- The building is the same building. The gold stays in the vault. Tokenization doesn’t upgrade the asset. It just makes ownership easier to deal with.

- Before, you needed big money and the right connections. Now ownership can be split into smaller pieces and moved more easily. That’s the shift.

- If the asset is real, legally backed, and easy to exit, tokenization works. If not, it’s just noise. The market is learning this the hard way.

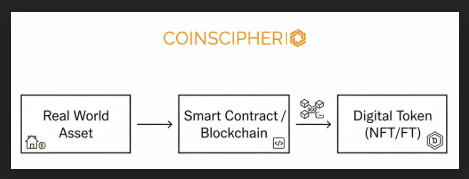

Real World Asset tokenization takes real assets like property, bonds, or commodities and represents them on the blockchain in a way that makes them easier to move and share. The goal is not to reinvent finance but to fix a basic problem. Many valuable assets are slow to trade, hard to access, and mostly reserved for big players.

- Why real world value gets Stuck

- How do you make real world value easier to move without changing the asset itself?

- Tokenization is only as strong as the real world systems behind it

- RWA tokenization succeeds or fails on three very boring things people ignore.

- RWA tokenization is not about replacing finance, it’s about upgrading how ownership is handled

- Why access is the real shift

- Tokenization isn’t about moving assets, it’s about moving ownership

- FAQs

So, what is real-world asset (RWA) tokenization? It is the process of linking real assets like property, bonds, or commodities to records on the blockchain that represent ownership or rights. The asset stays in the real world, but ownership becomes easier to track, split, and transfer. The goal is to reduce friction in traditional markets where valuable assets are slow, complex, and mostly accessible to large players. Tokenization does not remove legal or financial risk, but it offers a simpler way to handle real world value using modern infrastructure.

Why real world value gets Stuck

Most valuable assets in the real world are not easy to use. You can own property, bonds, or other investments that look great on paper, but selling them takes time, paperwork, and the right connections. For many people, these assets are locked away, not because they lack value, but because the system around them is slow and complex. This is the gap RWA tokenization tries to address.

It starts from a simple question.

How do you make real world value easier to move without changing the asset itself?

When people hear about bringing real world assets to the blockchain, they often imagine moving the asset itself. That is not what actually happens. The building does not move. The gold does not leave the vault. What changes is the way ownership is handled. Instead of relying on slow paperwork, private databases, and layers of middlemen, ownership is recorded in a shared system that everyone can verify. Once ownership becomes easier to record and transfer, value starts to move more freely. The asset stays the same, but the way people interact with it becomes simpler and faster.

Tokenization is only as strong as the real world systems behind it

Tokenization only works if the real world side is solid. A blockchain can show who owns what, but it cannot protect a building, hold gold in a vault, or enforce a contract on its own. Those parts still depend on legal agreements, custodians, regulators, and real people doing their jobs. If the asset is not properly held, insured, or legally backed, the token does not magically fix that. In RWA tokenization, the hardest problems are not on chain. They sit in the connection between digital records and the real world systems that support them.

RWA tokenization succeeds or fails on three very boring things people ignore.

In practice, RWA tokenization depends on a few very basic things that are easy to overlook:

- First, someone has to actually hold the asset. A building, bonds, or commodities do not protect themselves. There must be a clear custodian with legal responsibility, and if that part is weak, the token represents nothing solid.

- Second, ownership has to mean something outside the blockchain. Holding a token only matters if the law clearly recognizes what rights come with it. Without legal clarity, ownership on chain is just a record, not a guarantee.

- Third, there needs to be a real way out. Not future promises, not marketing, but actual liquidity. If you cannot sell, transfer, or exit in a realistic way, the asset is still stuck, just in a different form.

This is why many RWA projects struggle. The technology can work perfectly, but if custody, law, or liquidity fail, the entire structure falls apart. Tokenization does not remove these problems. It simply makes them impossible to ignore.

RWA tokenization is not about replacing finance, it’s about upgrading how ownership is handled

RWA tokenization is not trying to replace the financial system or bypass it. In most cases, it works with existing rules, legal frameworks, and institutions. What actually changes is how ownership is recorded and managed. Instead of slow transfers, fragmented databases, and manual processes, ownership can move in a more consistent and transparent way. This is why banks, funds, and regulators are paying attention. Not because it is disruptive, but because it offers a practical upgrade to how real world assets are handled today.

Why access is the real shift

What makes RWA tokenization interesting right now is access. For a long time, high quality assets were only available to institutions or people with the right connections. Entry was expensive, slow, and often closed. Tokenization does not promise easy profits, but it can lower the barriers to participation. It allows ownership to be divided, transferred, and managed in smaller pieces. Over time, this can change who gets access to real assets and how capital moves, not through hype, but through gradual, practical shifts.

Tokenization isn’t about moving assets, it’s about moving ownership

In 2025, a 30 floor office building in Japan stayed exactly where it was. Same concrete, same elevators, same people showing up to work every morning. Nothing about the building itself changed. This was not a thought experiment or a concept. It was a real project, covered by Forbes, showing how real world assets are already being handled differently.

What did change was how ownership was handled.

For years, the building belonged to a small group of large investors. If you were not part of that group, there was no real way in. Not because the building was special, but because the system around it was closed. Ownership was expensive, slow to transfer, and limited to people with the right access.

That changed when the ownership of the building was divided into digital records on a blockchain, all within Japan’s existing legal system. Instead of needing huge amounts of capital or special connections, people could now buy smaller pieces of the same building. It worked in a similar way to buying shares, but the ownership was tied directly to a real office building that physically exists and is still being used every day.

This is where the real value of tokenization shows up.

The building itself does not move. The value does not suddenly increase. Nothing is turned into a flashy tech product just to sound innovative. What changes is how people can participate. It becomes easier to enter, easier to transfer ownership, and easier to understand who owns what at any point in time.

The asset stays solid and boring, exactly as it should be. What becomes more flexible is the system around it. Ownership is less locked up, access is wider, and value can move without the usual friction.

This is the part many people miss. Tokenization is not about changing the asset. It is about upgrading the basic systems that sit underneath ownership and quietly decide who gets access and who does not.

FAQs

What do I actually own when I buy an RWA token

You own a defined right to a real asset. It can be a share of income, a claim on ownership, or both. The token is just the record. The value comes from the legal agreement behind it.

Is the real asset actually protected

Only if it is held by a real custodian and backed by clear legal contracts. The blockchain does not protect buildings or gold. People, laws, and institutions do.

What happens if something goes wrong

You fall back on the legal structure, not the code. Courts, contracts, and regulators still matter. Tokenization does not remove real world risk.

Is this legal or still a gray area

It depends on the country and the structure. In places like Japan, parts of Europe, and the US, clear frameworks already exist. Most serious projects work inside the law, not around it.

Is this just another form of crypto speculation

Not by default. The asset exists whether the token trades or not. Speculation can happen, but the value is tied to something real.

How is this different from buying shares or a fund

Traditional assets are often locked behind intermediaries and slow processes. Tokenization mainly changes how ownership is recorded and transferred, not what the asset is.

Does tokenization guarantee liquidity

No. It can make access easier, but liquidity still depends on real demand and real markets. Tokens do not create buyers out of thin air.

Who is this actually for

Right now, mostly institutions and serious platforms. Over time, it opens access to more people, but it is not a shortcut to easy money.