Investing in stocks is becoming increasingly popular in France. With the advance of technology, French investors now have access to the best stock trading platforms in France, providing great opportunities to buy and sell stocks from France and abroad.

Summary

The top online stock trading platforms available for investors in France include Interactive Brokers, Saxo Bank, XTB, eToro, and DEGIRO. These platforms offer low fees, strong regulation, advanced trading tools, extensive research capabilities, and high levels of security. French investors can conveniently open accounts, deposit funds, and start trading stocks seamlessly through these online platforms.

Choosing the Right Broker in France

With the wide selection of stock trading platforms available today in France, it is crucial for investors to thoroughly evaluate brokers to find one that best fits their needs. Priority factors to consider include:

- Regulation & Safety – Opt for well-regulated brokers to ensure the security of your funds. Top regulators like France’s AMF, UK’s FCA and EU passporting rules should be met. Also check broker is a member of an Investor Compensation Scheme.

- Fees & Commissions – Brokerage fees eat directly into your trading returns. Carefully compare commission structures across platforms. Discount brokers can save you significantly over the long-term.

- Trading Tools – Evaluate platforms for features that support your trading style – whether that’s powerful analytics, social community, copy trading, automation, or something else. Pick software you find simple and intuitive.

- Market Access – If investing internationally, ensure broker provides access to relevant global exchanges where you want to trade and at competitive rates. Research supported markets.

- Customer Service – Check reviews and test broker customer service when you have questions. Multilingual support during French market hours is ideal.

Best Stock Trading Platforms in France

Interactive Brokers

Interactive Brokers tops the list of best trading platforms in France. This international broker offers extremely low trading fees starting from just €1 per trade. At the same time, Interactive Brokers provides a very wide range of tradable securities including stocks, ETFs, options, futures, bonds, mutual funds from exchanges across Europe, North America, and Asia.

Interactive Brokers holds regulatory licenses from top-tier authorities like the UK’s Financial Conduct Authority (FCA), the US Securities and Exchange Commission (SEC), and the Australian Securities and Investments Commission (ASIC). French clients can rest assured their funds and data are safe with Interactive Brokers.

This broker also stands out for its advanced trading platforms, powerful screening tools, risk management features, and research capabilities suited for active traders. Interactive Brokers pays high interest rates up to 4.83% on idle cash balances.

Saxo Bank

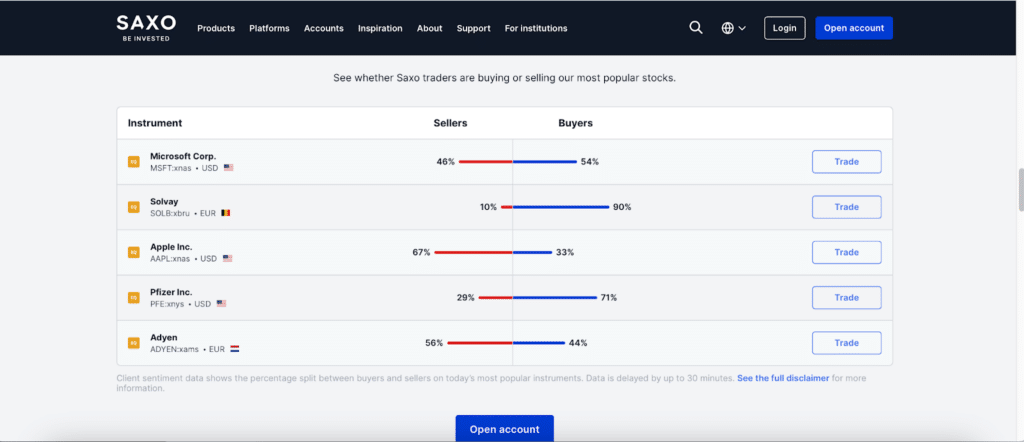

Danish brokerage Saxo Bank has built a strong reputation in Europe for its comprehensive trading platforms, broad range of tradable assets, professional research, and quality educational resources. Saxo Bank offers an excellent solution for active French traders seeking a sophisticated trading experience.

Saxo Bank provides access to stocks, ETFs, bonds, CFDs, forex, futures, and options across global markets. Trading fees are competitive starting from €10 per trade. Saxo Bank is regulated by the Danish FSA and other top European regulators to ensure the highest safety for client funds.

What stands out at Saxo Bank is its powerful web and mobile trading platforms that include advanced charting and analysis tools well-suited for active traders. Saxo Bank also produces high quality market research to help guide French investors in their investment decisions. For these reasons, Saxo Bank deserves its place among the top choices for stock trading in France.

XTB

XTB is a leading European CFD broker offering stock and ETF trades with zero commission. French investors can sign up for a XTB account in minutes and benefit from tight spreads from just 0.08% on stock trades. For larger investors, XTB provides discounts with spreads from 0.02% on trades over €100,000.

French clients can deposit and withdraw funds conveniently via card, wire transfer or popular e-wallets. XTB holds regulatory licenses from France’s AMF as well as the UK’s FCA showing its compliance with strict European standards. The broker also provides guaranteed stop-losses, negative balance protection, and investor compensation up to €20,000 under European rules.

XTB offers user-friendly web and mobile trading platforms where French traders can easily search, analyze, and trade global stock markets. With commission-free trades on over 1,500 global stocks, XTB is a compelling option for investing in France and abroad.

eToro

As a pioneer of social trading, eToro has captured the attention of millions of clients globally. French investors can join eToro quickly for free and gain access to a transparent social trading network. eToro allows French traders to connect with, learn from, and even automatically copy profitable stock investors from around the world. Even novice French investors can benefit from the experience of seasoned traders on eToro’s social trading platform.

At the same time, eToro offers commission-free trading on a range of global stocks and ETFs. French clients can easily build a diversified portfolio across international markets. eToro accepts a minimum deposit of just $50 to get started. The broker holds licenses from top regulators like the FCA to ensure funds remain secure. For French investors interested to explore social trading, eToro delivers a simple yet powerful solution.

DEGIRO

Based on its ultra-low fees starting from just €1 per trade, DEGIRO positions itself as the low-cost leader for stock trading across Europe. French investors can gain access to over 60 stock exchanges worldwide while paying some of the industry’s lowest commissions with this broker. DEGIRO charges just 0.03% commission on US and European stock trades with a €1.25 minimum fee per order.

DEGIRO holds regulatory licenses from the German BaFin as well as the Dutch AFM affirming its compliance with strict European regulations. The broker also guarantees the safety of client funds under the European Investor Compensation Scheme. Additionally, DEGIRO has eliminated non-trading fees such as account maintenance and inactivity fees which are common at other brokers.

How to Invest in Stocks from France

Here are the typical steps to start investing in stocks with an online broker in France:

- Find an Online Broker First, you need to make sure that the broker you’re looking at is available in France and suited for your investment goals. Our broker finder tool can help streamline your search.

- Open Your Account Opening an account is fully online and straightforward with most brokers, requiring just some basic personal details and ID verification.

- Fund Your Account You can deposit funds via bank transfer or card payment before you start trading. Most brokers do not require a minimum deposit.

- Trade Stocks Use the broker’s platforms to research and place trades on stocks you want to invest in. The order process is very intuitive with most brokers.

Fees for Buying Stocks in France

Stock trading fees can range widely across platforms in France. However, some of the best brokers highlighted earlier offer very competitive rates, such as:

- Interactive Brokers charges a €1 minimum commission per trade

- DEGIRO offers 0.03% commission on stock trades

- XTB and eToro provide commission-free stock and ETF trading

So investors in France can pay as little as €1 per trade at brokers like Interactive Brokers and DEGIRO, or trade commission-free for stocks and ETFs at brokers like XTB and eToro. Choosing a low-cost broker is key to keeping more of your investment returns in the long run.

Taxes on Investing in Stocks in France

In France, capital gains and dividends from stocks held in a normal taxable account are taxed as follows:

- Dividends are taxed at 30%

- Capital gains tax is charged at a flat rate of 30%

- Losses can be used to offset capital gains tax

To optimize taxes, the Plan d’Epargne en Actions (PEA) is popular in France as capital gains, dividends and withdrawals are not taxed if the PEA is kept open for 5+ years. Purchases within a PEA are limited to European stocks. Tax advantages make the PEA account suitable for long-term investors focused on European markets.

Summary

In conclusion, French investors now have an expanding range of regulated and trusted online brokers to choose from. Leading choices include Interactive Brokers, Saxo Bank, XTB, eToro, and DEGIRO.

These brokers allow investors to conveniently open accounts online, fund their accounts via bank transfer or debit/credit card, and seamlessly start buying and selling national and international stocks at competitive rates. As technology progresses, French investors will continue seeing improvements in the online tools and services available to help them trade stocks efficiently.

FAQs

What is the minimum amount I need to start investing in stocks in France?

Most top online brokers do not set minimum account balances for stock trading. You can start investing with as little as €1 trade commission at low cost brokers.

Can I trade US and Asian stocks from my broker account in France?

Yes, leading brokers available in France like Interactive Brokers provide access to trade stocks on exchanges worldwide directly from your French account.

How quickly can I open a trading account in France?

Opening an online trading account takes 5-10 minutes with most brokers these days. Verifying your identity may take 1-3 days before you can deposit and start trading.