As a leading DeFi platform, Curve Finance has become an integral backbone for efficient stablecoin trading within the broader crypto ecosystem. At Coincipher, we explore the unique aspects and metrics behind Curve’s meteoric rise to prominence – answering the question, “What is Curve Finance?”

Summary

Curve is a decentralized exchange that utilizes an automated market maker optimized for minimal slippage between pegged-value assets. It rose to prominence by facilitating seamless trades between stablecoins like USDC, USDT, and DAI.

Curve’s governance token, CRV, aligns incentives between liquidity providers and the protocol’s direction by rewarding participation and locking for voting rights. Despite sagging valuations in 2022, Curve remains an integral backbone protocol in DeFi.

What is Curve Finance?

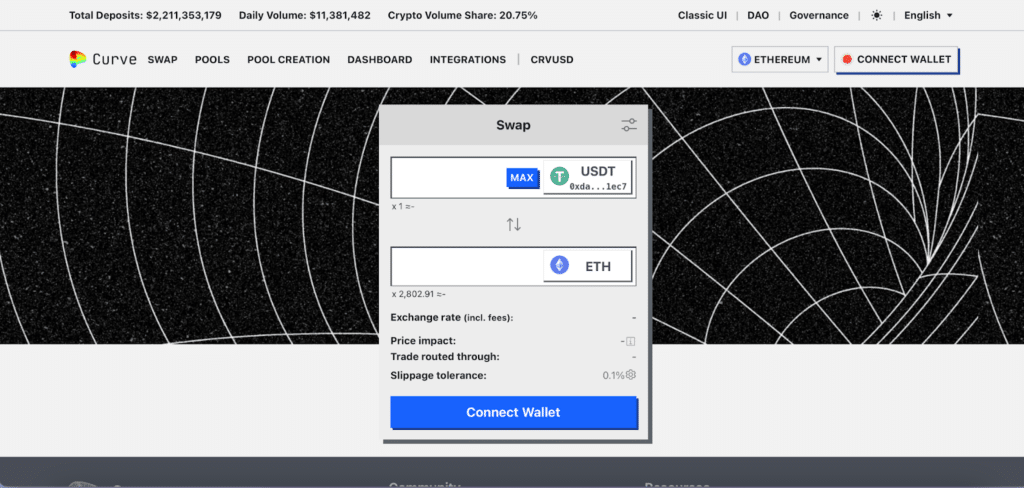

Curve is a decentralized exchange (DEX) focusing on efficient stablecoin trading. It uses a specialized automated market maker (AMM) model that minimizes slippage risk between assets with similar valuations like different stablecoins. If you want to dig deeper into the transformative potential of this technology, check out What is Decentralized Finance DeFi?

The platform’s AMM flattens the typical “bonding curve” used in protocols like Uniswap and Sushiswap. This makes large-size trades feasible between assets with pegged values.

Originally handling only stablecoin trades, Curve has expanded to also allow swaps between volatile crypto assets. It has also bridged across multiple layer 1 blockchains and layer 2 networks.

Key Metrics:

- Price – Current CRV price is $0.531

- 24H Real Volume – $22.21 million in 24 hour trade volume

- Market Capitalization – $592 million market cap. Fully diluted market cap is $1.74 billion.

- ROI Performance – Negative ROI over past 1 week, 1 month, 3 months, 1 year compared to USD, BTC, ETH, and DeFi overall

- Top Exchange by Volume – Binance leads with $14.13 million in CRV volume

- Circulating Supply – Based on $592 million market cap and $0.531 price, circulating supply is around 1.1 billion CRV

How was Curve Developed?

Curve, originally introduced as StableSwap, was created in 2019 by Michael Egorov. Egorov previously served as CTO of a cybersecurity firm before focusing on DeFi development.

In 2021, Egorov launched Curve v2 which brought non-stablecoin trading pools using a modified AMM model. The first of these pools was called TriCrypto and contained USDT, WBTC, and WETH.

After launching its CRV token, Curve saw its total value locked (TVL) rise 400% in days. It became an integral hub for arbitrage and stablecoin trading in DeFi.

How Does Curve Work?

There are several key reasons traders interact with Curve:

- Arbitrage between stablecoin prices across DEXs

- Swapping stablecoins to pay back loans in different denominations

- Providing liquidity to earn trading fees and CRV rewards

Like other DEXs, Curve uses an automated market maker (AMM) system to facilitate trading from liquidity pools. However, Curve’s mathematical formula optimizes swaps between assets with similar valuations.

A Modified AMM

Curve’s AMM seeks to “flatten” part of the normal bonding curve to minimize slippage risk between stablecoins. This allows larger size trades to happen with less price impact.

However, the risk of slippage is not fully removed. When prices diverge significantly from the expected range, high slippage can still occur.

Rewards on Curve

Liquidity providers earn a portion of the trading fees from the Curve pools they supply. CRV tokens are also distributed to certain pools as added incentive.

Curve allows CRV holders to “lock” their tokens to vote on governance matters. Locked CRV can also enable yield boosting rewards.

Some pools distribute additional yield by lending funds across platforms like Yearn, Compound, and Aave.

Support for Non-Stablecoin Assets

In 2021, Curve introduced pools that allow swapping of non-pegged crypto assets like WBTC, WETH, and alUSD.

While these pools are now popular, Curve remains largely dedicated to efficient stablecoin trading rather than volatile crypto assets.

How is the CRV Token Used?

The CRV token enables community governance of Curve through a decentralized autonomous organization (DAO). It also incentivizes platform usage by rewarding liquidity providers.

CRV and veCRV

While holding CRV allows governance voting, the token must first be staked to acquire “vote escrowed CRV” (veCRV). Users receive veCRV based on the amount and duration of their CRV lockup – up to 4 years.

Staking CRV enables holders to redirect platform trading fees similar to LPs. Locked CRV can also vote on proposals and enable liquidity pool reward boosting.

Curve Finance Essentials

- Curve is a DEX optimized for stablecoin swaps and minimizing slippage.

- Its unique AMM flattens the bonding curve near an expected $1 peg price.

- The CRV token aligns community governance incentives by rewarding participation.

- Despite crypto’s bear market, Curve remains a backbone DeFi protocol.

Advantages and Disadvantages

| Advantages | Disadvantages |

| Specialized for efficient stablecoin trading | Subject to high slippage outside optimized range |

| Lower slippage risks for pegged-value assets | Concentrated on stablecoins despite new asset support |

| Integral platform for DeFi arbitrage | Bear market reduced locked value and activity |

| Expanding functionality and blockchain support | Relies heavily on partner protocols for added yield |

Curve’s specialized AMM provides optimized stablecoin trading, minimizing slippage risks and serving a key role for arbitrage across DeFi. However, concentration on stablecoins has limitations, while reliance on partners and bear crypto markets undermine benefits for liquidity providers. Despite flaws, Curve maintains relevance through blockchain expansion.

Conclusion

Curve pioneered an AMM model purpose-built for minimizing slippage in stablecoin trades. This has made it a key avenue for arbitrage and swapping across DeFi.

Despite expanding asset support, Curve remains focused on seamless and efficient stablecoin trading. As crypto markets evolve, it’s likely to continue serving as an integral backbone protocol across DeFi.

FAQs

What is Curve’s governance token?

Curve’s governance token is called CRV. It can be staked and locked for voting rights and community governance over the protocol.

How do traders earn rewards on Curve?

Liquidity providers earn trading fees from their contributed pool funds. Many pools also distribute CRV token rewards which can be boosted by locking the tokens.

What blockchains does Curve support?

Originally developed on Ethereum, Curve now has presence across all major layer 1 chains including Bitcoin, Polkadot, Cosmos, Solana, and more. It also exists on layer 2 chains like Arbitrum.