In today’s accessible investment world, the stock market is a potentially lucrative option for many. As Coincipher experts, we will provide essential information and a step-by-step guide on how to buy Vanguard VTI ETF, ensuring a secure and informed investing process.

Summary

Based on expert research and analysis of top investment platforms, eToro emerges as the best overall choice for buying VTI. eToro enables smooth multi-currency transactions from any banking institution and offers over 3,000 stocks, ETFs, commodities and more, paired with competitive pricing.

What is Vanguard VTI ETF

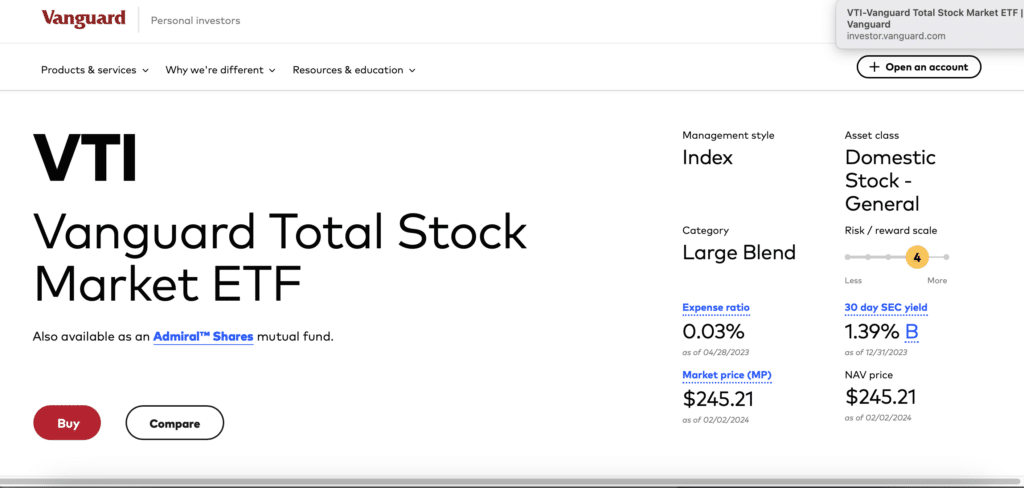

The Vanguard Total Stock Market ETF (VTI) serves as a comprehensive investment avenue, providing exposure to the broad U.S. equity market. Established in 2001, it closely tracks an extensive benchmark encompassing over 3,500 U.S. stocks across diverse sectors and market caps, from small to mid to large-cap companies. With a minimal expense ratio of 0.03% and a balanced risk profile, VTI offers investors substantial growth potential.

Key Metrics

- Assets Under Management: Over $7 trillion

- Number of Funds Offered: More than 200

- Number of ETFs Offered: Over 100

- Average ETF Expense Ratio: 0.05%

- VTI ETF Assets: $348 billion

- VTI Holdings: Over 3,700 stocks

- VTI Expense Ratio: 0.03%

- VTI Style: Blend across growth and value

- VTI Dividend Yield: 1.31%

- VTI Market Price: $245.21 (as of Feb 2, 2024)

Can I Buy Vanguard VTI ETF?

Yes, VTI can be purchased globally by individuals using a reputable online brokerage platform. To invest, simply open an account with a regulated platform like eToro, deposit funds in your currency of choice, and place a trade order for VTI shares, specifying details like quantity. Ensure any platform follows regulations in your country to facilitate secure transactions.

Step-by-Step Guide: How to Buy Vanguard VTI ETF

Step 1: Research and Analysis

Conduct due diligence by exploring VTI’s holdings, performance history, fees, and recent market developments.

Step 2: Select a Brokerage

Choose a secure platform like eToro, supporting multi-currency transactions and access to assets, including stocks, and ETFs like VTI.

For European investors, trusted multi-currency brokers like eToro allow funding accounts easily in EUR, GBP or other local currencies to invest in assets worldwide. For more on using eToro to buy ETFs, see this guide How to Buy ETFs with Revolut.

Those interested specifically in gold ETFs can read this overview How to Buy Gold ETFs in Europe.

Step 3: Fund Your Account

Deposit investment capital into your eToro account via convenient payment methods based on your location and preferences.

Step 4: Determine Shares to Buy

Decide on your budget and strategy to determine the appropriate number of VTI shares to purchase.

Step 5: Place Order

Use eToro’s platform to place a buy order for VTI, indicating details like order type, share price, and quantity.

Step 6: Review and Confirm

Verify order specifics like ticker symbol, share amount, price, fees etc. before confirming.

Step 7: Monitor Investment

Regularly track VTI’s performance using eToro’s tools and stay updated on news related to holdings.

Step 8: Reassess and Adjust

Periodically review and adjust your investment approach based on changing market conditions or financial goals.

Our guide provides an easy process to invest in VTI securely. eToro supports quick account setup, intuitive trading, global deposit options, +3,000 assets, and more – making trading VTI simpler.

Fees for Buying VTI

The primary fees incurred when purchasing VTI on eToro is the spread between the buy and sell price, typically around 0.15% or lower per trade. There are no deposit, withdrawal or management fees. Compared to platforms like DEGIRO charging additional commissions, eToro offers very competitive rates.

Taxes on Investing in VTI

Investment gains and dividends from VTI are subject to taxes. As a U.S. domiciled ETF, standard federal capital gains tax rates apply based on short-term vs long-term holdings. VTI distributions are taxed as ordinary dividends. Consult a tax professional for advice.

Conclusion

In conclusion, purchasing the Vanguard Total Stock Market ETF entails thorough research, prudent decision-making, and regular performance tracking. This guide has furnished a clear step-by-step approach to securely invest in VTI using regulated platforms like eToro, allowing seamless transactions. Achieving returns through VTI necessitates constant evaluation and adapting strategies based on shifting conditions.

FAQs

What is VTI’s expense ratio?

VTI has an exceptionally low expense ratio of 0.03%. This means annual fees work out to just $3 for every $10,000 invested.

How often does VTI pay dividends?

VTI pays dividends quarterly – once every three months. The trailing 12-month dividend yield is currently 1.31%.

Can I automatically invest in VTI every month?

Yes, eToro enables setting up recurring monthly investments, allowing you to steadily build your VTI position over time through dollar cost averaging.

Does VTI have high liquidity?

Yes, VTI has exceptionally high daily trading volumes, ensuring fast execution of buy and sell orders without significant slippage.