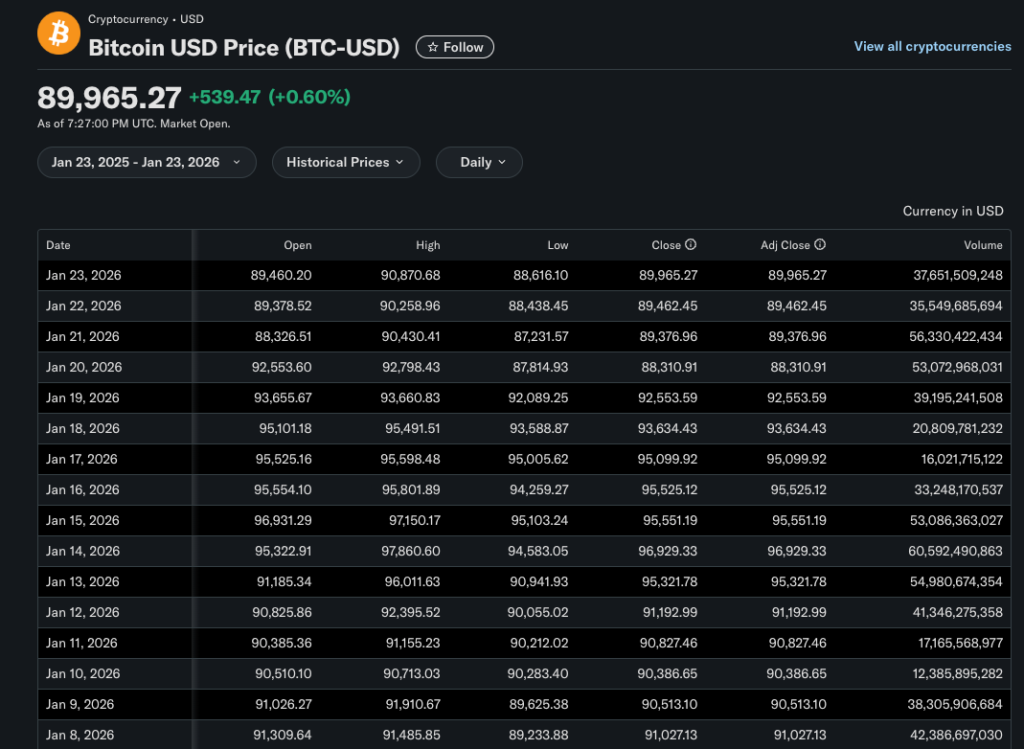

If you peeked at Bitcoin’s price this morning, you’d see it’s kind of staying in a tight range — right around $89,800 to $90,000. That’s not a big jump or a big crash, it’s more like the market is taking a breather and waiting for something new to happen.

Some people on trading platforms call this range-bound movement — it just means buyers and sellers are pretty evenly matched right now. The market isn’t screaming “boom!” or “bust!” just yet.

Quick takeaways

- Price: About $89.8k–$90k and stable today.

- Market Mood: Quiet; range-bound after recent volatility.

- Institutional Signals: UBS exploring crypto investment services.

- Market Events: BitGo’s big IPO lift hints at ongoing industry interest.

Bitcoin News of January 23rd

- The main thing to understand is that nothing “broke” today. Buyers and sellers are pretty evenly matched, which usually means the market is in pause mode after recent volatility.

- What matters more than the price action is the background story. Big financial players are still circling crypto, building products and exploring exposure. That keeps Bitcoin strong even on slow days.

- Bitcoin is sitting around the $90,000 level today, and the market is quiet. No big pump, no panic selling, just sideways movement while traders wait for something new to happen.

- Bottom line: Today isn’t about hype. Bitcoin is holding its ground, the market is cautious, and everyone’s waiting for the next real catalyst.

A little broader picture

Bitcoin’s price at this level comes after a pretty big roller coaster in the past few months. The cryptocurrency hit highs near the $96,000s earlier in January, but then cooled off and settled into this quieter pattern. That’s not unusual — big moves often lead to quiet periods while traders and funds decide what to do next

On places where traders discuss the markets, some are watching how gold and Bitcoin are moving together or against each other — that’s part of the puzzle investors are trying to solve about where capital is flowing this week.

Institutions are still watching

One of the more interesting stories today isn’t about price swings — it’s about who might be joining the crypto game.

Swiss bank UBS is reportedly planning to offer cryptocurrency investment options — including Bitcoin and Ethereum — to some of its private banking clients. That kind of move tells you big financial institutions are still thinking seriously about digital assets, even when prices aren’t making big headlines.

That doesn’t mean UBS confirmed everything yet, but it’s enough to make people in crypto circles talk about “institutional adoption” again — meaning traditional finance dipping its toes into crypto pools.

Old friends and new signals

Speaking of signals, yesterday’s big traditional finance news also included BitGo’s stock market debut, where its valuation climbed to about $2.6 billion and shares jumped significantly above their offering price. That’s the kind of event that can get the wider financial world talking about crypto in a different way — not just as a token price, but as part of bigger financial businesses.

So what does all this mean?

If you were explaining this to over coffee, you might put it like this:

Bitcoin isn’t exploding higher or crashing lower today. It’s just kind of hanging out around $90,000, and traders are waiting for a big clue — like a macroeconomic shift or new regulatory news — to decide which way it goes next.

At the same time, traditional finance isn’t ignoring crypto — banks and big firms are quietly building products and getting involved, and that’s a long-term story that helps keep Bitcoin in the conversation.