You’re asking yourself “Does KuCoin Report To The IRS? ” The answer is yes. Let’s dive into it.

As the popularity of cryptocurrencies continues to rise, so do the regulations surrounding them. One question that has been on the minds of many traders and investors is whether KuCoin, a well-known cryptocurrency exchange, reports transactions to the Internal Revenue Service (IRS).

In this blog post, we will delve into the intricacies of this matter, exploring the requirements and obligations imposed on exchanges like KuCoin and shedding light on the implications for individuals who engage in cryptocurrency trading.

Join us as we navigate through the complexities of taxation in the crypto world and gain a better understanding of whether KuCoin reports to the IRS.

Does Kucoin Report its Users’ Earnings and Transactions To The IRS?

KuCoin does not report its users’ earnings and transactions to the IRS. The private data of customers are not disclosed to any governmental institutions. Though not licensed, highlighted to be the reason why KuCoin does not report to the IRS; it must be noted that KuCoin’s terms, conditions, and privacy policies do not establish that users’ private data be made available to a third party.

However, the exchange makes it expressive in its user agreement policies that it will entertain any request from any regulatory body looking to investigate its users’ cryptocurrency transactions or other personal information.

Earnings refer to the amount of money that a user has made. With KuCoin, users can earn in different ways. Various products on the platform, such as Savings, Staking, Flexible Staking Promotion & Fixed Staking Promotion, allow users to earn passively while using the platform.

Transactions refer to the exchange of cryptocurrencies on the platform by users. Users can decide to sell these when the valuation is high, and they can choose to buy them when the valuation is at the lowest bottom. Withdrawals and deposits are effortlessly easy on KuCoin.

Do I Have To Report My Cryptocurrencies to the IRS?

While KuCoin’s policy does not directly involve reporting users’ cryptocurrencies to the IRS or any governmental institutions, this does not imply that it should not be done. According to IRS Notice 2014–21, cryptocurrencies are considered property with applicable capital gains and losses. These should be declared on Schedule D and Form 8949 if necessary.

Users might assume that due to the pseudo-anonymous nature of crypto transactions, the IRS would find it challenging to track non-compliant individuals. However, this is not the case. The IRS is capable of tracking transactions through 1099 forms provided by exchanges. In the past, the agency partnered with–Blockchain analysis firm–Chainalysis to scrutinize transactions on blockchains like Bitcoin and Ethereum. Here are the detailed steps to report cryptocurrencies to the IRS

- Calculate your Crypto Profits and Losses: For every transaction that a user makes, the user either makes a loss or a profit. Thus, to report cryptocurrencies to the IRS, users need to run a proper calculation of the profits and losses. The quickest formula to calculating that is: Gross Proceeds — Cost Basis: Capital Gain/ Capital Loss. After the calculation has been completed, report the gains or losses on Form 8949.

- Complete IRS Form 8949: IRS Form 8949 is utilized for reporting the disposals or sales of capital assets. The following are examples of capital assets; stocks, bonds, and cryptocurrencies. Form 8949 has two segments. The first is Part I tagged as Short-term. The second is Part II tagged as Long-term. Any cryptocurrency sold in less than 12 months of holding should have its gain or loss reported on Part I. However, if it is sold after more than 12 months of holding, its gain or loss should be reported on Part II.

- Add Totals From 8949 To Schedule D: After filling the 8949 form, the total net gain of net loss should be added to Schedule D.

- Include Any Crypto Income: All Crypto income should be included as users can generate crypto income via mining, staking, interest or as compensation.

- Round Up The Rest of your Tax Return: After inputting the capital gains and income, that should be all on reporting all the crypto-related transactions on tax return. Once these have been done, the tax return can then be submitted to the IRS.

How To Report Your KuCoin Taxes To The IRS?

Here is a well-detailed procedure on how to report KuCoin taxes to the IRS and we will explain using CoinLedger:

Step 1

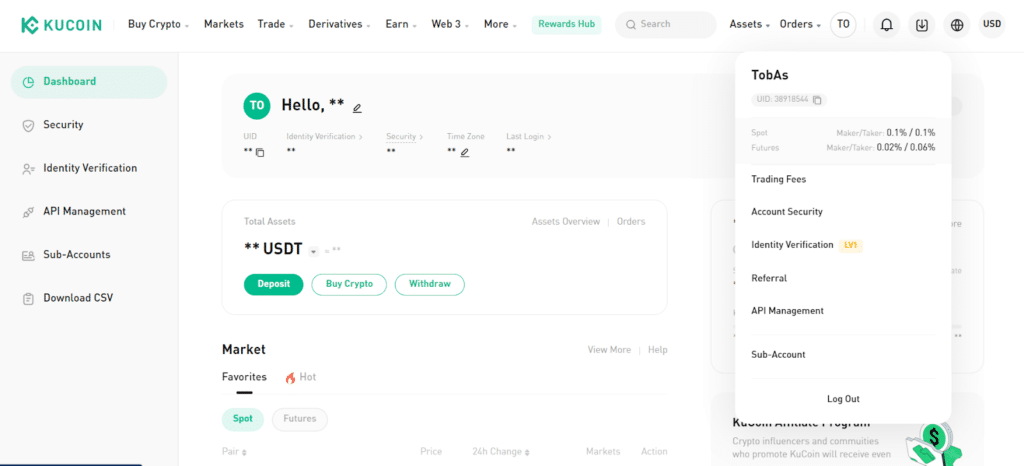

When you log into KuCoin, click on the top right corner of your profile. Afterwards, click on ‘API Management’, which appears in the drop-down menu.

Step 2:

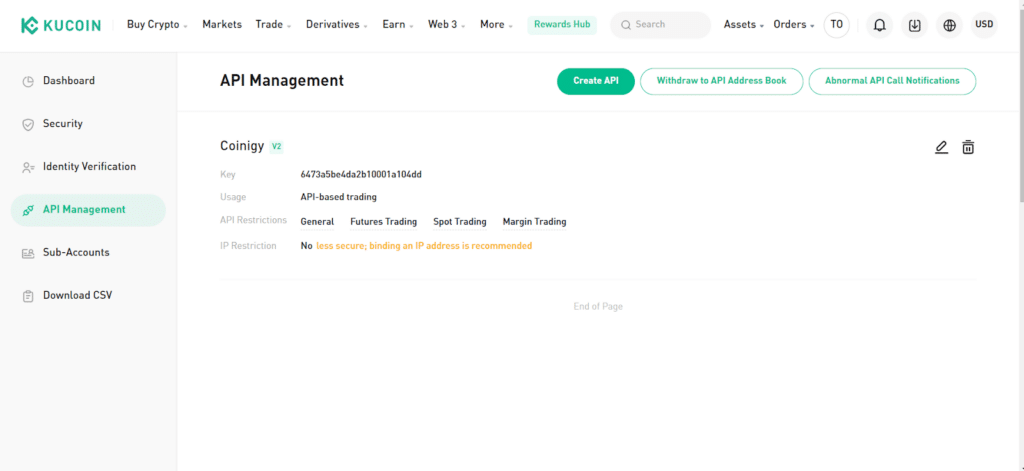

Press the button tagged as ”Create API” to create your API

Step 3

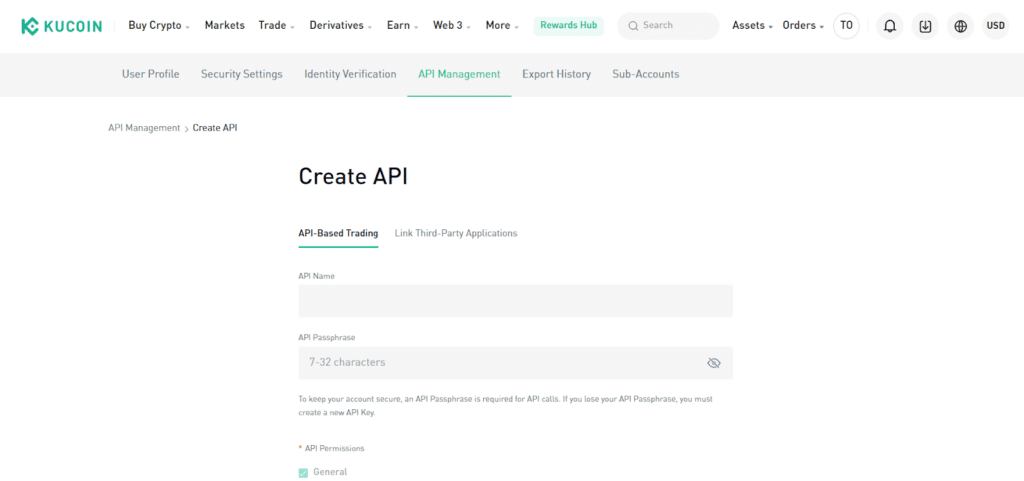

After clicking the button, you’ll need to input your API Name and API Passphrase. Set your API Restrictions to ‘General.’ This configuration restricts access to your API Key, ensuring that only authorized platforms can view your transaction history.

Click on the IP Restriction. This is going to ensure CoinLedger is able to access your transaction history. Before leaving, save API Passphrase in a well-secured spot. You must ensure it is not found by someone else.

Step 4

Insert Trading Password, 2FA Digits and Email Verification Code.

Step 5

Once you have followed the outlined steps, you’ll receive a personalized API Key and API Secret. Your next step involves navigating to the KuCoin Tab within CoinLedger, where you can select the Auto-import option. Enter your API Key, API Passphrase, and API Secret into the designated fields.

Upon completion of these steps, you’ll be able to import your transaction history from various wallets and exchanges. With a simple click, you can generate a comprehensive tax report with detailed insights.

The Importance of reporting your Crypto to the IRS

As a platform that facilitates the trading of various cryptocurrencies, KuCoin must comply with the regulatory guidelines and tax requirements imposed by relevant jurisdictions. While KuCoin strives to maintain an atmosphere of anonymized trading, it is important to note that any financial institution dealing with digital assets is subject to reporting obligations. Therefore, it is reasonable to assume that KuCoin does report relevant user information to the IRS, designed to ensure compliance with tax regulations and prevent illicit activities. As a responsible exchange, KuCoin understands the importance of maintaining transparency and adhering to necessary legal procedures, further reinforcing trust within the cryptocurrency community

FAQs

Do I Have to pay tax on my cryptocurrencies on Kucoin?

Yes, as a KuCoin user you have to pay taxes on KuCoin, if you made transactions using the platform.

Does the IRS See KuCoin?

Yes, the IRS sees KuCoin. However this is through a legal procedure as indicated in the platform’s user policy.

Does KuCoin Send 109 To The IRS?

Kucoin is not obligated to report user transactions to the IRS for tax purposes.

Do I have to report my crypto to the IRS if I am not a U.S. citizen?

Only taxpayers in the U.S are obligated to report crypto to the IRS.

Which Exchange Does Not Report To IRS?

There are certainly a good number of cryptocurrency exchanges that do not report to the IRS as stated in their users’ policy. Some of these exchanges are KuCoin, OKX, CoinEX, just to mention a few.