XRP is getting talked about more than Ethereum on X, and that matters because attention usually moves before price does. This shift shows traders and investors are focusing on XRP again, not because its tech suddenly changed, but because the story around it has. While Ethereum still dominates in real usage, XRP is winning the conversation, which often signals a change in short term market sentiment. In crypto, when attention rotates, money often follows.

Something unusual has been happening on Twitter over the past few weeks.

XRP a token many people stopped paying attention to years ago is being talked about more than Ethereum. Not for a few hours. Not during one spike. But consistently day after day.

That alone does not move markets. But in crypto attention almost never moves randomly. It usually shows up after something has already started shifting underneath the surface.

And that is what makes this moment interesting.

Between December 2025 and mid January 2026 social data tracked on X shows XRP mentions overtaking Ethereum’s. For the first time in years the payment focused token generated more daily conversation than the world’s second largest cryptocurrency.

Bitcoin still dominates the overall discussion as it always does. But when you look specifically at XRP versus Ethereum the balance changed and people noticed.

At first glance this feels backwards.

Ethereum is still the backbone of DeFi. Around 68 billion dollars is locked in Ethereum based protocols. Billions of dollars in stablecoins move across its network every single day. It is deeply embedded in how crypto actually works.

XRP by comparison has around 68 million dollars in total value locked. That is not a typo. The difference is massive.

XRP is dominating the conversation because markets do not just price what exists today. They price expectations about what might exist tomorrow.

In November 2025 spot XRP ETFs launched in the United States. Over their first 50 days they pulled in roughly 1.3 billion dollars. That made XRP the second fastest crypto ETF to cross the 1 billion dollar mark behind only Bitcoin.

At the same time money was quietly leaving other places. During December Bitcoin ETFs saw net outflows of about 1.09 billion dollars. Ethereum ETFs lost around 564 million dollars. XRP ETFs meanwhile recorded 483 million dollars in net inflows.

That shift did not start on Twitter. It started in portfolios.

Social media followed later.

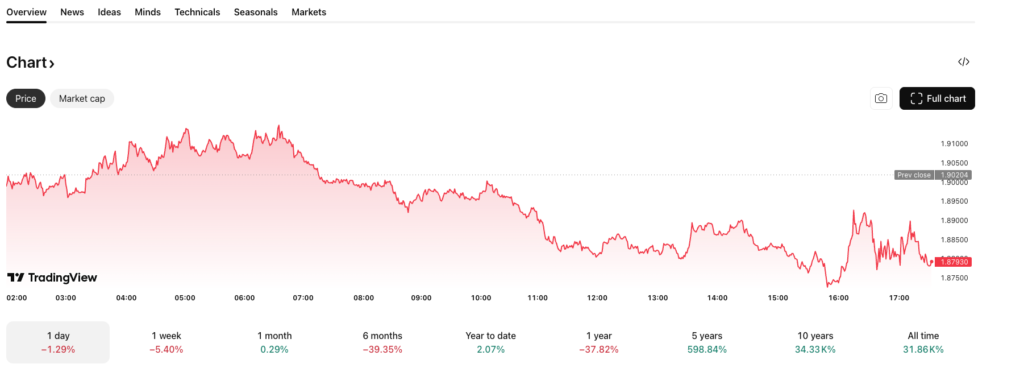

In early January XRP surged about 25 percent in a single week while Bitcoin gained roughly 6 percent and Ethereum about 10 percent over the same period. XRP briefly traded near 2.40 dollars before pulling back toward the 1.90 dollar area where it has been consolidating since.

The spike in social activity happened during that move not before it.

That is an important detail.

In crypto people often say Twitter drives price. In reality it is usually the other way around. Capital moves first. Attention catches up later.

What we are seeing now looks a lot like that pattern.

Ethereum spent most of 2025 focused on infrastructure. Layer two scaling institutional DeFi slow and steady progress. XRP spent the year clearing regulatory uncertainty expanding payment corridors and positioning itself as a more institution friendly asset.

Those are not flashy narratives. But they matter to banks funds and long term allocators.

Retail traders tend to notice those shifts last.

That is why this moment feels less like hype and more like confirmation.

On Twitter XRP related hashtags and cashtags began outperforming Ethereum’s. Not just passive mentions but active discussion. Debates analysis sharing news arguing about price targets. The kind of engagement that signals real interest not bots or spam.

None of this guarantees higher prices.

Social momentum does not cause markets to move. But it does show where attention is concentrating and attention in crypto is often the early warning system for narrative change.

The last time XRP commanded this level of attention relative to Ethereum was years ago during a very different market cycle. Back then XRP did not have ETFs. It did not have the same regulatory clarity. And it did not have the same level of institutional access it does now.

History does not repeat exactly. But sometimes it echoes.

Right now the echo sounds like this. Institutions moved first quietly. The crowd is starting to notice. And Twitter for better or worse is where that realization becomes visible.

Whether XRP’s current attention turns into something lasting depends on what happens next. Do inflows continue. Do institutions stay involved. Does the narrative hold when markets slow down.

Those answers are not on Twitter yet.

But the fact that XRP is suddenly louder than Ethereum tells us one thing clearly. Something changed. And the market is still in the process of understanding what it means.