As crypto enthusiasts and experts at coincipher website, we analyzed best crypto exchanges in Asia. We have highlighted the 5 most reliable platforms to buy, sell and trade digital currencies across the region based on key factors like regulation compliance, trading fees, payment options, and overall security.

Summary of 5 Best Crypto Exchanges in Asia

Across Asia, we advise opting for crypto exchanges regulated by local financial authorities for secure and lawful transactions involving Bitcoin, Ethereum, and altcoins. By funding your account through domestic bank transfers or electronic payments, you can legally invest in and trade digital assets.

After extensive assessments, here are the top 5 exchanges we recommend for crypto ventures in Asia:

- Bybit – Best Overall Crypto Exchange in Asia

- MEXC – Best for Security Measures

- Binance – Ideal for Newbies [Easiest to Use]

- KuCoin – Top Choice for Institutional Investors

- OKX – The Cheapest Exchange

Comparison of Top 5 Crypto Exchanges in Asia

| Exchange | Cryptocurrencies | Trading Fees | Deposit Methods | Key Features |

| Bybit | 1,000+ | 0.01% maker & 0.06% taker | Bank transfer, cards, e-wallets | Up to 100x leverage, multilingual, intuitive |

| MEXC | 300+ | 0.01% maker & 0.0% taker | Bank transfer, cards | 200x leverage on derivatives, staking |

| Binance | 350+ | 0.1% spot & 0.06% derivatives | Bank transfer, cards | Lending, institutional liquidity, earning features |

| KuCoin | 700+ | 0.1% spot, 0.02%/0.06% derivatives | Cards, Apple/Google Pay | Generous staking rewards, 24/7 support |

| OKX | 300+ | 0% deposits, 0.08% spot | Bank transfer, cards, e-wallets | DeFi tools, NFT marketplace, pro trading |

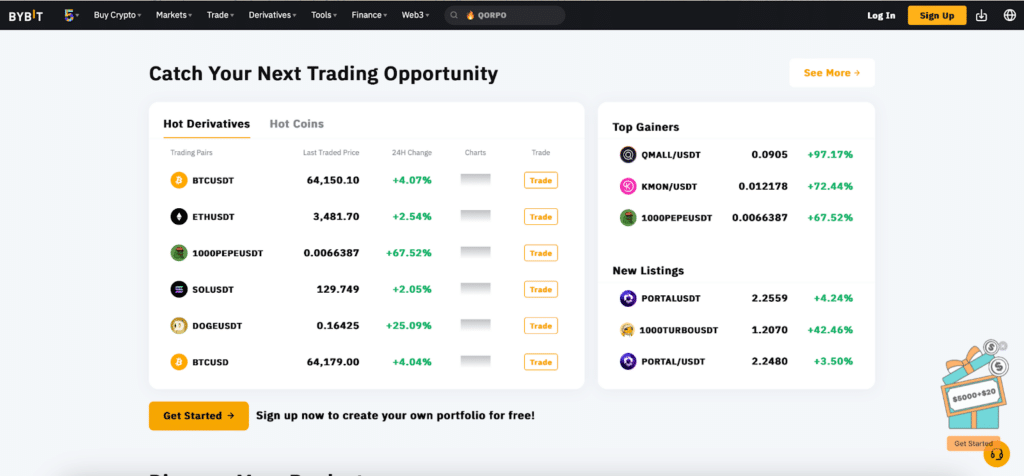

Bybit Overview

Rated as the premier crypto exchange in Asia, Bybit stands out for its intuitive platform, diverse payment methods, and competitive fees – charging just 0.01% for makers and 0.06% for takers. With over 1,000 cryptocurrencies available and a 20+ million strong user base globally that trusts Bybit’s reliability. Its accessibility in over 30 languages including Mandarin, Japanese, Korean, Vietnamese, Thai etc. underscores a commitment to serving Asia’s diverse crypto market.

Best Features

- Access to over 1,000 cryptocurrencies (Spot, Futures & Options)

- Free deposits & ultra-low 0.1% trading fees

- Bank transfers, credit/debit cards, Google Pay, PayPal etc. accepted

- Up to 100x leverage available for futures trading

- Trusted by 20+ million users globally

- Website and app available in 30+ languages tailored for Asia

Why we like it: We recommend Bybit for its beginner-friendly and professional-grade interfaces, ultra-low trading fees, and commitment to regulatory compliance across Asia.

Key Metrics

- $60 billion+ in daily trading volume showcases deep liquidity

- Went from ~$15 billion TVL in 2021 to over $25 billion in 2023

- Ranked among the top 5 crypto derivatives exchanges globally

- Over 4.5 million mobile app downloads in 2022

- 9.2/10 trust rating on leading review platforms

- 4.7/5 average app store rating with over 580k reviews

MEXC Overview

Positioning itself as a security-focused trading platform, MEXC is licensed in Estonia with headquarters in Seychelles. It adheres to strict compliance standards, cementing its reputation as a premier exchange in Asia. MEXC’s solid security infrastructure safeguards its users’ assets without compromising on providing a broad range of trading avenues – from spot and derivatives to staking, IEOs and more.

Best Features

- Provides access to over 300 cryptocurrencies

- 0% Futures Maker Fee, 0.01% Taker Fee

- 0% Spot Maker & Taker Fees

- Competitive fee structure with low maker and taker fees

- Bank transfers, debit/credit card deposits offered

- Up to 200x leverage available on derivatives

- Cutting-edge security protocols like PoR to ensure transparency

Why we like it: We recommend MEXC for its robust security infrastructure, competitive fees, and diverse trading opportunities across spot, derivatives, staking, IEOs and more.

Key Metrics

- $3 billion+ in daily trading volume

- Went from ~$550 million TVL in 2021 to over $4.2 billion in 2023

- Over 40 million registered users globally

- 950+ trading pairs across spot and derivatives

- 180+ staking & wealth products

- 4.5/5 app store rating with over 32k reviews

Binance Overview

Securing 3rd place, Binance stands out for its extensive ecosystem beyond just trading – with unique offerings like Binance Earn allowing yields on 180+ cryptos. This positions it well to broaden investment horizons. Despite facing regulatory challenges, Binance maintains strong appeal especially among institutional investors owing to robust liquidity.

Best Features

- Competitive 0.1% fees for spot & 0.06% for derivatives

- Bank transfers and card payments accepted

- Advanced tools tailored for professionals

- Features staking, lending, P2P trading

- Access to over 350 cryptocurrencies

Why we like it: Binance’s solid brand, user-friendly interface for beginners, and pro-tools/research for experts makes it a balanced choice across all levels.

Key Metrics

- $44 Billion+ in daily trading volume

- 150+ million user accounts globally

- Trust score of 8.7/10 on leading review sites

- Partnerships with payment processors like Klik&Pay

- Went from $15 billion TVL in 2021 to over $31 billion in 2023

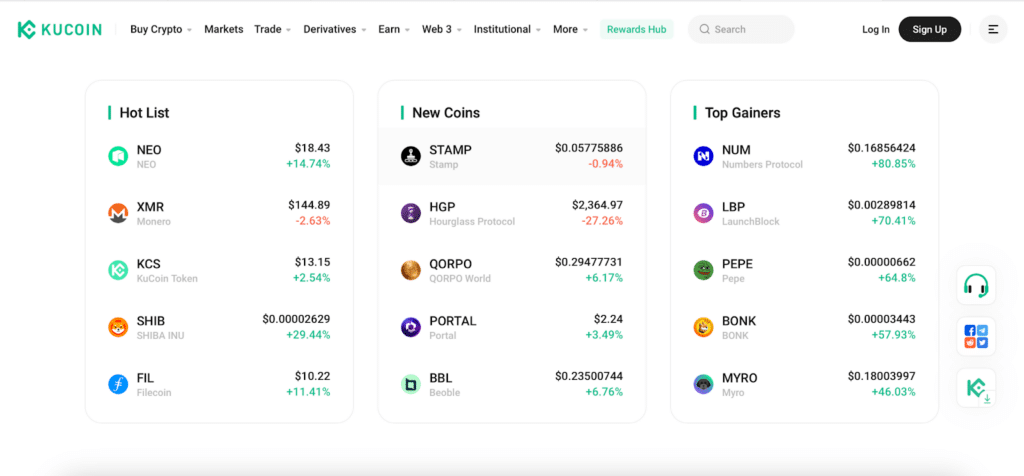

KuCoin Overview

KuCoin takes 4th place, reaching 200+ countries with $2.48 billion+ in daily volume. It offers 700+ cryptos and 100+ staking assets – opening doors for diverse opportunities. State-of-the-art security via Proof of Reserves along with derivatives, Halo wallet etc. make it a top contender.

Best Features

- Spot fees starting at just 0.1%

- Generous staking rewards paid out daily

- Bank transfers, card payments, Apple/Google Pay

- Insurance Fund safeguards user assets

- 24/7 global customer support

Why we like it: We recommend KuCoin for its customer-centric approach, round-the-clock support, and focus on transparency with proof of reserves certifications.

Key Metrics

- Boasts 29+ million registered users globally

- Quarterly reviews assure integrity of reserves

- Fiat purchases enabled through Simplex partnership

- 4.3/5 App Store rating reflecting strong usability

- $14.7 million insurance fund protects against volatility

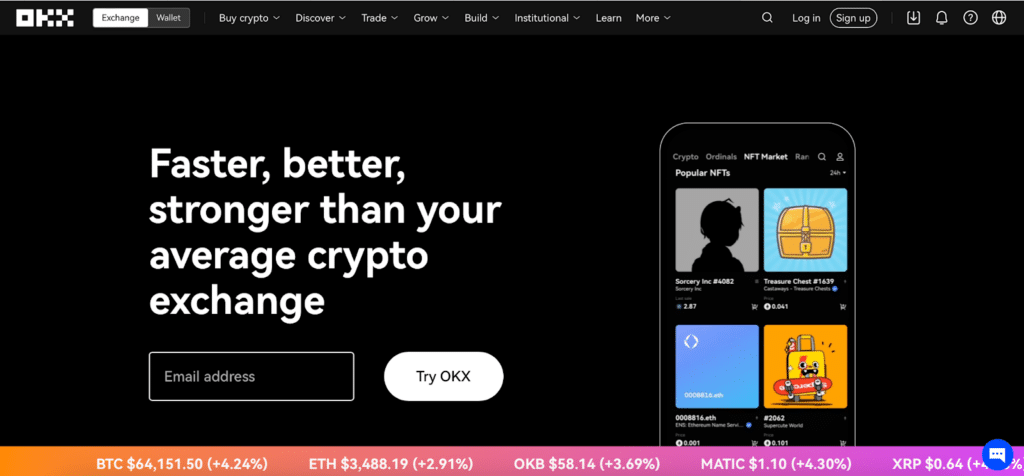

OKX Overview

OKX appeals with robust liquidity across coins like BTC, ETH stablecoins. Its 300+ crypto selection coupled with DeFi offerings via OKT blockchain gives it an edge. Traders benefit from derivatives and NFT marketplace while DeFi portfolio managers enable earned yields.

Best Features

- Features over 300 leading and emerging cryptocurrencies

- Competitive 0% deposit & 0.08% spot trading fees

- Bank transfers, cards, FPS accepted

- Options, spot, margin, futures trading available

- Active NFT marketplace

Why we like it: We appreciate OKX for its DeFi tools and pro trading options while also appealing to long-term HODLers through passive yield opportunities.

Key Metrics

- $7.21 trillion in total trading volume in 2022

- 600+ trading pairs catering to Asian preferences

- $5 million protection fund secures trader assets

- TradingView integration eases analysis

- Partnerships driving adoption across Asia

How to Purchase Cryptocurrencies in Asia

For investing in digital currencies across Asia, follow this detailed guide for smooth and secure transactions:

- Choose a reliable, regulated exchange from our guide

- Sign-up and complete any required KYC verifications

- Deposit your local currency via bank transfer or e-wallets

- Select your desired crypto and quantity to purchase

- Withdraw to a secure wallet to store your assets

Legality and Regulation of Crypto in Asia:

Is Crypto Legal in Asia?

The legality of cryptocurrencies varies widely across Asia. While countries like India, Singapore, Japan, and South Korea have embraced digital assets under regulatory frameworks, others including China, Nepal, and Indonesia have imposed partial or blanket bans. Most regulators now aim to strike a balance between innovation and risk management.

How is Crypto Taxed in Asia?

There is no uniform taxation policy for crypto gains made by investors and traders in Asia. Most countries treat such profits as capital gains or investment income, requiring documentation and declaration beyond a specified threshold in yearly tax filings. Cryptocurrency mining and staking activities also attract income tax in certain jurisdictions.

Conclusion

To conclude, our guide summarizes the best crypto exchanges in Asia based on security, reliability and unique offerings. We advise sticking to regulated exchanges like Bybit, MEXC, Binance, KuCoin and OKX for seamless access to leading cryptocurrencies. Their robust systems secure your digital assets while providing the liquidity needed to capitalize on lucrative trading opportunities across Asian markets. Use our tips to make informed choices when venturing into the exciting world of crypto investing in Asia.

For crypto investors in other regions, check our recommendations for the:

FAQs

What are the main benefits of using a regulated crypto exchange in Asia?

Regulated crypto exchanges adhere to strict operational guidelines set by local financial authorities. This provides better security for your assets and transactions. They also tend to offer more payment methods tailored specifically for each country.

How do trading fees on Asian crypto exchanges compare to global platforms?

The top exchanges we recommend offer competitive trading fees ranging from 0% to 0.1%. This is on par or lower than leading global platforms. Special fee tiers and discounts are also available.

What precautions should I take when depositing funds on Asian exchanges?

Stick to domestic bank transfers over international wires, which may have higher fees or conversion charges. Similarly, use regulated payment gateways when opting for credit/debit cards and mobile transactions. Check for any deposit limits and allow up to 1-3 business days for large amounts.