In today’s increasingly accessible world of investing, the stock market presents a potentially lucrative opportunity for those looking to grow their money. At CoinCipher, we aim to provide essential information and a straightforward guide to buy Indian ETF in the UK. These investment vehicles offer exposure to India’s rapidly expanding economy.

Summary

The iShares MSCI India ETF provides exposure to leading Indian companies across diverse sectors, offering UK investors a way to tap into one of Asia’s rapidly growing economies.

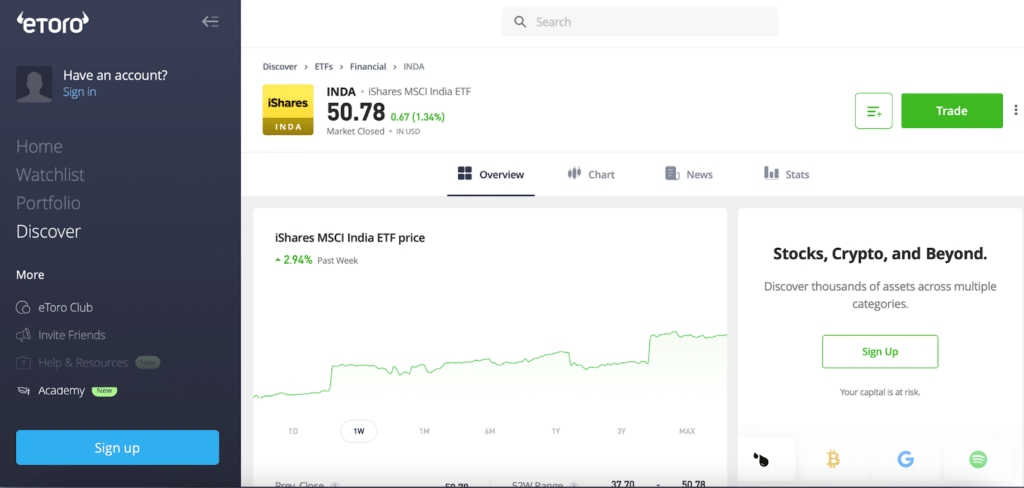

Experts recommend using the eToro platform due to its low fees, user-friendly interface, and support for top Indian indices. The key steps involve opening an eToro account, funding it via Faster Payments, bank transfers or credit cards, and then searching for and investing in the iShares MSCI India ETF. When considering fees, eToro’s minimal spreads and commissions make it a cost-effective choice. However, the ETF’s 0.64% expense ratio should also be factored in.

What is Indian ETF

An exchange-traded fund (ETF) tracks the performance of an underlying index or basket of assets. The iShares MSCI India ETF specifically mirrors the MSCI India Index, comprising large- and mid-cap Indian companies across information technology, financial services, healthcare, consumer goods and other high-growth sectors. This makes it a popular avenue for gaining diversified exposure to India’s booming economy.

Key Metrics

- Net Expense Ratio: 0.65%

- Discount/Premium to NAV: 0.02%

- Total Assets Under Management: $8.111 billion

- 30-Day Average Daily Volume: 3.654 million

- Dividend Yield: 1.16%

- Turnover Ratio: 18.00%

- 1 Year Fund Level Flows: 1.993 billion

- Max Drawdown Since Inception: -21.34%

- Top 10 Holdings: 36.4% of fund

- Sector Allocation: Information Technology (18.8%), Financials (17.3%), Consumer Staples (11.8%)

Can I How to Buy Indian ETF in the UK

Yes, UK residents can invest in the iShares MSCI India ETF. You’ll need a GBP-denominated trading account on a UK-regulated platform.

Step-by-Step Guide on How to Buy Indian ETF in the UK

Step 1: Research and Analysis

Conduct research on the iShares MSCI India ETF, examining its holdings, sector exposure, past performance and role in achieving your investment goals. Also, research eToro to ensure it suits your needs.

Step 2: Open eToro Account

Register for an eToro account and complete identity verification. eToro supports GBP transactions and is regulated by the UK Financial Conduct Authority (FCA).

Step 3: Fund Account

Click ‘Deposit Funds’ and transfer money from your UK bank account via Faster Payments, Bacs, or card.

Step 4: Find iShares MSCI India ETF

Use eToro’s search function to find the fund by its INDA ticker.

Step 5: Buy ETF

Decide on your desired investment amount and place your buy order for the ETF.

Step 6: Monitor Performance

Track your investment and stay up-to-date on the news related to ETF holdings and the Indian market.

Step 7: Periodic Rebalancing

Consider reallocating your assets over time based on performance or changes in your investment goals.

We have provided UK investors with a straightforward process for accessing India’s high-growth economy through the secure, regulated eToro platform.

Related Articles

Check out these other helpful guides on investing platforms and assets for European residents:

- How to Buy Stocks with ING Bank – Learn how Europeans can purchase stocks directly in companies they choose using ING Bank’s investor-friendly platform.

- How to Buy Vanguard VTI ETF – Discover how to invest in the Vanguard Total Stock Market ETF as a European investor for broad US equity exposure.

- How to Buy Vanguard 500 (VOO) in Europe – This article explains how Europeans can buy the popular S&P 500-tracking Vanguard ETF (VOO).

Fees for Buying the iShares MSCI India ETF

eToro offers low fees, with no deposit, withdrawal or account fees for UK customers funding via domestic channels. Expect tight spreads from 0.14% and transparent commissions disclosed before trading. Account for the ETF’s 0.64% expense ratio as well.

Taxes on Investing in the iShares MSCI India ETF

As a UK-domiciled ETF, the iShares MSCI India fund should not incur additional overseas withholding taxes. Capital gains tax applies only when holdings are sold at a profit. Dividend income may also be subject to taxation. Consider seeking professional tax advice regarding your specific circumstances.

Conclusion

In conclusion, purchasing the iShares MSCI India ETF as a UK investor involves opening an account on a regulated platform like eToro, funding your account via GBP deposit methods, and placing your buy order for the ETF. Ongoing portfolio monitoring and periodic rebalancing are also key. With minimal platform fees from eToro coupled with the ETF’s intrinsic advantages of diversified Indian market access, this investment avenue offers an attractive opportunity to participate in India’s high-growth Story.

FAQs

What are the benefits of the iShares MSCI India ETF?

The iShares MSCI India ETF provides diversified exposure to India’s fast-growing economy through holdings in leading IT, financial, healthcare and consumer goods companies. As a passive index fund, it offers a low-cost way to tap into India’s growth potential.

Does the iShares MSCI India ETF pay dividends?

Yes, the iShares MSCI India ETF pays out dividends on a quarterly basis based on the dividend yields within its underlying portfolio. This offers investors an additional source of investment returns besides capital appreciation.

Does eToro charge commission fees?

eToro discloses its transparent commissions upfront before any trade. For some markets like stocks and ETFs, commissions are minimal at just 0.09% of trade value. This makes eToro a cost-effective option for accessing assets like the iShares MSCI India ETF.