In today’s accessible investment world, the stock market is a potentially lucrative option. As a leading crypto analyst, we provide a comprehensive guide on how to buy Vanguard 500 (VOO) in Europe for those investors who want exposure to the U.S. stock market.

Summary

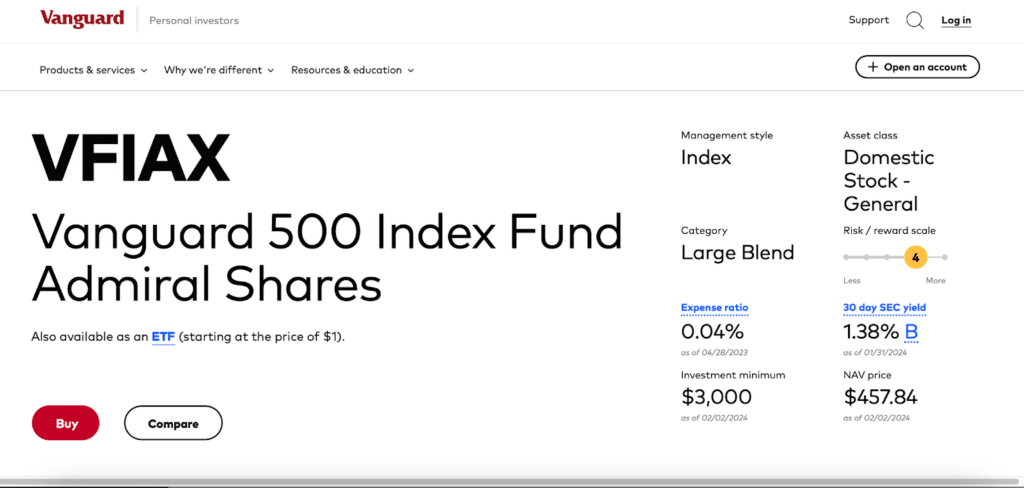

The Vanguard 500 ETF (VOO) offers European investors exposure to the broad U.S. stock market through the S&P 500 index. With over $250 billion in assets under management and a low expense ratio of 0.04%, VOO is a popular choice to add domestic U.S. equities to investment portfolios (as of February 2024).

Based on expert analysis, the recommended platform for Europeans to buy Vanguard 500 (VOO) is eToro. This regulated brokerage offers seamless Euro deposits through bank transfer, debit/credit card, and other payment methods. eToro also provides access to over 3,000 stocks, ETFs, cryptoassets, and CFDs.

What is Vanguard 500 (VOO)?

The Vanguard S&P 500 ETF (VOO) tracks the S&P 500 index, comprising 500 large U.S. companies. It diversifies across 11 sectors, with top holdings in information technology, healthcare, financials, communication services, and consumer discretionary. Launched in 2010, VOO has delivered strong historical returns, closely mirroring the performance of the broader U.S. stock market.

Key Metrics

- 3 Month Return: 16.26%

- Net Asset Value (NAV) as of Feb 1, 2024: $457.84

- Total Assets Under Management: $394.12 billion (as of Feb 1, 2024)

- Inception Date: September 9, 2010

- Premium/Discount: 0.03%

- Average 52-Week Premium: 0.01%

- Last Reported Dividend: $1.80 per share

- Indicated Gross Dividend Yield: 1.59%

Recent VOO Performance & Outlook

VOO has continued its strong run in 2023, gaining over 7% year-to-date as of February 2024. Investors are bullish on U.S. equities for 2024 as the economy shows resilience with moderating inflation and a healthy labor market. Vanguard expects another positive year as corporate earnings grow, supporting stock prices.

New EU Legislation Impacting Investors

In 2023, European regulator ESMA introduced new restrictions on marketing complex financial products to retail investors. However, these rules exempt UCITS funds like VOO. Europeans can continue easily accessing plain vanilla ETFs, including VOO, that provide transparency and liquidity.

Can I Buy Vanguard 500 (VOO) in Europe?

Europeans can buy Vanguard 500 (VOO) in Europe through online brokerages like eToro that accept Euro deposits. You simply fund your account, search for VOO, and place a live trade in a few clicks. As a regulated platform, eToro provides convenience, transparency, and security for European investors.

Step-by-Step Guide: How to Buy Vanguard 500 (VOO) in Europe

Step 1: Research and Analysis

Conduct research on VOO, understanding the S&P 500 composition, sectors, risk metrics, past performance, and Vanguard as the ETF provider.

Step 2: Open an eToro Account

Visit eToro.com to open an account instantly. Complete profile verification for secure access.

Step 3: Fund Your Account

Navigate to Deposit Funds and choose your preferred Euro payment method to transfer money into your eToro account.

Step 4: Search for VOO

Use the search bar to find the Vanguard S&P 500 ETF (VOO).

Step 5: Choose Order Type & Quantity

Decide on order type (market, limit) and quantity based on your trade strategy.

Step 6: Review & Confirm Order

Verify purchase details, then confirm the order. VOO shares will be added to your portfolio after execution.

Step 7: Monitor Investment

Check your VOO position regularly and stay updated on related news and financial reports.

Step 8: Adjust Strategy

Periodically rebalance your portfolio weights based on performance or reassess risk factors.

This guide outlines an efficient process for Europeans to invest in Vanguard’s flagship S&P 500 ETF (VOO).

Fees for Buying VOO

The main fees for buying VOO on eToro are the small spread and an overnight carry charge for certain leveraged positions. There are no commissions, monthly account fees, or deposit/withdrawal charges.

Competitor platforms like DEGIRO charge higher spreads of around 0.50% plus commissions that take a percentage of trade volume. For European investors, eToro provides competitive rates for buying and holding VOO.

Taxes on VOO

In Europe, capital gains tax applies to profits from selling VOO shares. The specific rate varies by country. For example, in the UK, capital gains above the £12,300 annual allowance are taxed at 10% or 20% based on total income. Consult a tax advisor to understand how VOO is taxed in your jurisdiction.

Conclusion

In conclusion, purchasing VOO involves diligent research, strategic decision-making, and ongoing monitoring. This comprehensive guide has provided a step-by-step approach to buying VOO shares in Europe, emphasizing the importance of a reliable brokerage, transparent fees, and continual evaluation. By following these essential steps, European investors can incorporate the Vanguard S&P 500 ETF into their portfolios and work towards their financial goals.

Related Reading

Looking to access other major US indexes? Check out our guide on How to Buy NASDAQ in the UK for exposure to tech mega-caps.

If seeking more broker recommendations headlined by a top bank, read How to Buy Stocks with ING for their fee structures.

And for a comparable Vanguard ETF covering the whole US stock market, see how to buy Vanguard’s VTI ETF.

FAQs

Can I buy VOO directly from Vanguard?

No, Vanguard only sells their ETFs directly to U.S. citizens or residents. As a European, you need to use a brokerage platform like eToro to buy VOO.

What is the minimum amount to invest in VOO on eToro?

The minimum for opening an eToro account is $200 (or equivalent in EUR). After depositing funds, you can invest any amount into VOO without restrictions.

Does eToro charge commission fees for buying ETFs?

No, eToro does not charge any commission fees. You simply pay the small spread which is embedded in the assets bid-ask price. This helps keep investing costs low compared to other European brokerages.

Can I transfer my VOO shares to another brokerage?

Unfortunately, VOO cannot be transferred between brokerages or to an external wallet. Your VOO shares must remain in your eToro account. You can choose to close positions and withdraw funds anytime.