Neuralink Stocks?

No, Neuralink stock cannot currently be purchased by anyone. Since it is still a private company, regular investors cannot buy shares. Retail investors will need to wait until Neuralink decides to go public before being able to invest.

Other Ways to Invest in Neuralink

While Neuralink stock itself is not yet available, there are some alternative ideas for investors who want exposure to Neuralink’s technology and future prospects:

Invest in Alphabet Stock

Buying shares of Alphabet (GOOGL) allows investors to gain some indirect exposure to Neuralink, since Alphabet’s venture capital arm Google Ventures invested early on. However, it’s important to note that Neuralink likely makes up a very tiny portion of Alphabet’s overall business.

Invest in Tesla Stock

Tesla (TSLA) stock similarly provides some basic exposure to Elon Musk’s universe of companies. While highly speculative, Musk did state he’s open to potentially combining his firms, like Tesla and Neuralink, under one entity someday. But the possibility seems remote currently.

Wait for the Neuralink IPO

The most direct path is for investors to simply wait for a Neuralink IPO and invest at that time. However, the IPO likely remains years away and may never occur. Investors could set aside a small amount of “lottery ticket” money for a future debut, but should weigh opportunity cost given money would be sidelined for an unknown period.

Step-by-Step Guide on How to Buy Neuralink Stocks

Here is a step-by-step overview of what the process would look like for buying Neuralink stock once it completes an IPO:

Step 1: Research the Company

Conduct due diligence by studying Neuralink’s financials, leadership team, competitive advantages, risks, and growth potential. As a speculative investment, understand the upside and downside.

Step 2: Choose a Brokerage

Select an online brokerage platform like Fidelity to open an investment account. Make sure to compare fees, tools, and services across brokers.

Step 3: Fund Your Account

Deposit money into your investment account to cover the amount you want to potentially invest in a future Neuralink IPO.

Step 4: Wait for the IPO

IPOs involve filing paperwork with regulatory agencies beforehand, so investors will know in advance when one is coming. Be patient for a Neuralink IPO announcement.

Step 5: Evaluate the IPO Price

Once the initial price range is set, determine if the valuation seems appropriate given the business fundamentals and growth outlook.

Step 6: Place Your Order

On the first day of trading, log into your brokerage account and place a market or limit order for the number of shares you want.

Step 7: Manage Your Investment

Monitor Neuralink’s stock performance and news after investing. Adjust your position size over time based on new developments.

This walkthrough provides the key steps for retail investors to buy into a Neuralink IPO. Remember that the business is still extremely young, and investing would involve substantial risk.

Fees for Buying Neuralink Stock

Fidelity offers $0 stock and ETF trades, so investors would pay no fees directly to the broker for buying Neuralink stock after its IPO. However, there are other potential costs to consider:

- Account fees: Fidelity has no annual, maintenance, or minimum balance fees for regular brokerage accounts.

- Bid/ask spread: The difference between the highest price a buyer will pay and the lowest a seller will accept. Paying the asking price when buying shares essentially builds in a small fee.

- Short-term trading fees: Frequent trading often incurs additional fees. Fidelity doesn’t charge for this, but short-term capital gains taxes can still apply.

So, while direct trading commissions are $0, investors should know the other minor fees that can impact total costs.

Taxes on Investing in Neuralink

In the United States, investing in Neuralink stock would generate capital gains taxes whenever shares are sold for a profit. The rate depends on how long the position is held:

- Short-term capital gains apply to investments held for 1 year or less. These are taxed at your ordinary income rate.

- Long-term capital gains are for investments held over 1 year. Depending on your tax bracket, these have preferential rates of 0%, 15%, or 20%.

Stock dividends are also taxable; investors may owe taxes on these even if the shares are not sold. So be aware that the IRS will want a portion of any investment profits achieved from owning Neuralink stock over time.

Learning cross-border investing and overseas assets can be tricky, but we’re here to help point you in the right direction.

To learn step-by-step how to buy Vanguard’s VTI or VOO ETFs from Europe, check out our guide: How to Buy Vanguard 500 (VOO) in Europe.

And for UK investors interested in Indian ETFs specifically, read our walkthrough here: How to Buy Indian ETF in the UK.

Our experts break down the specifics, including availability, taxes, fees, and more. With the right broker and a little planning, globally diversified ETF exposure is feasible, even from Europe or the UK.

Conclusion

In conclusion, purchasing Neuralink stock first requires the company to complete an IPO, which likely remains years away. Once the company goes public, performing research, selecting a brokerage like Fidelity, and placing a buy order will provide individual investors with a means to gain exposure to this speculative medical technology startup. While an intriguing long-term opportunity, shareholders must stay realistic about the investment risks for a pre-revenue business still requiring significant R&D. Careful monitoring and portfolio adjustments will be necessary when owning a stake in Neuralink.

FAQs

Can I invest in Neuralink right now?

No, Neuralink is currently a private company, so regular investors cannot purchase shares at this time. Retail investors must wait until Neuralink completes an IPO before gaining an opportunity to invest.

What is the minimum amount needed to invest in Neuralink?

Most brokerages no longer require account minimums, so investors could buy Neuralink with practically any amount they choose after its IPO. Of course, share price would be a factor, and investors may prefer putting in at least a few thousand dollars.

What stock exchange will Neuralink be on?

The exchange is unknown until Neuralink files its IPO paperwork. But major exchanges like the NYSE and Nasdaq would provide the most liquidity, increasing the likelihood Neuralink pursues one of them.

Will Neuralink stock be profitable?

No, Neuralink is expected to be unprofitable for the next several years at a minimum. As a medical device company conducting R&D and seeking regulatory approval, it has virtually no revenue. Profitability would only come years down the road once its technology is commercialized.