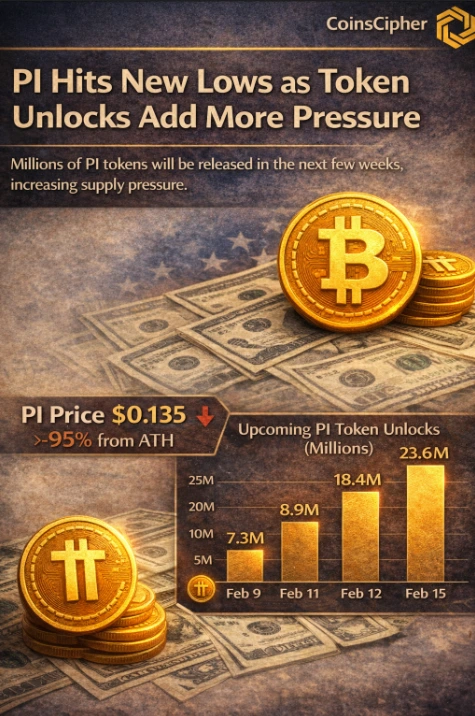

Pi Network’s (PI) token has dropped to new all time lows, trading below $0.14 after weeks of steady decline. The move did not happen in isolation. Broader crypto markets have been under pressure, and PI followed the same direction, falling more than 30% over the past month and over 95% from its peak in early 2025.

As usual, parts of the Pi community point to rising on chain activity as a sign of growing interest. Transaction volume has increased, which some interpret as renewed demand or accumulation. Volume alone, however, does not explain price direction, especially when supply dynamics are changing at the same time.

Read More: Bitcoin Slips Below 70000 as Selling Pressure Spreads Across Major Coins

Why Supply Matters More Than Sentiment

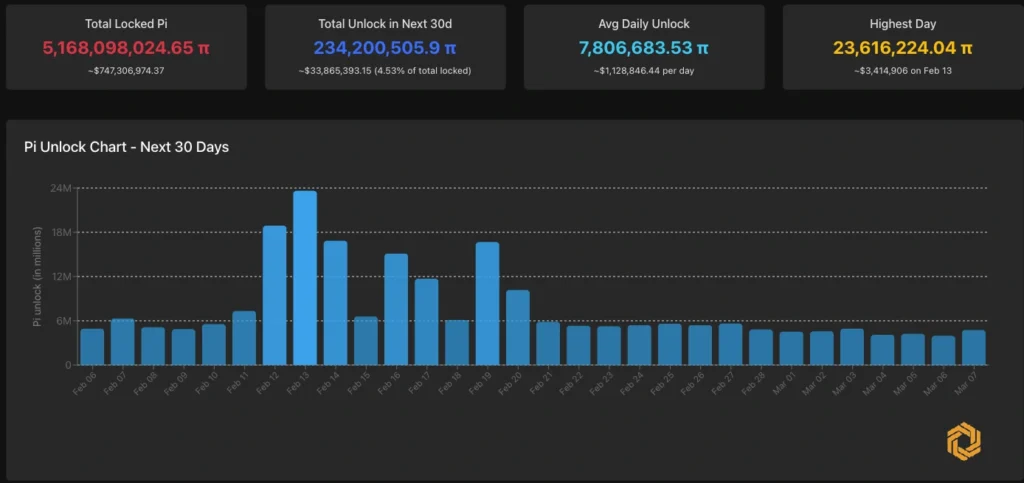

The main factor weighing on PI right now is supply. According to data from PiScan, millions of tokens are scheduled to be unlocked over the coming weeks. On average, close to 8 million PI tokens are set to enter circulation each month, with several days seeing much larger releases.

Around mid February, daily unlocks are expected to spike sharply, with over 18 million tokens becoming available on one day and more than 23 million on another. For a token that already struggles with sustained demand, this creates a clear risk of additional selling pressure.

Token unlocks do not guarantee immediate selling, but they increase the number of holders who are able to sell. In a weak market environment, that usually tilts the balance toward further downside rather than a rapid recovery.

Short Term Pressure, Longer Term Unknowns

There is some relief later in the schedule. After late February, the number of newly unlocked tokens is expected to decline and return to more typical levels. If demand stabilizes or improves, this could reduce pressure on price over time.

There are also unconfirmed rumors about a potential exchange listing, including speculation around Kraken. At this stage, these remain rumors. Until something is officially announced, they should be treated as noise rather than a factor to price in.

The Bottom Line

PI’s recent drop is not just about market sentiment or short term panic. It is closely tied to supply coming into circulation at a time when demand remains uncertain. Transaction volume may show activity, but supply still sets the tone.

Until the unlock pressure eases or real demand absorbs it, volatility is likely to remain high. For now, PI’s price action reflects a simple reality: when more tokens become tradable, the market has to find buyers willing to take them.