n today’s accessible investment world, the global bond market stands as a potentially lucrative option for diversifying portfolios. This comprehensive guide provides essential information and a step-by-step process to buy US Treasuries in Australia, one of the most renowned bonds worldwide.

Summary

US Treasuries, also known as US government bonds, are debt securities issued by the US Department of the Treasury to fund government spending and exist in the form of Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds). Experts recommend US Treasuries as a low-risk investment for Australian investors seeking to complement their portfolio with foreign exposure while maintaining capital stability.

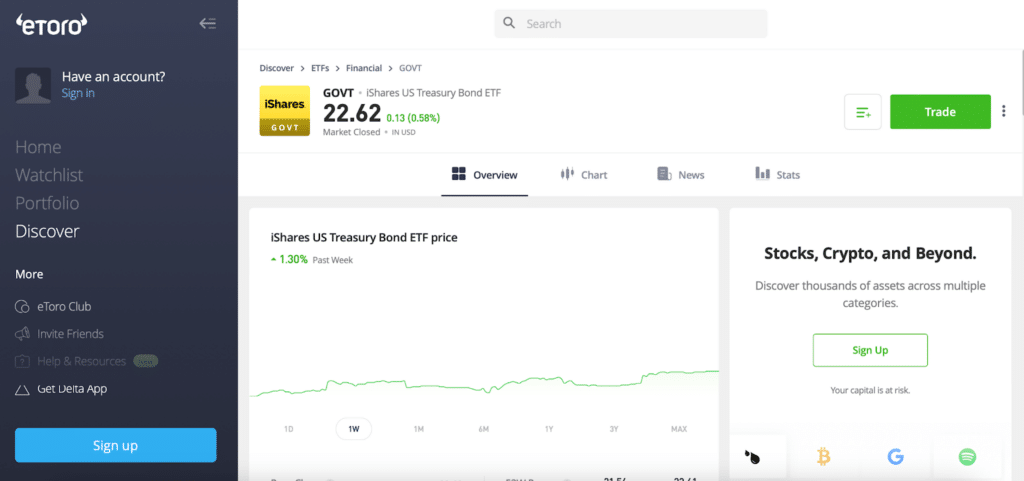

Based on market research and reviews, eToro is one of the best platforms for Australians to Buy US Treasuries. eToro is regulated by ASIC and offers a user-friendly interface along with a diverse range of US Treasury ETFs covering various durations. You can register for a free eToro account here to begin your US Treasuries investment journey.

US Treasuries Overview

US Treasuries are considered among the most secure bond investments globally given the low default risk associated with securities issued by the US government. T-bills mature in one year or less, T-notes from two to ten years, and T-bonds have 30-year maturities. The interest rate remains fixed throughout the bond’s lifespan. Principal is returned upon maturity, making US Treasuries less volatile than stocks.

How to Buy US Treasuries in Australia with eToro

Step 1: Research US Treasuries

Understand types of Treasuries, yield curves, and issuance calendars to determine suitable durations based on your risk tolerance and investment goals.

Step 2: Open an eToro Account

Register for a free eToro account by providing basic personal details during the simple signup process.

Step 3: Deposit Funds

Deposit Australian dollars into your newly created eToro account through low-cost bank transfers or debit/credit cards.

Step 4: Search and Select a Treasury ETF

Use eToro’s search bar to find popular US Treasury ETFs like the BIL, SHY or TLT ETFs tracking various maturities.

Step 5: Place a Buy Order

Input the amount you wish to invest or number of shares to purchase the selected Treasury ETF. Leave leverage at 1x to avoid CFD speculation.

Step 6: Monitor Your Investment

Stay on top of US Treasury yields, economic indicators and company reports impacting your chosen ETF’s performance over its lifespan.

Step 7: Rebalance as Needed

Periodically reassess your portfolio and reallocate amounts between Treasuries and other assets according to changing needs and market conditions.

By following these straightforward steps, Australians can easily purchase US Treasuries to build international exposure into low-risk portfolios.

Fees for Buying US Treasuries on eToro

Major fees may include 0.1-0.5% ETF spreads and conversion charges of up to 1% if trading in a different currency than AUD. However, eToro avoids inactivity or overnight holding penalties applicable to leveraged trading. Overall costs remain low for long-term buy-and-hold Treasury ETF investments through this platform.

Taxation of US Treasuries in Australia

Capital gains or dividends from US Treasuries held over 12 months qualify for the 50% CGT discount in Australia. Treasury ETF distributions are also subject to a final withholding tax deducted before receipt. Investors must declare foreign income and holdings in their tax returns annually.

Conclusion

In conclusion, this guide has demonstrated the simplicity and accessibility of purchasing globally diversifying US Treasuries for Australian portfolios. By conducting thorough research, registering with a reputable platform like eToro, and following the step-by-step process, any investor can effortlessly Buy US Treasuries in Australia. Ongoing performance monitoring and periodic rebalancing help ensure a secure fixed-income component within diversified investment strategies.

FAQs

Can I buy US Treasuries in Australia?

Yes, Australian residents can gain exposure to US Treasury bills and other Treasuries through US dollar-denominated ETFs purchased on offshore investment platforms regulated locally, like eToro.

How do I buy US Treasuries directly?

It’s not practical for most Australian retail investors to purchase physical US Treasuries directly. Instead, investing in US Treasury ETFs provides low-cost consolidated access to the US government bond market.

How do I access US Treasuries?

The most efficient method is purchasing Treasury ETFs on a platform like eToro, which allows investing in US dollar assets from Australian bank accounts. Create a free eToro account online, deposit AUD funds and search for Treasury ETFs to buy.