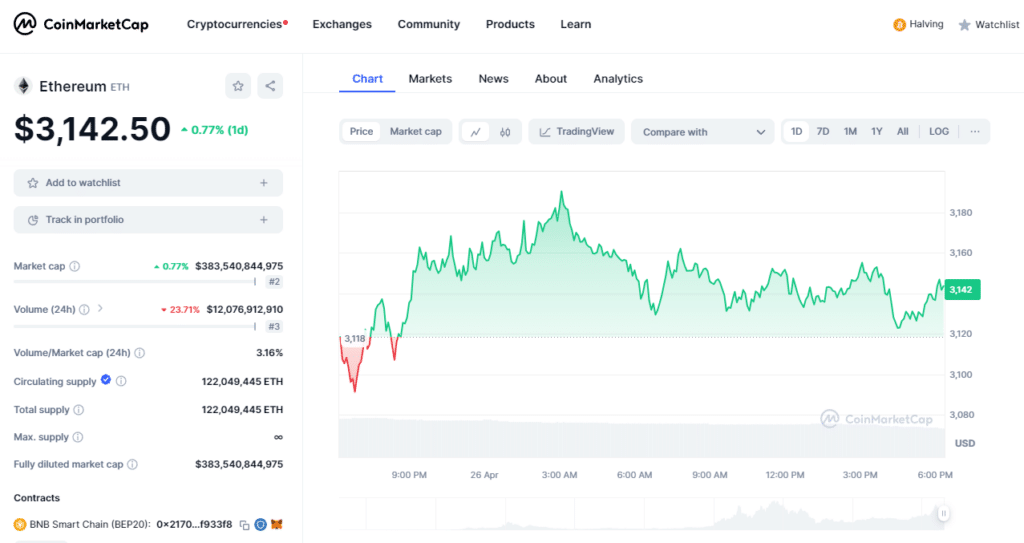

Ethereum (ETH) prices took a tumble yesterday, dropping 4.73% in the last 24 hours. This reverses the recent bullish momentum that followed Bitcoin’s halving event. As of writing, ETH is trading at $3,125 according to CoinMarketCap.

However, despite the price slump, large investors, known as “whales,” are displaying continued confidence in Ethereum’s future. On-chain tracking platform Spot On Chain reports that whales have been actively accumulating ETH during this dip.

One particularly notable transaction involved a wallet acquiring a massive 7,128 ETH (worth roughly $22 million) at an average price of $3,111. This whale investor now holds a staggering $482 million worth of ETH, though currently experiencing unrealized losses due to the recent price drop.

Source: CoinMarketCap

This buying activity isn’t an isolated event. Santiment data analysis by AMBCrypto reveals a surge in large ETH transactions exceeding $100,000 over the past few days. Additionally, the percentage of total ETH supply held by major addresses has risen from 41.37% on the halving day to 41.45% on April 24th, further suggesting ongoing accumulation by whales.

Bullish sentiment persists among whales in the derivatives market as well. Analysis of Hyblock Capital data indicates that roughly 63% of total whale positions on Binance are currently “long” on ETH, meaning they’re betting on price increases. While this long exposure has decreased slightly since the halving, it remains a significant indicator of whale confidence.

The overall market sentiment leans towards “greed,” which could lead to increased buying pressure in the coming days. This could potentially support a rebound in Ethereum’s price.