The broader crypto market is seeing some selling pressure on Jan. 16 trading hours, with Bitcoin price retracing back to $95,000 level. After the rejection at $97,000, BTC is once again trading lower. A similar sentiment is visible across Altcoins, with Ethereum (ETH) price down 1.67%, while bulls still defend the $3,300 support.

Crypto Market Faces Selling Pressure As Bitcoin Price Rally Halts

The crypto market is facing selling pressure once agai,n with Bitcoin and alt coins heading lower. The broader market has lost 1.51% i.e. around $50 billion in the last 24 hours. Despite this, the Bitcoin dominance continues to remain high as altcoins show greater weakness.

Since the beginning of 2026, the BTC dominance has once again restored strength and is moving to 60%. This is bad news for altcoins, as the development could delay the alt season even further.

Rising Bitcoin dominance | Source: Merlin The Trader

As per the technical chart patterns, Bitcoin price faced a rejection at the 50-week exponential moving average (EMA) at $97,000 and has since pulled back. Now, the key support to watch ahead is at between $93,500 and $94,000. As long as bulls defend this range, the next major move could be on the upside.

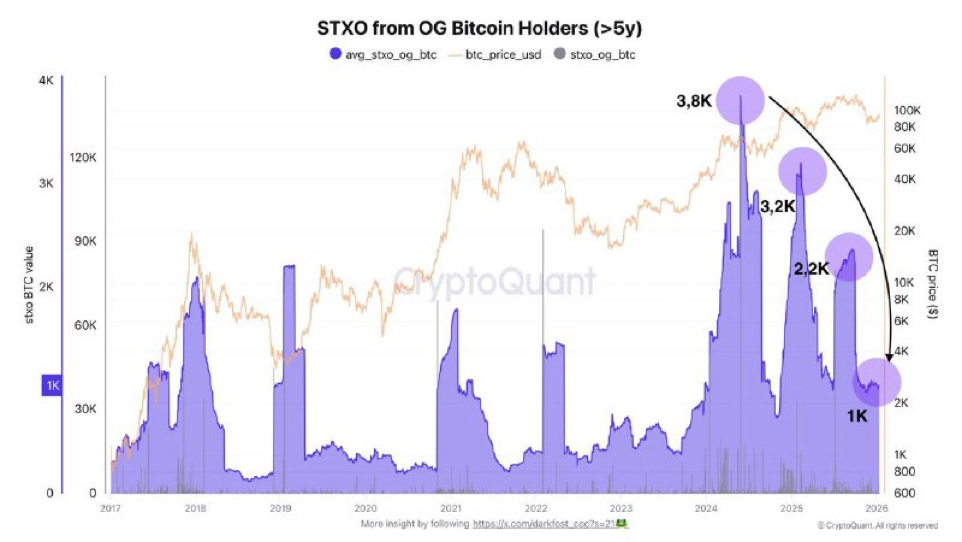

Furthermore, the good thing is that the selling from long-term players has slowed down significantly. This shows that the Bitcoin price downside could be limited from here onwards. Furthermore, with less BTC supply hitting the market, we could see buyers joining quickly. It could help the Bitcoin price regain $100K levels very soon.

Long Term Bitcoin Holders | Source: CryptoQuant

Altcoins Snapshot: ETH, XRP, SOL, DOGE All Head South

Along with Bitcoin, the overall altcoins market is also facing some selling pressure. Ethereum (ETH) price is down 2.2% but bulls still defend the $3,300 levels. In order for the alt coins to start outperforming Bitcoin, the capital rotation from BTC to ETH should be prominent.

For this to happen, the ETH/BTC ratio needs to climb to 0.06 and above. This would confirm that Ethereum is gaining momentum once again and would attract even greater capital.

Apart from Ethereum other top alt coins like XRP, Solana (SOL), and Dogecoin (DOGE) continue to face selling pressure.

Privacy coins like Monero (XMR), ZCash (ZEC), which were dominant last week are also trading lower today. XRP price is down 2.25% today, while ZEC price is down by 7% and is testing the crucial support at $400.

Pi Coin, the native cryptocurrency of the Pi Network, is trading at $0.20 wherein bulls defend the key support zones. Furthermore, large deposits of Pi Coin on the exchanges support a sell-side bias.

PiScan data showed that two of the three largest Pi Network transactions in the past 24 hours were deposits of 1.03 million PI tokens each. This points to continued distribution by large holders and signals weaker market sentiment.

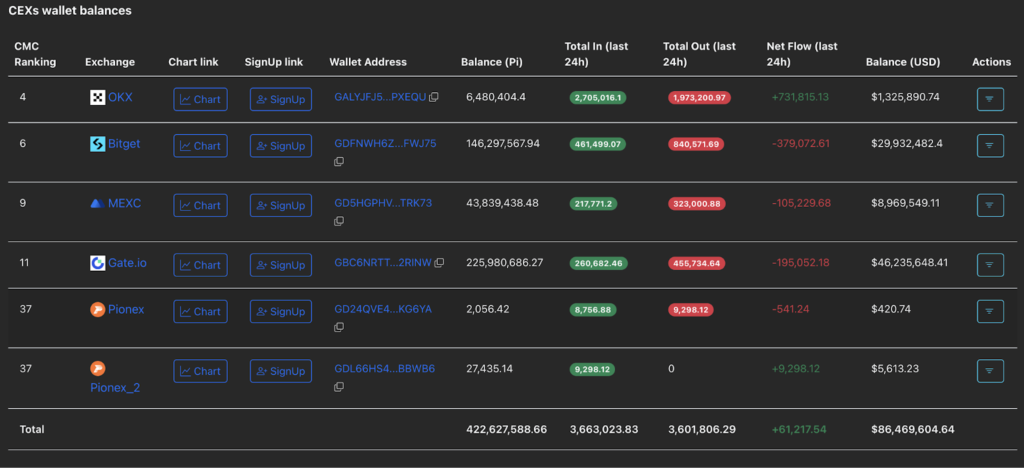

Exchange wallet balances also rose by a net 61,217 PI tokens, with OKX posting the largest inflow at 2.70 million PI. The rise in CEX reserves suggests increasing potential supply pressure as more tokens move onto trading venues.

Pi coin CEX balance