Crypto margin trading allows traders to access leverage to maximize potential profits. But with greater reward comes greater risk. Choosing the right platform is key. Here, we review the best crypto margin trading platforms.

Summary of Best Crypto Margin Trading Platforms

Experts advise opting for trading platforms regulated by financial authorities like the SEC, CFTC, or FCA for stronger oversight and protection. However, more advanced traders may prefer platforms offering high leverage and various assets.

For novices embarking on their crypto margin trading journey, a regulated platform with strong risk management tools is recommended. Here are the top recommendations:

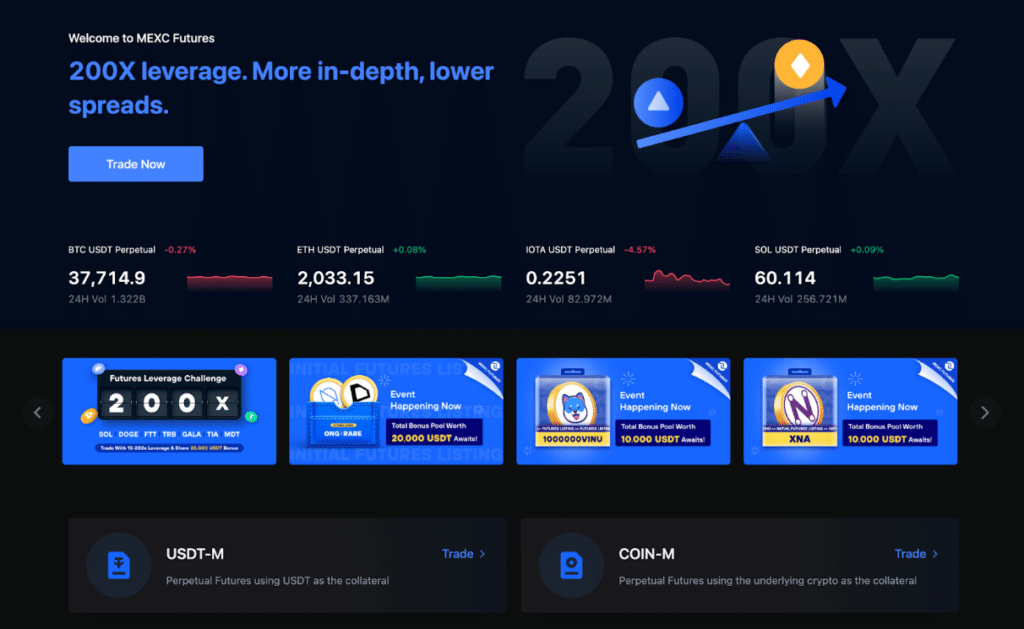

- MEXC – Best platform for advanced traders pursuing very high leverage of up to 200x and low trading fees.

- OKX – Ideal for seasoned traders seeking advanced trading bots and high leverage up to 100x.

- Binance – The most comprehensive offering for investors trading various crypto assets.

- Coinbase – Best overall for beginner margin traders, given its trusted brand, smooth user experience, and educational resources.

- Kraken – Excellent platform for US traders needing strict regulation and caps on risky high-leverage trading.

What is Crypto Margin Trading?

Crypto margin trading involves borrowing funds from an exchange to trade larger positions and amplify potential profits. The funds in your account act as collateral. Rather than a 1:1 value, margin provides leverage – for example, 5x or 100x.

So a $1,000 deposit with 100x leverage allows a $100,000 trade. If the asset price moves up 1%, you earn $1,000 profit rather than $10. However, leverage is a double-edged sword, equally amplifying losses if the market moves against you.

How We Ranked the Best Margin Trading Exchanges

We compared platforms across several factors:

- Tradable assets – Number of cryptos available to margin trade

- Leverage – Maximum leverage ratios offered

- Fees – Competitive trading, withdrawal and deposit fees

- Security – Safeguards to protect user funds and crypto

- Features – Trading tools, analysis, risk management capabilities

Overview of the 5 Best Crypto Margin Trading Platforms

MEXC

Our top exchange pick is MEXC, launched in 2018 and used by 10+ million traders worldwide today. Reasons include:

- High leverage – Access up 100x leverage on BTC & ETH futures, and up to 10x leverage on over 1,000 spot market assets

- Low fees – Maker and taker fees as competitive as 0.02% and 0% respectively

- Risk management – Stop losses, take profits, effective margin controls

- Practice trading – $50,000 demo account replicates the live markets for testing

- Added features – Crypto lending, staking, analytics tools, VIP rewards programs

Key Metrics

- Over 1,000 available cryptos for spot trading

- 200+ perpetual futures contracts

- Up to 200x leverage on futures

- Maker fees as low as 0%

- Taker fees from 0.02% to 0.06%

- 10+ million users globally

With robust trading protections combined with high leverage, MEXC caters well to both professionals and newer margin traders. MEXC also provides copy trading, crypto lending, staking services, and more. Users can access high leverage while also effectively managing risk.

OKX

OKX is likely the closest competitor to MEXC. Benefits include:

- Diverse markets – Over 600 token pairs available. Up to 10x leverage on spot trades or 100x leverage on 220+ futures contracts. Options trading is also provided.

- Useful bots – Automated trading bots execute strategies 24/7 according to preset parameters

- Practice facilities – Demo account with simulated trading mirrors the real-world platform

Key Metrics

- 200+ perpetual futures contracts

- Up to 100x leverage on futures

- 0.02% maker and 0.05% taker fee for futures

- Fees range 0.05% – 0.07% for spot trading

- 20+ million registered traders

However, OKX faces regulatory restrictions in the US, UK, EU, Canada and Australia – reducing access in major Western markets.

Binance

As the largest crypto exchange globally, Binance leads in these areas:

- Unmatched liquidity – Critical for best pricing and minimal slippage, even on huge margin trades

- Comprehensive assets – 500+ perpetual swaps and 1,000+ spot cryptos can be traded on margin

- Discount programs – 25% off trading fees when paying with Binance Coin (BNB)

Key Metrics

- 500+ perpetual futures contracts available

- Up to 125x leverage on crypto futures

- Over 1,000 spot cryptos listed

- 0.1% flat fee for spot trades

- Futures fees from 0.012% to 0.072%

- 120+ million traders globally

Yet the extensive functionality comes at the cost of a complex interface. This can overwhelm novice margin traders. Users benefit from Binance’s liquid markets and the broad range of assets. However, the interface can be complex for beginners.

Coinbase

Meeting strict regulatory policies in the US and EU gives Coinbase advantages:

- Oversight – CFTC and SEC regulated with insurance safeguards in place

- Transparent company – As the largest publicly traded crypto firm

- Trusted brand – Over 100 million verified users demonstrates immense consumer trust

Key Metrics

- Up to 5x leverage currently available

- BTC, ETH and 8 other cryptocurrencies to trade

- $50,000 qualifying assets required for US users

- Spot fees 0.5%, Futures 0.03% and 0.06%

- 100+ million verified users

However, opportunities mainly focus on Bitcoin and Ethereum. Just 5x leverage minimizes risk but reduces profit potential compared to up to 200x on MEXC, for example. As a publicly traded exchange, Coinbase offers transparency and oversight. However, trading options are limited for some users.

Kraken

Known for security and regulatory compliance, Kraken offers:

- Verified reserves – Confirmed holdings reduce risk of fractional reserve practices

- Tight controls – 3-5x leverage on spot protects margin traders somewhat from losses

- Regulatory approval – Licensed to operate in the US, EU, UK, Canada

Key Metrics:

- 95 futures contracts available, up to 50x leverage

- Over 80 cryptocurrencies can be traded

- Futures fees from 0.02% (maker) to 0.07% (taker)

- US traders require $10 million in assets

- 8+ million clients trade on Kraken

Yet heavy restrictions limit options for advanced crypto traders. Still, Kraken delivers a stable option for dabbling into margin trading major coins like Bitcoin and Ethereum. Kraken provides a high level of security and oversight. But limits leverage ratios for consumer protection.

How Does Cryptocurrency Margin Trading Work?

Using the funds in your account as collateral, margin trading borrows extra capital to increase buying power. For example, with a 5x leverage rate and $1,000 in your Kraken account, you could buy $5,000 worth of Bitcoin rather than $1,000.

If Bitcoin’s price increases by 10%, the 5 BTC position bought with 5x leverage would gain $500 instead of $100. However, you can lose funds quickly with margin trading if the market moves against your position.

It’s critical to use stop losses and risk-less capital with lower, safer leverage ratios. Always check margin requirements before entering leveraged trades.

While this guide has focused on the top-margin trading crypto platforms available globally, you may also be looking for the best exchange options specifically for your country.

Fortunately, we have also researched and reviewed exchanges best serving growing crypto markets like:

Conclusion

In summary, while margin trading presents risks, it can effectively amplify trading gains. Select exchanges like MEXC and OKX allow advanced traders to use high leverage. Meanwhile, platforms such as Coinbase and Kraken help reduce risks for beginners. Consider your risk appetite and experience when choosing a platform.

Use stops, low leverage levels, and small position sizes and uphold robust risk management when margin trading crypto.

FAQs

What is the maximum leverage on MEXC?

MEXC allows up to 10x leverage on spot trades and up to 200x leverage on crypto futures contracts. Always assess your personal risk tolerance when using leverage.

Does Kraken offer 100x leverage?

No, Kraken caps leverage at 50x due to regulatory restrictions in their operating jurisdictions. Maximum leverage ratios on Kraken are 50x for futures and between 3-5x on spot trading.

Is margin trading riskier than regular spot trading?

Yes, margin trading is riskier due to the use of leverage that amplifies both gains and losses. However, prudent risk management mitigates these risks substantially.