In today’s accessible investment world, the stock market stands as a potentially lucrative option for individuals seeking to grow their wealth. Exchange-Traded Funds (ETFs) have gained significant popularity among the various investment vehicles available due to their diversification benefits and ease of trading. For investors in France, we will walk you through the process of how to buy ETFs with Boursorama, highlighting key considerations and steps to ensure a well-informed investment journey.

Summary

Based on our extensive research and market analysis, we recommend eToro as the best overall platform to buy ETFs with Boursorama. eToro outshines Boursorama in terms of its vast selection of tradable assets, competitive fee structure, and robust regulatory compliance. With over 4,500 stocks, ETFs, and commodities available, eToro offers investors a diverse range of options to build their portfolios.

Moreover, eToro’s user-friendly interface and absence of commission fees make it an attractive choice for both novice and experienced investors. Throughout this article, we will provide a step-by-step guide on how to buy ETFs with Boursorama while highlighting the advantages of choosing eToro as your preferred investment platform. Visit eToro to start your ETF investment journey today.

Step-by-Step Guide on How to Buy ETFs with Boursorama

Step 1: Research and Analysis

It is crucial to conduct thorough research on the ETFs available through Boursorama. Analyze the underlying assets, historical performance, expense ratios, and the issuing company’s reputation. Consider your investment goals, risk tolerance, and time horizon to identify ETFs that align with your financial objectives. You may also consider buying Gold ETFs in Europe if you want to expand your ETF portfolio.

Step 2: Select a Brokerage

Our market research suggests that eToro stands out as the top choice for buying ETFs, surpassing Boursorama in terms of asset variety, fee structure, and regulatory compliance. With a minimum deposit of €50 and no maximum limit, eToro caters to investors of all levels.

Step 3: Fund Your Account

Once you have chosen your preferred brokerage, in this case, eToro, proceed to open an account and fund it with the desired investment amount. Navigate to the “Deposit Funds” section, typically located at the bottom left of the eToro interface, to initiate the funding process.

Step 4: Determine the Number of Shares to Buy

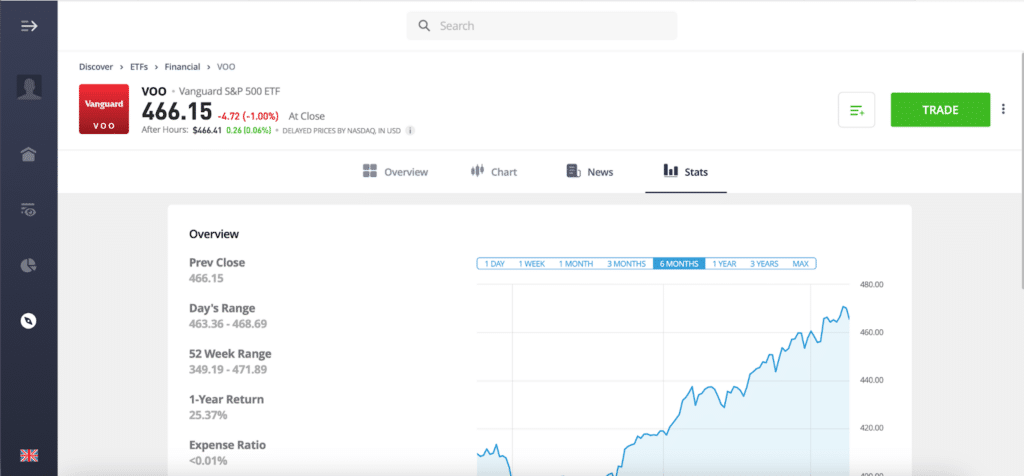

Based on your investment strategy and available funds, decide on the number of ETFs or specific ETFs, like buying Vanguard VTI ETF. Consider factors such as diversification, risk management, and overall portfolio allocation when determining the appropriate number of shares.

Step 5: Place an Order

Using eToro’s user-friendly platform, search for the desired ETF by entering its name or ticker symbol in the search bar. Once you have located the ETF, click on the “Trade” button to open the order window.

Step 6: Review and Confirm

Double-check the information to ensure accuracy and avoid any potential errors. Once satisfied with the details, click on the “Open Trade” button to execute your ETF purchase.

Step 7: Monitor Your Investment

After successfully buying ETFs with Boursorama through eToro, it is crucial to regularly monitor the performance of your investment. Stay informed about market trends, news, and developments that may impact the underlying assets of your chosen ETFs.

Step 8: Reassess and Adjust

As market conditions evolve and your financial goals change, periodically reassess your ETF investment strategy. Evaluate the performance of your ETF portfolio and consider making adjustments if necessary.

Fees for Buying ETFs with Boursorama

Boursorama charges a standard commission fee of 0.20% for ETF trades, which can eat into your investment returns over time. Additionally, the platform may impose a spread exceeding 1.2%, further increasing the overall cost of investing.

In contrast, eToro offers a more cost-effective solution for ETF investors. With no commission fees on trades and a variable spread averaging around 1% across a wide range of assets, eToro provides a financially advantageous alternative to Boursorama.

Taxes on Investing in ETFs with Boursorama

Capital gains realized from the sale of ETFs are taxed at a flat rate of 30%, which includes both income tax and social contributions. However, it is important to note that capital gains below €305 per year are exempt from taxation.

Additionally, ETFs may be subject to a financial transaction tax (FTT) of 0.3% on the purchase value, depending on the underlying assets and the issuing company’s location. It is advisable to consult with a tax professional to understand the specific tax implications based on your individual circumstances and to ensure compliance with French tax regulations.

Conclusion

Buying ETFs with Boursorama involves careful research, strategic decision-making, and ongoing monitoring. This comprehensive guide has provided a step-by-step approach to buying ETFs with Boursorama, emphasizing the importance of understanding the available options, selecting a reliable brokerage like eToro, and making informed investment decisions.

FAQs

Can I buy ETFs with Boursorama?

Yes, Boursorama offers investors in France the opportunity to buy ETFs, including those tracking major indices such as the CAC 40, S&P 500, and NASDAQ.

Is eToro a better alternative to Boursorama for buying ETFs?

Based on our research, eToro emerges as a superior alternative to Boursorama for buying ETFs. eToro offers a wider selection of assets, competitive fees, and robust regulatory compliance, making it an attractive choice for investors.

What fees does Boursorama charge for buying ETFs?

Boursorama charges a standard commission fee of 0.20% for ETF trades and may impose a spread that can exceed 1.2%, which can impact investment returns.