OKX is a leading global cryptocurrency exchange launched in 2017 and based in the Seychelles. With its extensive selection of coins, low fees, and advanced trading features, OKX caters primarily to experienced traders. However, the platform also provides ways for beginners to learn, like copy trading and a demo account.

In this in-depth OKX review, we’ll explore the platform’s pros, cons, fees, features, security, and more to help you decide if OKX is the right cryptocurrency exchange for you.

OKX Review: The Pros and Cons

| Pros | Cons |

| 320+ tradable cryptocurrencies | Not available in the US or Canada; Okcoin and OK Wallet are available |

| Low trading fees for spot and futures trades | Identity verification required for crypto deposits |

| Up to 100x leverage trades on futures, 10x on spot trades | Difficult fiat withdrawals, such as USD or GPB; crypto withdrawals available with identity verification |

| Supported in 160+ countries | |

| Demo account for virtual trading | |

| Copy trading – follow profitable traders |

Overall, OKX stands out for its competitive fees, broad selection of cryptocurrencies, and robust trading features for advanced users. The cons are relatively minor and won’t be dealbreakers for most.

OKX Ventures

OKX recently launched a $100 million venture capital fund called OKX Ventures. It is focused on investing in promising blockchain projects related to infrastructure, Layer 2, DeFi, Web 3.0, NFTs, and the metaverse.

OKX Ventures aims to support sustainable growth of the broader blockchain industry by providing funding and sharing resources and experience with founders globally. The fund looks for innovative projects with strong potential across the decentralized ecosystem.

As one of the largest cryptocurrency exchanges, OKX is in a strong position to identify and invest in cutting-edge technologies and teams. The OKX Ventures fund further expands the company’s involvement in shaping the future of crypto and Web3.

OKX Fees

OKX offers some of the lowest trading fees in the industry. Fees start at just 0.1% for spot trading and go down to 0.02% for futures trades.

Maker/taker fees for spot trading are 0.1%/0.15%. VIP discounts based on 30-day trading volume can reduce fees to as low as -0.03%.

For futures, perp swap fees start at 0.02% maker/0.05% taker. Options trading fees are also competitive at just 0.05%.

There are no deposit fees, and withdrawal fees are set dynamically based on network conditions. Overall, fees on OKX are very attractive compared to competitors.

OKX Security

OKX utilizes industry-standard security features to keep your funds safe. These include:

- Cold storage for majority of assets

- 2FA login

- Encrypted communication

- DDoS protection

- Bug bounty program

- Insurance fund for futures trading

The exchange has not suffered any major security breaches. OKX also publishes quarterly proof-of-reserves audits to verify its 1:1 reserves.

OKX Verification Process

To trade on OKX, you’ll need to complete a straightforward identity verification process. This involves submitting:

- Legal name

- Date of birth

- Mobile number

- Email address

- Proof of identity (national ID or passport)

- Selfie holding ID

Verification typically takes 1-2 days. OKX offers four levels of verification depending on required features and limits. Overall, the process is quick and smooth compared to some exchanges.

OKX Customer Service

OKX provides customer support through email, web tickets, and 24/7 live chat. Unfortunately, wait times for responses can be slow, sometimes up to 24 hours for email/tickets.

Many users report frustrating experiences with OKX customer service compared to more responsive exchanges like Crypto.com or Gemini. This is an area OKX could improve.

OKX User Experience

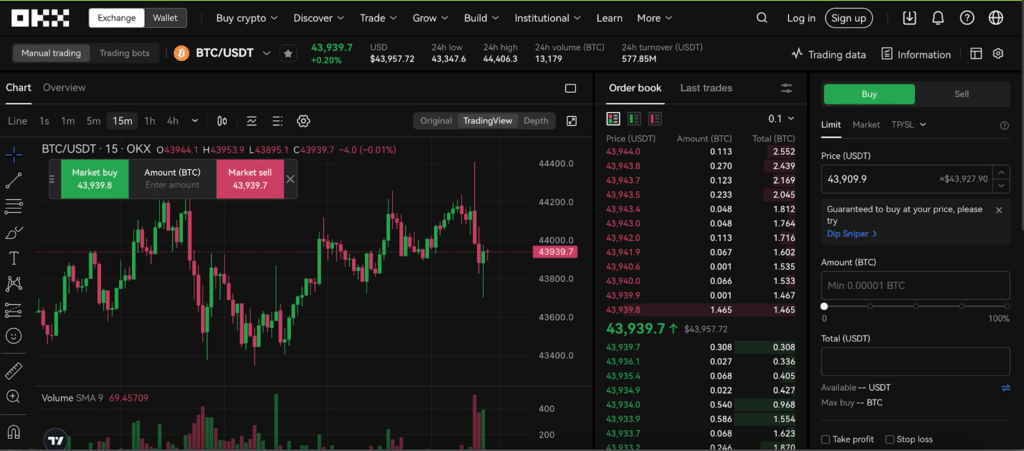

The OKX interface can be complex and intimidating for new traders. The dashboard shows advanced trading modules for futures, options, margin trading, and more. Simplicity is not a priority.

However, for experienced traders, OKX offers a powerful trading platform with excellent charts, order book depth, and custom screeners to find trading opportunities. Execution is fast and uptime is strong.

While not ideal for beginners, OKX does provide a demo account with virtual funds to practice trading risk-free. Overall, the platform is geared towards advanced traders.

Available Tokens on OKX

OKX offers 300+ cryptocurrencies, including all major coins like Bitcoin, Ethereum, Solana, Cardano, Dogecoin, etc. The selection is on par with leading exchanges such as Crypto.com, KuCoin, and Gate.io.

Each coin has multiple trading pairs against BTC, ETH, stablecoins, and fiat currencies. Liquidity is excellent for top coins but weaker for small-cap altcoins. Margin trading and derivatives are available for dozens of coins.

OKX does not have its own native utility token. But you can earn discounts on fees by holding the OKB token, which is the utility token of OKX’s sister exchange OKCoin.

Regulatory Compliance and Legal Status

OKX is based in the Seychelles and not directly regulated by major financial authorities. However, its related company OK Group is registered with FinCEN in the US as a money services business.

OKX takes steps to block users from certain high-risk jurisdictions where its services may be illegal. Overall, OKX makes efforts to be compliant but operates in a legal gray area for US users.

Liquidity and Volume

As a top-5 global spot exchange by volume, OKX provides excellent liquidity for major coins like Bitcoin. Bid-ask spreads are tight, and large orders can be filled quickly with minimal slippage.

OKX is the #1 derivatives exchange with over $70 billion in perpetual swap volume. So futures, options, and margin traders will find the deepest liquidity on OKX.

Staking and Lending Options

Relative to top platforms like Binance and Crypto.com, OKX has limited staking and lending options. The APYs for tokens like BTC, ETH, and stablecoins are lower than on competitors.

However, OKX does offer staking via DeFi protocols for coins not directly supported on the platform. Returns are generally better through DeFi staking than OKX’s own staking program.

OKX App and Web Experience

OKX offers full-featured mobile apps for Android and iOS devices in addition to the web platform. The apps are well-designed with intuitive interfaces that replicate the desktop experience.

Everything available on the web is also available on mobile, including advanced order types, charts with indicators, crypto withdrawals, account management, etc. The OKX app is rated 4.6/5 on the App Store.

Both the mobile and web experiences are tailored towards professional traders, with minimal concessions made to simplify things for beginners. But the platforms themselves are fast, reliable, and powerful.

Final Recommendation

Overall, OKX stands out as a top choice for active cryptocurrency traders seeking low fees, advanced features, and excellent liquidity. The selection of coins is vast, and futures trading volume is unmatched.

While the learning curve is steep for new users, the demo account and copy trading options allow you to build skills over time. For intermediate to advanced traders, OKX is one of the premier exchanges to consider.

Just be aware that customer service has room for improvement, and fiat currency options are limited compared to some competitors. But for serious crypto trading, OKX delivers a robust, low-cost platform.

OKX Alternatives

Some top alternatives to consider include:

| Exchange | Pros | Cons |

| Binance | Largest exchange, low fees | Limited payment methods |

| KuCoin | Many altcoins, rewards | Laggy mobile app |

| Crypto.com | Beginner friendly, Visa card | Spread markup on prices |

Can OKX be trusted?

Yes, OKX can generally be considered trustworthy. It has operated reliably since 2017 with no major security incidents. OKX provides transparency via proof of reserves audits and is compliant with global AML/KYC regulations. While not regulated in the US, OKX does have adequate security and liability protections in place.

Is OKX better than Binance?

OKX and Binance are very close competitors. Both offer low fees, a huge selection of coins, and deep liquidity. Binance has more payment methods while OKX has lower spot trading fees. For advanced trading features, OKX may have a slight edge. Overall they are on par, with preference depending on individual user needs.

Is OKX better than Coinbase?

For beginner investors looking for simplicity, Coinbase is likely better than OKX. However, for intermediate to advanced traders, OKX easily beats Coinbase with its lower fees, wider selection, and more robust trading platform. OKX caters to active traders while Coinbase targets casual investors.