As a leading authority in the cryptocurrency space, CoinsCipher is dedicated to providing you with the most up-to-date and accurate information on buying, selling, and trading digital assets. We will walk you through the process of purchasing USDT, one of the most popular stablecoins, using a credit card. Our team of experts has thoroughly researched and tested various platforms to bring you the best options available in the market to buy USDT with credit card.

Summary:

Buying USDT with credit card is one of the easiest and most convenient ways to obtain this popular stablecoin. Most major cryptocurrency exchanges allow credit card purchases of USDT, making it accessible to beginners and experienced traders alike.

The process typically only requires creating an exchange account, completing identity verification, adding a credit card, and executing the USDT purchase. Fees, limits, and processing times vary across platforms.

For the smoothest experience purchasing USDT with a credit card, check out these top recommended exchanges:

For US users: Binance.US

For international users: Binance

Binance and Binance.US offer easy credit card purchases of USDT with competitive fees and strong security measures. The intuitive interfaces make buying USDT a breeze.

What is USDT?

USDT, or Tether, is a stablecoin that aims to maintain a 1:1 peg with the US Dollar. Issued by Tether Limited, USDT is the most widely used stablecoin in the cryptocurrency market. It is designed to offer stability and minimize volatility by being backed by a reserve of US Dollars and other assets. USDT is built on multiple blockchain networks, including Ethereum, Tron, and Omni, making it easily accessible and transferable across various platforms.

Key Metrics:

- Market Capitalization: $100 billion

- 24-hour Trading Volume: $150 billion

- Circulating Supply: 99 billion USDT

- Supported Blockchain Networks: Ethereum, Tron, Omni, EOS, Liquid, Algorand, Bitcoin Cash, Solana

- Pegged Value: 1 USDT = 1 USD

- Issuer: Tether Limited

- Transparency: Quarterly reserve reports published

- Adoption: Accepted by 100+ exchanges and 10,000+ merchants worldwide

- Stablecoin Market Dominance: 80%

USDT’s widespread adoption and high trading volume make it an essential tool for traders and investors looking to enter and exit positions quickly without the need to convert their holdings back to fiat currencies. The stablecoin’s pegged value to the US Dollar provides a stable store of value within the volatile cryptocurrency market, enabling users to hedge against market fluctuations and minimize risk exposure.

Can I buy USDT with a credit card?

Yes, buying USDT with a credit card is available on most major cryptocurrency exchanges. Credit cards provide a fast and convenient way to purchase USDT, with funds usually available within minutes. However, credit card USDT purchases may carry higher fees compared to other funding options. Purchase limits may also apply depending on the exchange.

Step-by-Step Guide: How to Buy USDT with Credit Card

This step-by-step guide provides a comprehensive approach for individuals looking to purchase USDT using a credit card, ensuring a secure and informed investment process.

Step 1: Research and Preparation

Begin by researching USDT and its compatibility with credit card purchases on major exchanges. Compare fees, limits, and ease of use across different platforms that support credit card USDT buys.

Don’t forget to also research any fees or cash advance implications associated with cryptocurrency purchases on your specific credit card.

Step 2: Create an Account on a Reputable Exchange

Sign up and create an account on a well-established cryptocurrency exchange that supports USDT purchases via credit card such as Binance, Binance.US, Coinbase, or Crypto.com.

Step 3: Identity Verification

Complete the identity verification process as required by the exchange, ensuring compliance with Know Your Customer (KYC) norms. Prepare necessary identification documents for this step.

Step 4: Link Credit Card to the Exchange

Follow the exchange’s instructions to link your credit card to facilitate USDT transactions. Be sure to use a card that allows cryptocurrency purchases.

Step 5: Deposit Funds

Deposit fiat currency funds into your exchange account using the linked credit card. Check for any deposit fees and ensure sufficient credit limit.

Step 6: Purchase USDT

Navigate the exchange interface and execute the USDT purchase using your deposited credit card funds. Pay attention to current USDT exchange rates and fees.

Keep in mind when buying USDT with credit card:

- Credit card purchases typically carry higher fees around 3-5% compared to bank transfers or wire deposits.

- Purchase limits often start around $50-$100 for initial buys, with higher limits after identity verification.

- Funds are usually available instantly, allowing fast access to purchased USDT.

- International purchases may incur additional currency conversion fees.

- Some banks or credit card companies may treat crypto buys as cash advances.

Top Exchanges to Buy USDT with Credit Card

Binance/Binance.US

- Offers competitive fees for credit card USDT purchases (3.5%)

- Supports a wide range of cryptocurrencies (300+)

- High liquidity and trading volume

- Advanced trading features and charting tools

- Staking and savings products available

- Mobile app for iOS and Android devices

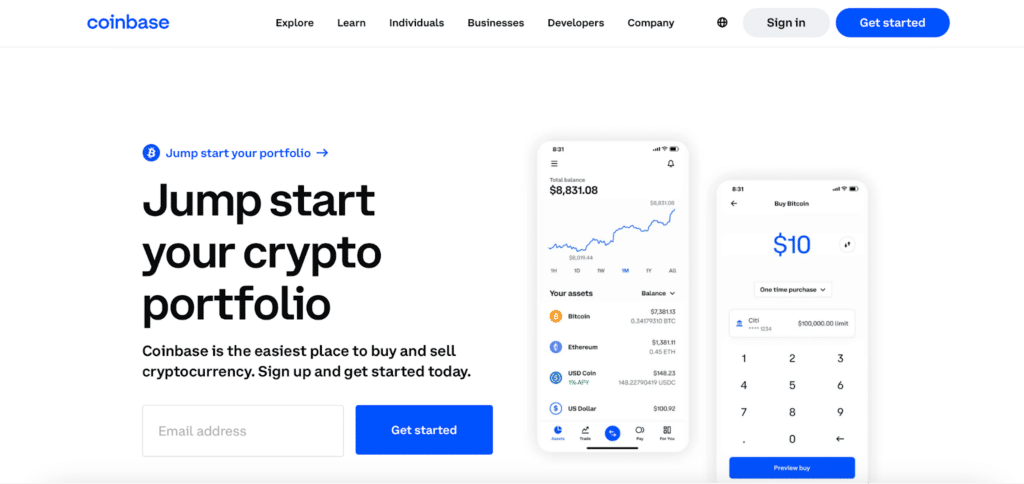

Coinbase

- User-friendly platform for credit card USDT purchases

- Instant fund availability after credit card transactions

- Insured custodial wallets

- Debit card for spending crypto (Coinbase Card)

- Earn rewards by learning about cryptocurrencies

- Comprehensive mobile app

Crypto.com

- Supports 20+ fiat currencies for credit card purchases

- Competitive fees (3.5% for credit cards)

- Cashback rewards on Crypto.com Visa Card purchases

- Earn attractive interest rates on USDT and other crypto deposits

- DeFi Swap feature for decentralized token swaps

- NFT marketplace and collectibles

Can you buy USDT with credit card with no verification?

Most reputable exchanges will require some level of identity verification before allowing cryptocurrency purchases with credit cards to comply with anti-money laundering regulations. However, some may allow small initial purchases before full verification. To trade or withdraw purchased USDT, full KYC will be necessary in most cases.

Conclusion:

Buying USDT with a credit card is a straightforward process on major cryptocurrency exchanges. Following the proper steps—creating an account, completing identity verification, adding a credit card, and executing the USDT order—can make for a smooth purchase. While credit card buys come with higher fees, they offer speed and convenience in obtaining this popular stablecoin. As with any investment, individuals should educate themselves and exercise caution when purchasing cryptocurrencies.

Frequently Asked Questions

Can I buy USDT with credit card Binance?

Yes, Binance and Binance.US both allow users to buy USDT directly with credit cards. Simply sign up for an account, complete identity verification, link your credit card, deposit funds and execute the USDT purchase. Binance is recommended for international users while Binance.US is best for US customers.

Can I use my credit card to buy USDT?

Yes, you can use your credit card to buy USDT on most major cryptocurrency exchanges like Binance, Binance.US, Coinbase, and Crypto.com. These platforms allow linking a credit card during the account creation and verification process, then using the card to deposit funds and purchase USDT. Just be aware credit card transactions typically carry higher fees than other funding methods.

Can I buy crypto using credit card?

Yes, you can buy cryptocurrencies like USDT using a credit card on most major exchanges including Binance, Binance.US, Coinbase, Crypto.com and others. These platforms allow linking a credit card during the signup process to deposit funds that can then be used to purchase cryptocurrencies. Credit cards offer convenience but usually come with higher purchase fees than other funding methods. Be sure to check any cash advance fees from your card issuer as well.